TO COMMENT CLICK HERE

Corporate Criminals

They Don't Go to Jail, They Just Rob You

january 2024

Truly great companies are built on ideals, not just deals.

Alan Watts

articles

*THE GREAT MEDICARE ADVANTAGE MARKETING SCAM

(ARTICLE BELOW)

*BOFA HIT WITH $250 MILLION IN FINES, PENALTIES, REFUNDS FOR 'DOUBLE-DIPPING' FEES, FAKE ACCOUNTS(ARTICLE BELOW)

*AMAZON DUPED MILLIONS INTO ENROLLING IN PRIME, US REGULATOR SAYS IN LAWSUIT

(ARTICLE BELOW)

*'STRAIGHT UP FRAUD': DATA CONFIRMS PRIVATE INSURERS ARE STEALING BILLIONS

(ARTICLE BELOW)

*HOW TO DECIMATE THE CORPORATE TAX-AVOIDANCE INDUSTRY

(ARTICLE BELOW)

*‘They all knew’: textile company misled regulators about use of toxic PFAS, documents show(ARTICLE BELOW)

*HOW MEDICARE ADVANTAGE SCAMMERS GET AWAY WITH IT

(ARTICLE BELOW)

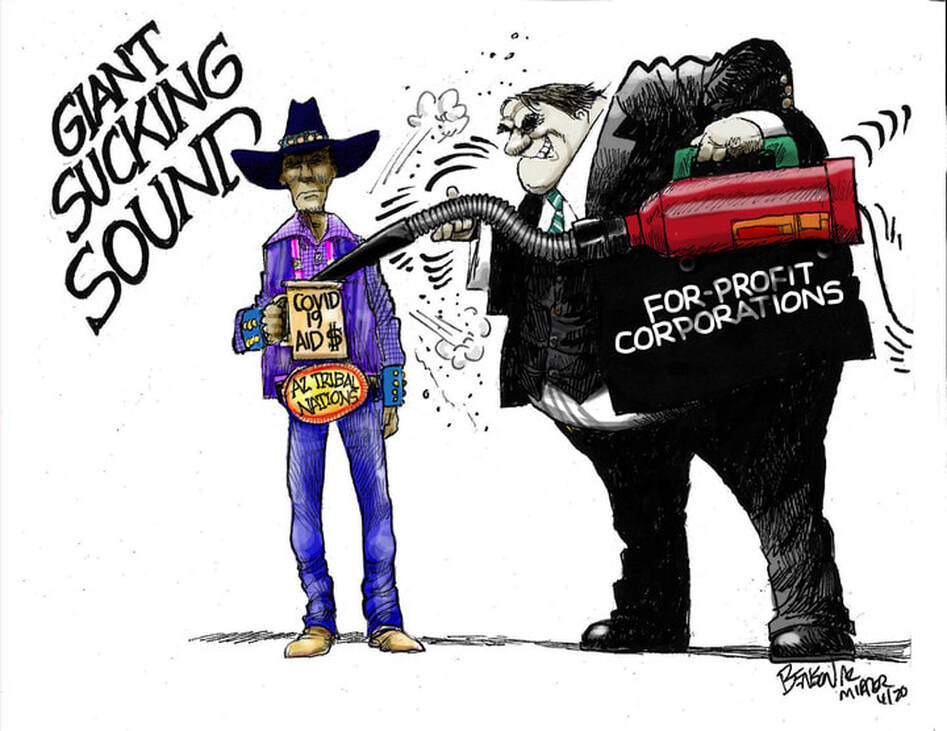

*RIGHT-WING GROUPS OPPOSED TO GOVERNMENT AID CASHED IN WHILE COLLECTING PPP LOANS

(ARTICLE BELOW)

*THE 2021 CORPORATE RAP SHEET

(ARTICLE BELOW)

*J&J is using a bankruptcy maneuver to block lawsuits over baby powder cancer claims(ARTICLE BELOW)

*McKinsey Never Told the FDA It Was Working for Opioid Makers While Also Working for the Agency(ARTICLE BELOW)

*COMPANIES LOBBYING AGAINST INFRASTRUCTURE TAX INCREASES HAVE AVOIDED PAYING BILLIONS IN TAXES(ARTICLE BELOW)

*POVERTY WAGES AND TAX DODGING FUNDED BEZOS’S RIDICULOUS SPACE TRIP

(ARTICLE BELOW)

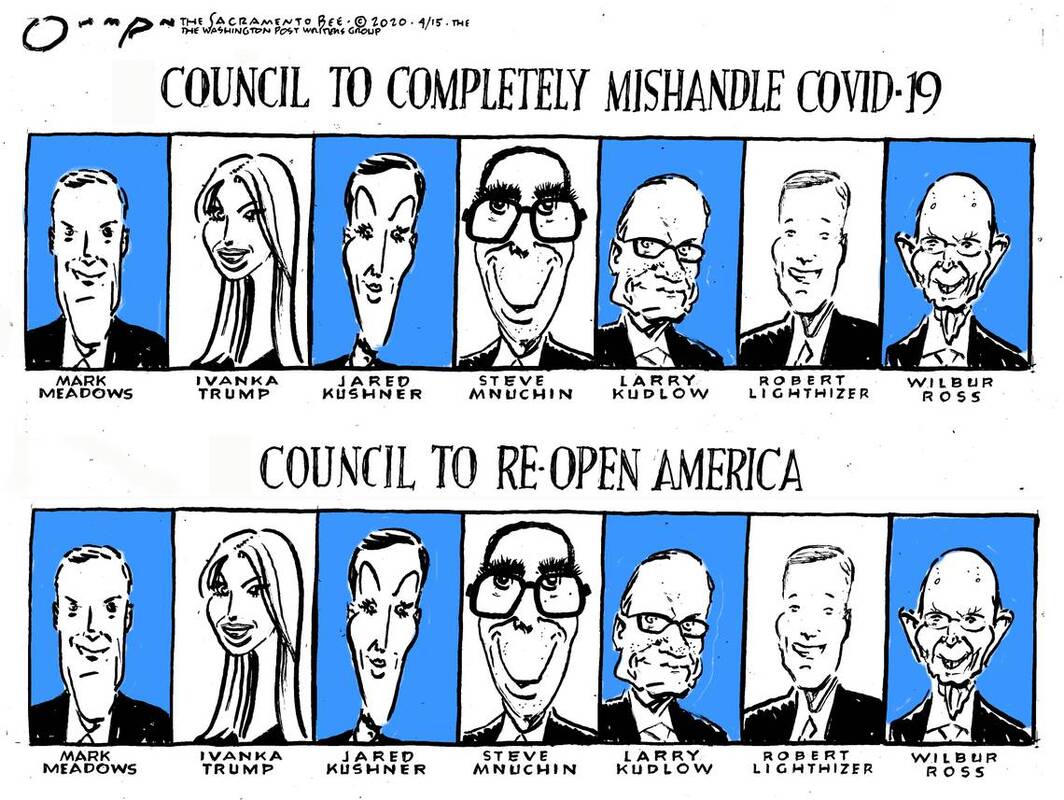

*TRUMP'S CORRUPTION WAS SO GARISH THAT WE LOST SIGHT OF THE OTHER BRIGANDS

(ARTICLE BELOW)

*Ending Corporate Impunity

(ARTICLE BELOW)

*KUSHNER COMPANIES VIOLATED MULTIPLE LAWS IN MASSIVE TENANT DISPUTE, JUDGE RULES

(ARTICLE BELOW)

*Company awarded $1.3B by Trump to make vaccine syringes has not made even one

(ARTICLE BELOW)

*REVEALED: SEAFOOD FRAUD HAPPENING ON A VAST GLOBAL SCALE

(ARTICLE BELOW)

*BIDEN PUTS REGULATORS BACK IN BUSINESS

(ARTICLE BELOW)

*JPMORGAN CHASE BANK WRONGLY CHARGED 170,000 CUSTOMERS OVERDRAFT FEES. FEDERAL REGULATORS REFUSED TO PENALIZE IT.(ARTICLE BELOW)

*Big Pharma is the disease

(ARTICLE BELOW)

*TYSON EXPLOITS CONSUMERS JUST LIKE ITS ANIMALS AND THE WORKERS WHO RAISE THEM

(ARTICLE BELOW)

*TOP HOSPITALS CHARGING PATIENTS UP TO 1,800% MORE FOR SERVICES THAN THEY ACTUALLY COST: STUDY(ARTICLE BELOW)

*Watchdog group calls for SEC probe: Pfizer CEO dumped $5.6M in stock on day of vaccine news(ARTICLE BELOW)

*'FinCEN' reports say big banks moved dirty money

(ARTICLE BELOW)

*Trump & Co. Keeps Hiring Companies with Histories of Ripping Off Our Government

(ARTICLE BELOW)

*COVID Is Turning Out To Be Very Good For Bad Businesses

(ARTICLE BELOW)

*Bayer to pay $1.6 billion to settle US claims over birth control device

(ARTICLE BELOW)

*US HEALTH INSURERS DOUBLED PROFITS IN SECOND QUARTER AMID PANDEMIC

(ARTICLE BELOW)

*‘TAKING TAXPAYERS FOR A RIDE’: MODERNA TO CHARGE $32-$37/DOSE FOR COVID-19 VACCINE DEVELOPED ENTIRELY WITH PUBLIC FUNDS(ARTICLE BELOW)

*HOUSE DEMOCRATS FIND ADMINISTRATION OVERSPENT FOR VENTILATORS BY AS MUCH AS $500 MILLION(ARTICLE BELOW)

*They Sued Thousands of Borrowers During the Pandemic — Until We Started Asking Questions(ARTICLE BELOW)

*THE FOOD INDUSTRY PUTS PROFITS OVER PUBLIC HEALTH USING BIG TOBACCO’S PLAYBOOK

(ARTICLE BELOW)

*Watchdog questions why Wells Fargo reported giving only one large PPP loan to a Black-owned business(ARTICLE BELOW)

*NY equity management firm under investigation for alleged Ponzi scheme received $1.6 million in stimulus aid: WSJ(ARTICLE BELOW)

*DOUBLE-DIPPING SPOTTED AMONG PPP HEALTHCARE LOAN RECIPIENTS

(ARTICLE BELOW)

*BANKS STAND TO MAKE $18 BILLION IN PPP PROCESSING FEES FROM CARES ACT

(ARTICLE BELOW)

*Different Names, Same Address: How Big Businesses Got Government Loans Meant for Small Businesses(ARTICLE BELOW)

*‘Absolute robbery’: Gilead announces $3,120 price tag for COVID-19 drug developed with $70 million in taxpayer funds(ARTICLE BELOW)

*EPA Gives Farmers Another Month To Use Widely Banned Poison

(ARTICLE BELOW)

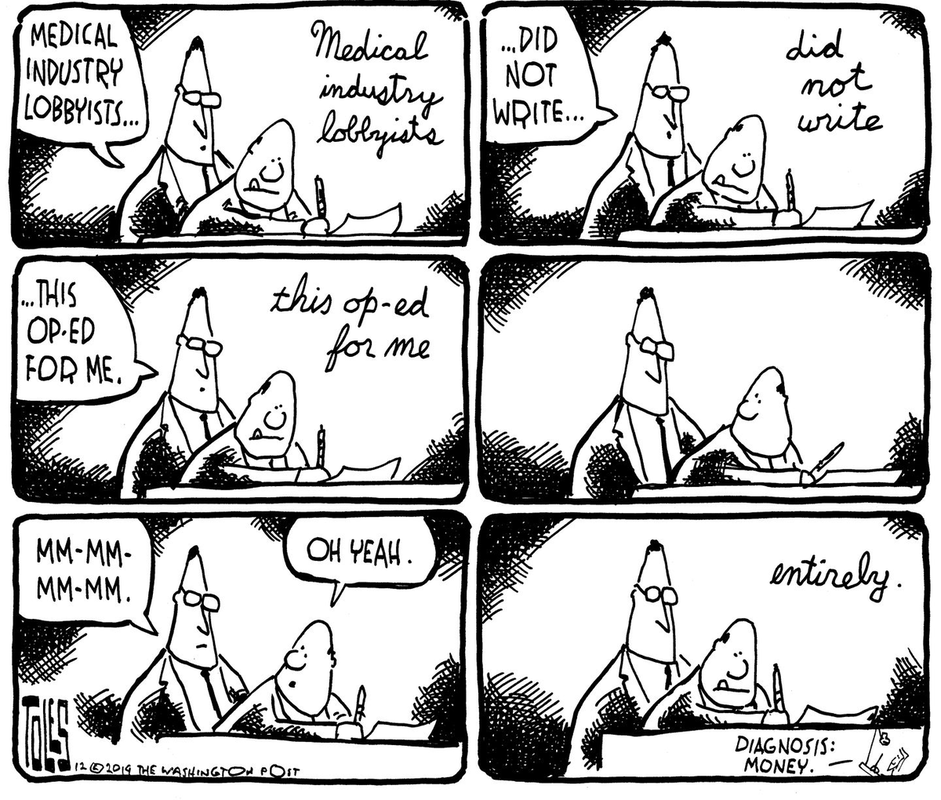

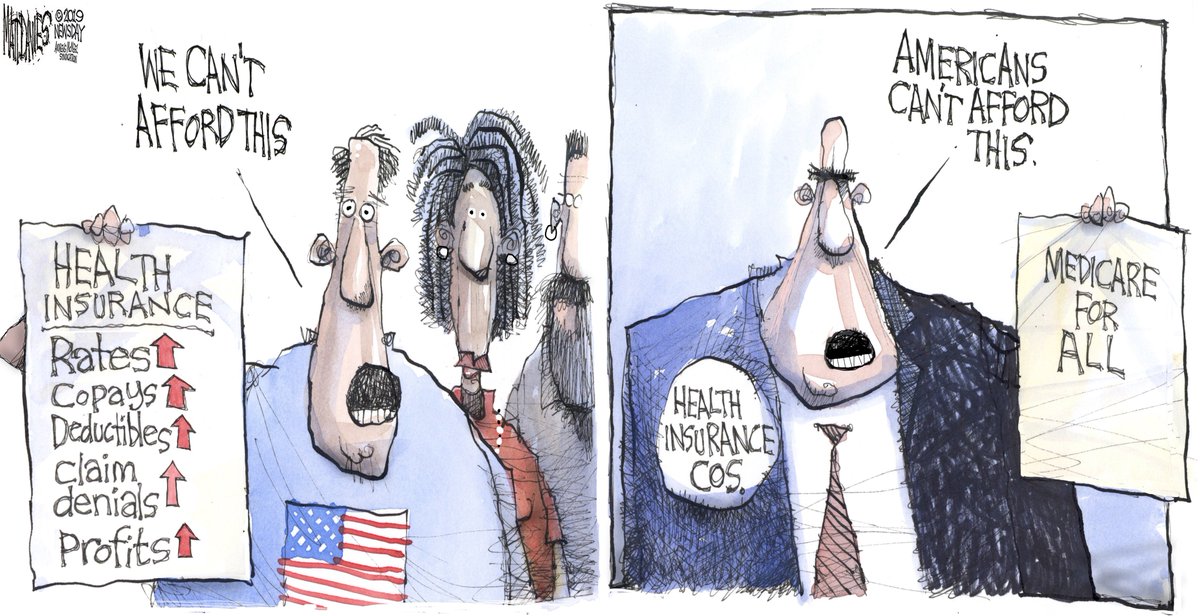

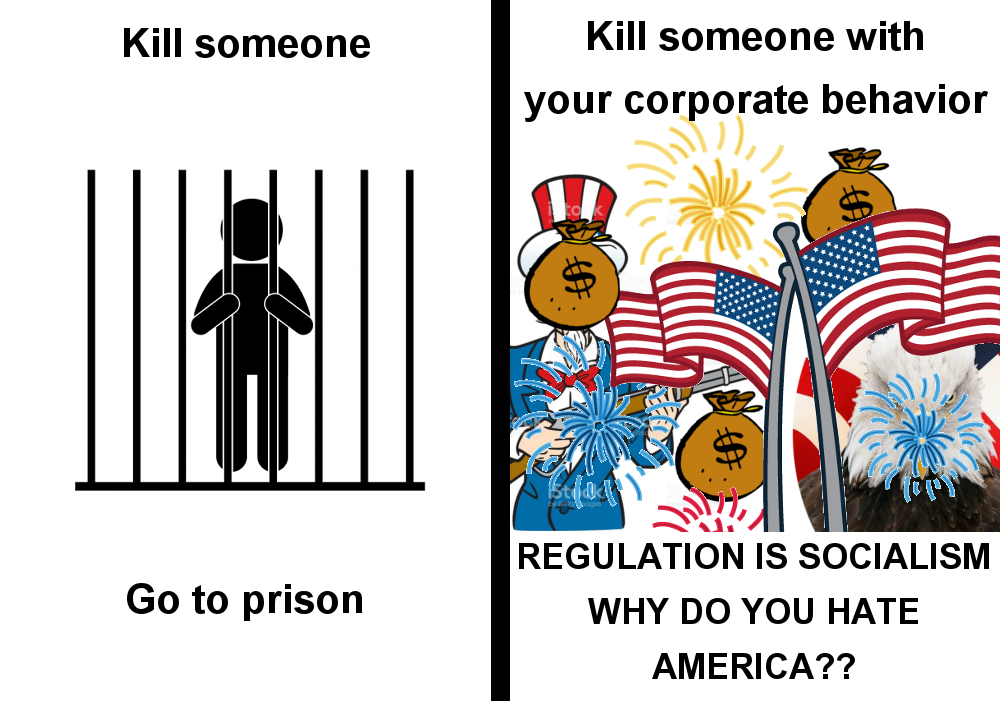

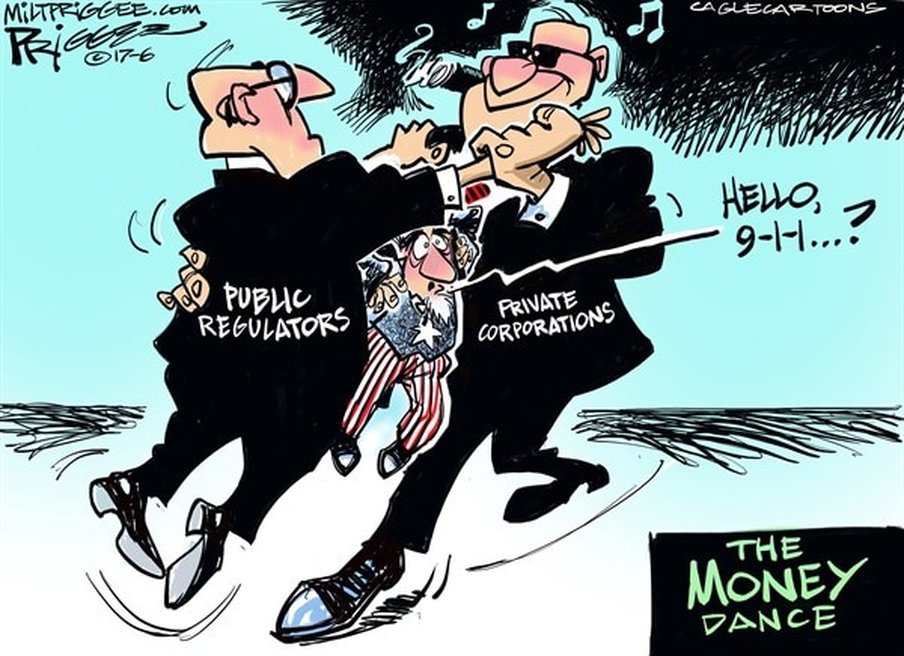

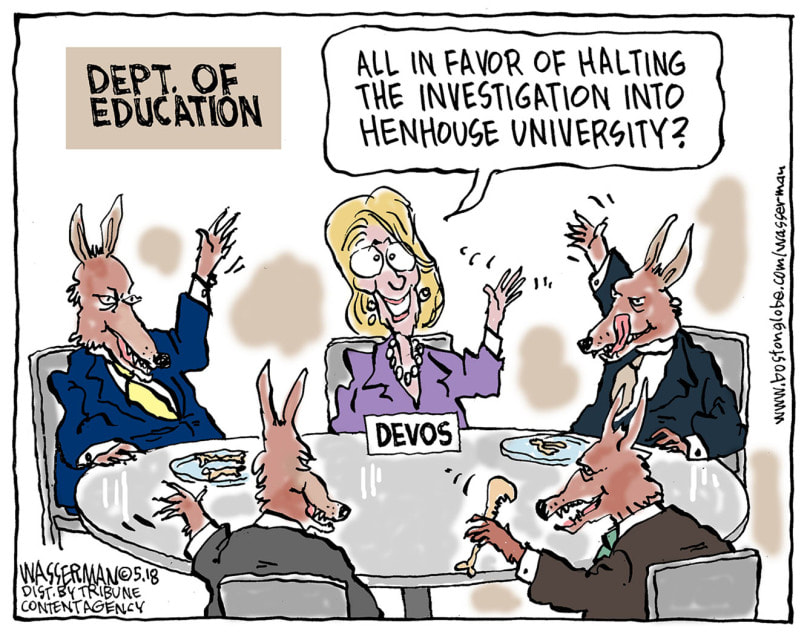

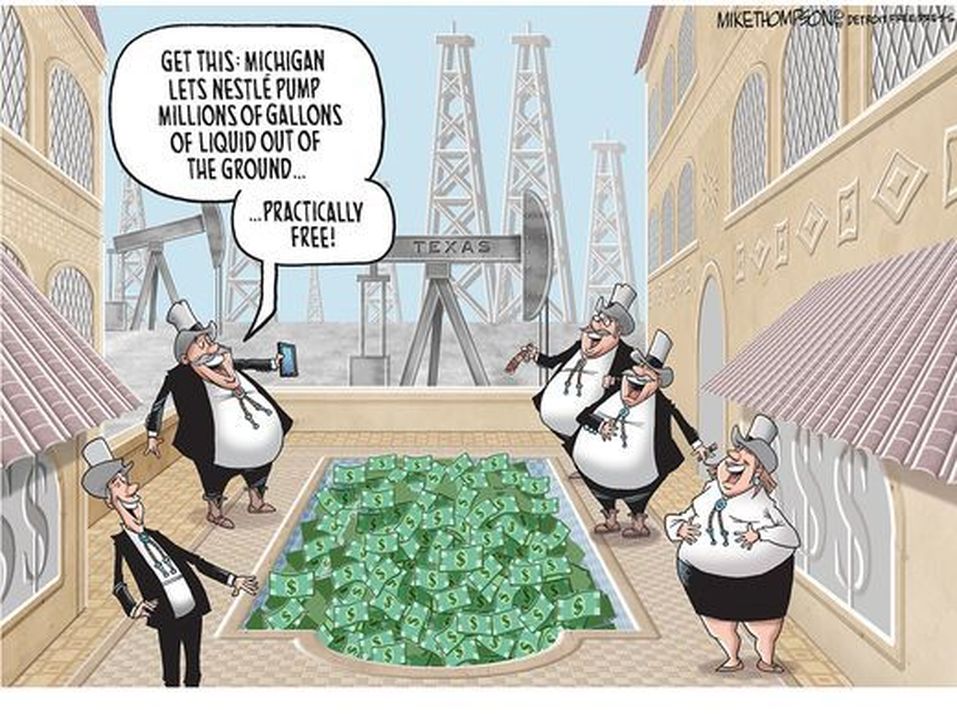

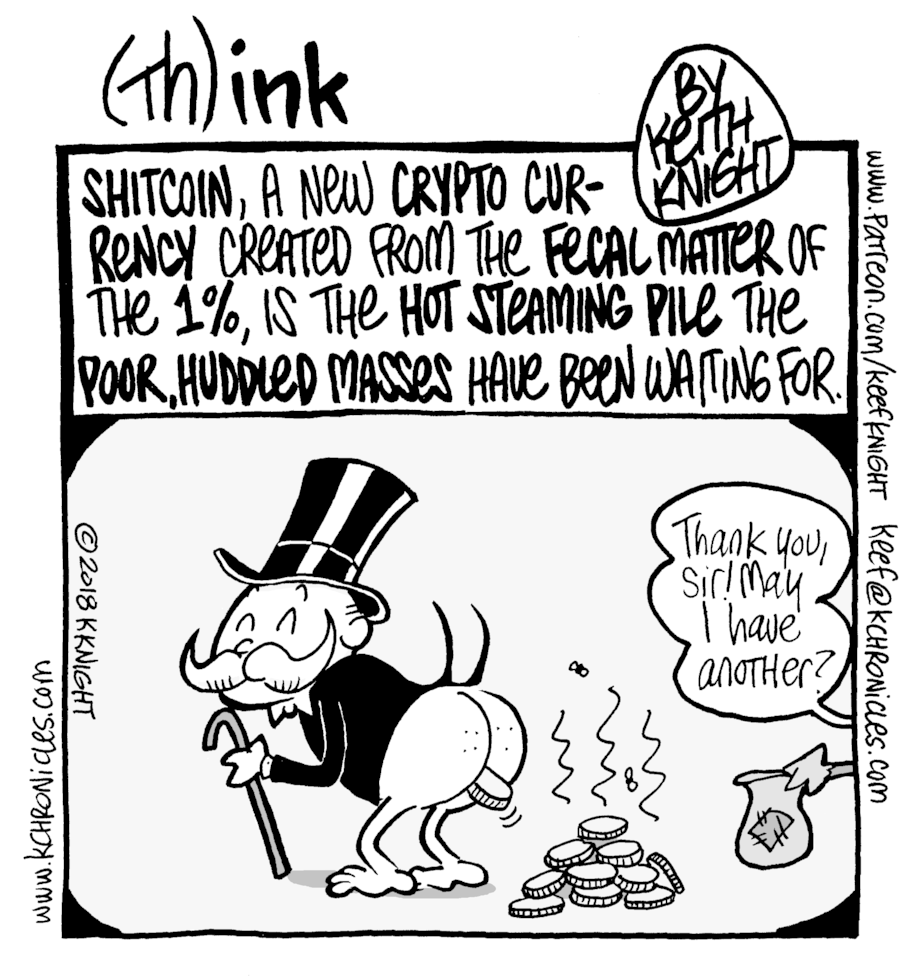

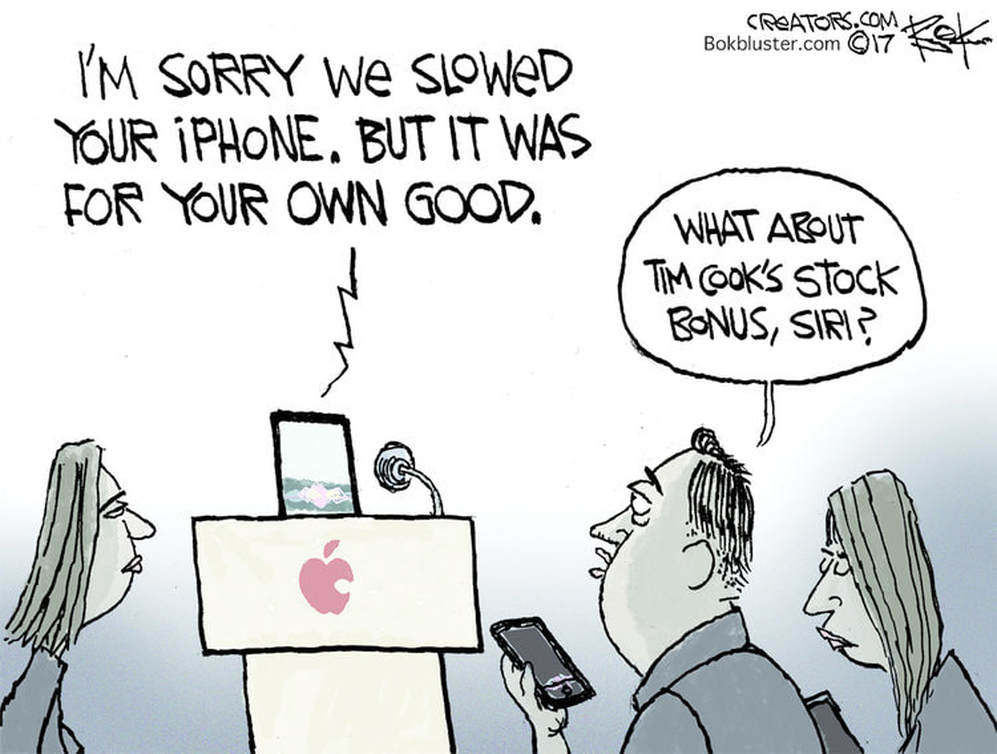

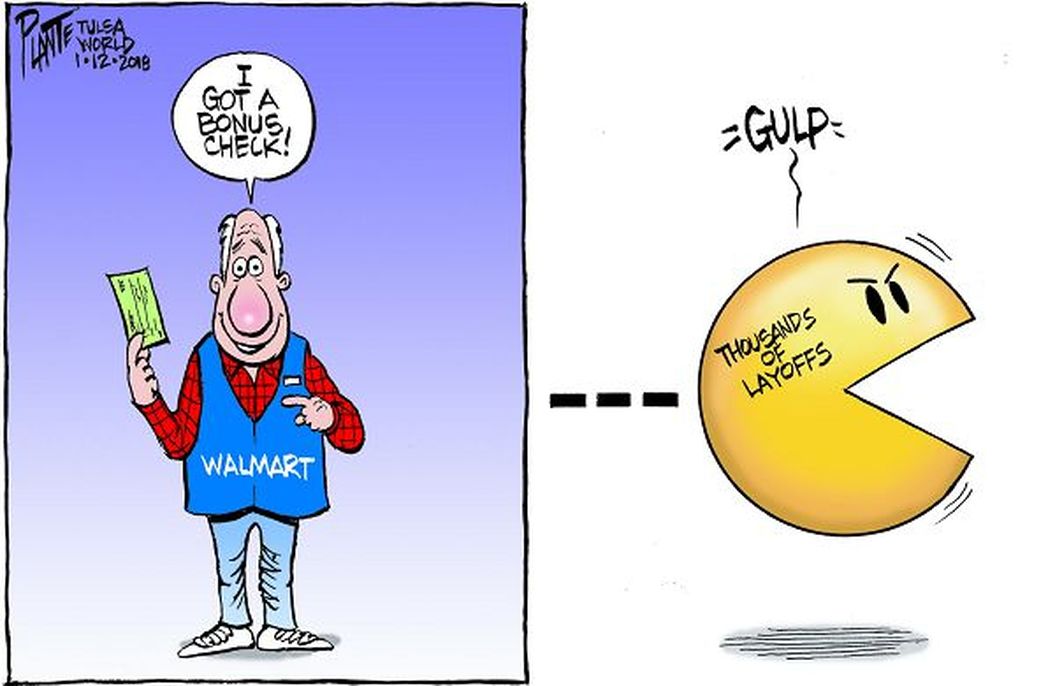

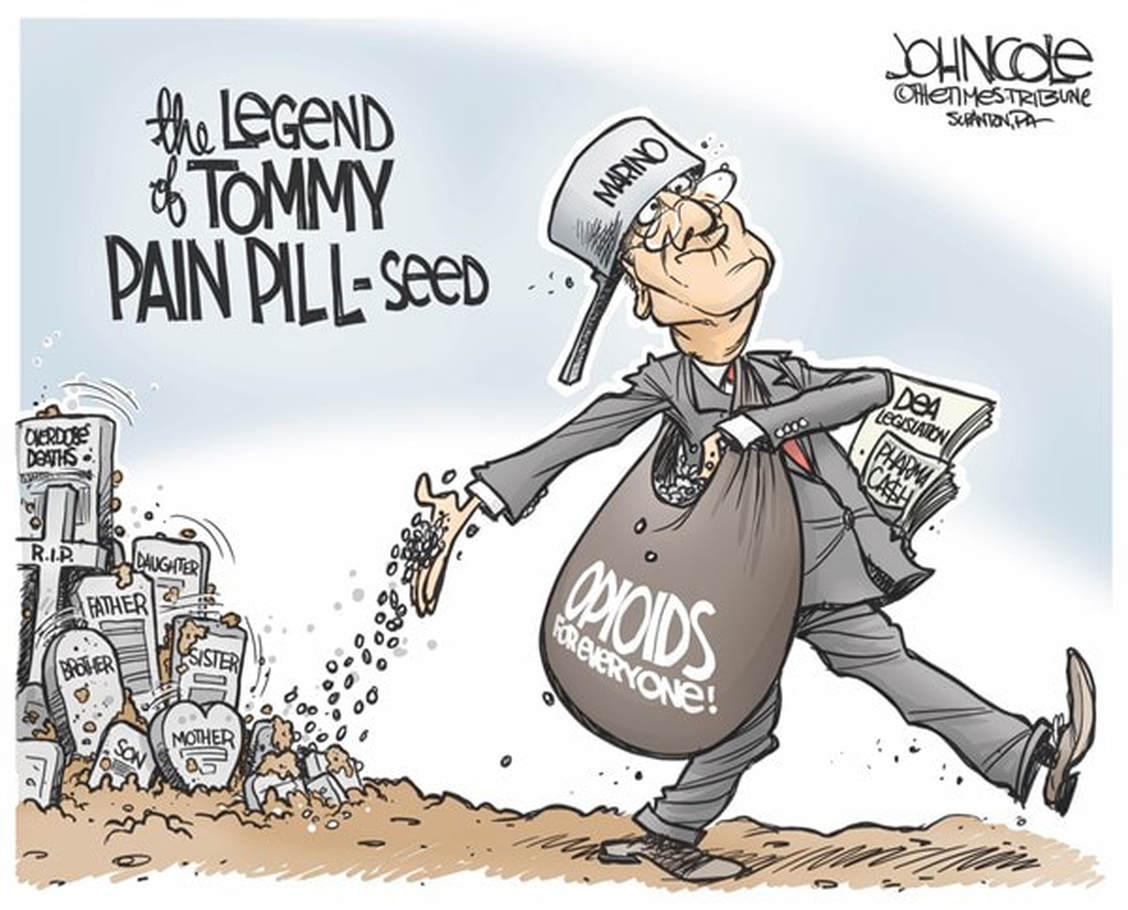

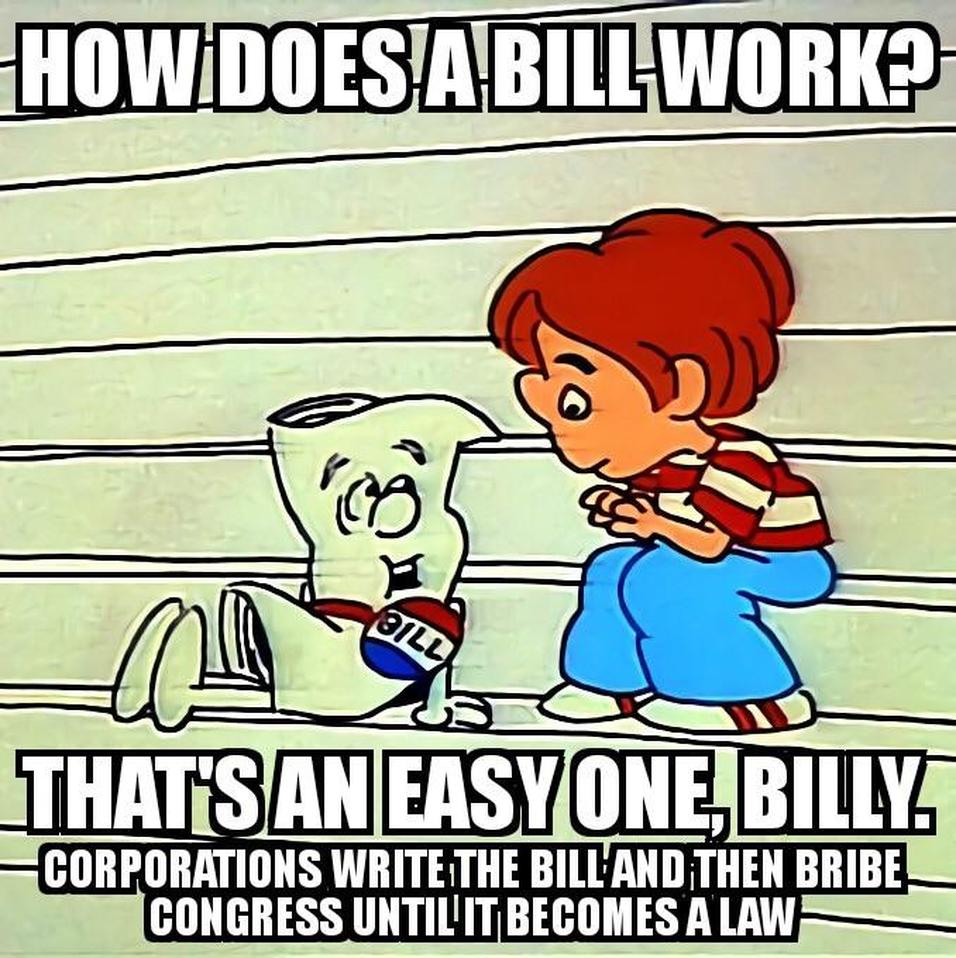

funnies(below)

...The more the warning signs are palpable—rising temperatures, global financial meltdowns, mass human migrations, endless wars, poisoned ecosystems, rampant corruption among the ruling class—the more we turn to those who chant, either through idiocy or cynicism, the mantra that what worked in the past will work in the future, that progress is inevitable. Factual evidence, since it is an impediment to what we desire, is banished. The taxes of corporations and the rich, who have deindustrialized the country and turned many of our cities into wastelands, are cut, and regulations are slashed to bring back the supposed golden era of the 1950s for white American workers. Public lands are opened up to the oil and gas industry as rising carbon emissions doom our species. Declining crop yields stemming from heat waves and droughts are ignored. War is the principal business of the kleptocratic state...

"reign of idiots" by chris hedges

The Great Medicare Advantage Marketing Scam

How for-profit health insurers convince seniors to enroll in private Medicare plans

BY MATTHEW CUNNINGHAM-COOK - the american prospect

JANUARY 12, 2024

Jayne Kleinman is bombarded with Medicare Advantage promotions every open enrollment period—even though she has no interest in leaving traditional Medicare, which allows seniors to choose their doctors and get the care they want without interference from multi-billion-dollar insurance companies.

“My biggest problem with being barraged is that so many of the ads were inaccurate,” Kleinman, a retired social services professional in New Haven County, Connecticut, told HEALTH CARE un-covered. “They neglect to say that the amount of coverage you get is limited. They don’t talk about what you are losing by leaving traditional Medicare. It feels like insurance companies are manipulating us to get Medicare Advantage plans sold so that they can control the system, as opposed to treating us like human beings.”

Seniors face a torrent of Medicare Advantage advertising: an analysis by KFF found 9,500 daily TV ads during open enrollment in 2022. A recent survey by the Commonwealth Fund found that 30% of seniors received seven or more phone calls weekly from Medicare Advantage marketers during the most recent open enrollment (Oct. 15 to Dec. 7) for 2024 coverage.

In 2023, a critical milestone was passed: over half of seniors are now enrolled in privatized Medicare Advantage plans. The marketing for these plans nearly always fails to mention how hard it is to return to traditional Medicare once you are in Medicare Advantage, and that the MA plans have closed provider networks and require prior authorization for medical procedures. Instead, the marketing emphasizes the fringe benefits offered by Medicare Advantage plans like gym memberships.

U.S. Sen. Ron Wyden (D-Ore.), chairman of the Senate Finance Committee, criticized the widespread and predatory marketing of Medicare Advantage in a report in November 2022 and has continued to pressure the Biden administration to do more to address the problem.

The report said that consumer complaints about Medicare Advantage marketing more than doubled from 2020 to 2021 to 41,000. It cites cases such as that of an Oregon man whose switch to Medicare Advantage meant he could no longer afford his prescription drugs, as well as a 94-year-old woman with dementia in a rural area who bought a Medicare Advantage plan that required her to obtain care miles further from her residence than she had to travel before.

When open enrollment began last fall, it was “the start of a marketing barrage as marketing middlemen look to collect seniors’ information in order to bombard them with direct mail, emails, and phone calls to get them to enroll,” Wyden stated in a letter to the Centers for Medicare and Medicaid Services (CMS), which was signed by the other Democrats on the Senate Finance Committee.

Just three weeks after Wyden sent the letter, CMS released a proposed rule reforming Medicare Advantage practices that the main lobby group for Medicare Advantage plans, the Better Medicare Alliance, endorsed.

But key recommendations by Wyden were missing, including a ban on list acquisition by Medicare Advantage third-party marketing organizations, which includes brokers, and banning brokers that call beneficiaries multiple times a day for days in a row.

Among the prominent third-party marketing organizations is TogetherHealth, a subsidiary of Benefytt Technologies, which runs ads featuring former football star Joe Namath. In August 2022, the Federal Trade Commission forced Benefytt to repay $100 million for fraudulent activities. The month before, the Securities and Exchange Commission levied more than $12 million in fines against Benefytt. But CMS continues to allow Benefytt to work as a broker. Benefytt is owned by Madison Dearborn Partners, a Chicago-based private equity firm with ties to former Chicago mayor and current Ambassador to Japan Rahm Emanuel. Benefytt collects leads on potential customers, which they then sell to brokers and insurers to aggressively target seniors. CMS did not provide comment as to why they had not blocked Benefytt’s continuing work as a third-party marketing organization for Medicare.

Two different rounds of rule-making on Medicare Advantage marketing in 2023 instead focused on such reforms as reining in exaggerated claims and excessive broker compensation.

The enormous profits generated by Medicare Advantage plans—costing the federal government as much as $140 billion annually in overpayments to private companies—explains what drives the aggressive and often unethical marketing practices, said David Lipschutz, an associate director at the Center for Medicare Advocacy.

“The fact is, there is an increasingly imbalanced playing field between Medicare Advantage and traditional Medicare,” he said. “Medicare Advantage is being favored in many ways. Medicare Advantage plans are paid more than what traditional Medicare spends on a given beneficiary. Those factors combined with the fact that they generate such profits for insurance companies, leads to those companies doing everything they can to maximize enrollment.”

Adding to the problem, Lipschutz argued, was the enormous influence of the health insurance industry in Washington. Health insurers spent more than $33 million lobbying Washington in just the first three quarters of 2023 alone.

“There is no real organized lobby for traditional Medicare, or organized advertising efforts,” he said. “During open enrollment, 80% of Medicare-related ads have to do with Medicare Advantage. We regularly encounter very well-educated and savvy folks who are tripped up by advertising and lured in by the bells and whistles. The deck is stacked against the consumer.”

Private equity firms have made a large investment in the Medicare Advantage brokerage and marketing sector, in addition to Madison Dearborn’s acquisition of Benefytt. Bain Capital, which Sen. Mitt Romney (R-Utah) co-founded, invested $150 million in Enhance Health, a Medicare Advantage broker, in 2021. The CEO of EasyHealth, another private equity-backed brokerage, told Modern Healthcare in 2021 that “Insurance distribution is our Trojan horse into healthcare services.”

As federal law requires truth in advertising, a group of advocacy organizations—led by the Center for Medicare Advocacy, Disability Rights Connecticut, and the National Health Law Project—cited what they considered blatantly deceptive marketing by UnitedHealthcare to people who are eligible for both Medicare and Medicaid, in a complaint to CMS.

UnitedHealthcare had purchased ads in the Hartford Courant asking seniors in large bold-faced type: “Eligible for Medicare and Medicaid? You could get more with UnitedHealthcare.”

People who are eligible for both Medicare and Medicaid due to their income level are better off in traditional Medicare than Medicare Advantage given that Medicaid covers their out-of-pocket costs, meaning that they have wide latitude to choose their doctors, hospitals and medical procedures.

Sheldon Toubman, an attorney with Disability Rights Connecticut who worked to draft the complaint, framed the ad in the broader context of poor marketing practices by the Medicare Advantage industry.

“I have been aware for a long time of basically fraudulent advertising in the MA insurance industry,” Toubman told HEALTH CARE un-covered. “There’s an overriding misrepresentation—they tell you how great Medicare Advantage is, and never the downsides.[...]

“My biggest problem with being barraged is that so many of the ads were inaccurate,” Kleinman, a retired social services professional in New Haven County, Connecticut, told HEALTH CARE un-covered. “They neglect to say that the amount of coverage you get is limited. They don’t talk about what you are losing by leaving traditional Medicare. It feels like insurance companies are manipulating us to get Medicare Advantage plans sold so that they can control the system, as opposed to treating us like human beings.”

Seniors face a torrent of Medicare Advantage advertising: an analysis by KFF found 9,500 daily TV ads during open enrollment in 2022. A recent survey by the Commonwealth Fund found that 30% of seniors received seven or more phone calls weekly from Medicare Advantage marketers during the most recent open enrollment (Oct. 15 to Dec. 7) for 2024 coverage.

In 2023, a critical milestone was passed: over half of seniors are now enrolled in privatized Medicare Advantage plans. The marketing for these plans nearly always fails to mention how hard it is to return to traditional Medicare once you are in Medicare Advantage, and that the MA plans have closed provider networks and require prior authorization for medical procedures. Instead, the marketing emphasizes the fringe benefits offered by Medicare Advantage plans like gym memberships.

U.S. Sen. Ron Wyden (D-Ore.), chairman of the Senate Finance Committee, criticized the widespread and predatory marketing of Medicare Advantage in a report in November 2022 and has continued to pressure the Biden administration to do more to address the problem.

The report said that consumer complaints about Medicare Advantage marketing more than doubled from 2020 to 2021 to 41,000. It cites cases such as that of an Oregon man whose switch to Medicare Advantage meant he could no longer afford his prescription drugs, as well as a 94-year-old woman with dementia in a rural area who bought a Medicare Advantage plan that required her to obtain care miles further from her residence than she had to travel before.

When open enrollment began last fall, it was “the start of a marketing barrage as marketing middlemen look to collect seniors’ information in order to bombard them with direct mail, emails, and phone calls to get them to enroll,” Wyden stated in a letter to the Centers for Medicare and Medicaid Services (CMS), which was signed by the other Democrats on the Senate Finance Committee.

Just three weeks after Wyden sent the letter, CMS released a proposed rule reforming Medicare Advantage practices that the main lobby group for Medicare Advantage plans, the Better Medicare Alliance, endorsed.

But key recommendations by Wyden were missing, including a ban on list acquisition by Medicare Advantage third-party marketing organizations, which includes brokers, and banning brokers that call beneficiaries multiple times a day for days in a row.

Among the prominent third-party marketing organizations is TogetherHealth, a subsidiary of Benefytt Technologies, which runs ads featuring former football star Joe Namath. In August 2022, the Federal Trade Commission forced Benefytt to repay $100 million for fraudulent activities. The month before, the Securities and Exchange Commission levied more than $12 million in fines against Benefytt. But CMS continues to allow Benefytt to work as a broker. Benefytt is owned by Madison Dearborn Partners, a Chicago-based private equity firm with ties to former Chicago mayor and current Ambassador to Japan Rahm Emanuel. Benefytt collects leads on potential customers, which they then sell to brokers and insurers to aggressively target seniors. CMS did not provide comment as to why they had not blocked Benefytt’s continuing work as a third-party marketing organization for Medicare.

Two different rounds of rule-making on Medicare Advantage marketing in 2023 instead focused on such reforms as reining in exaggerated claims and excessive broker compensation.

The enormous profits generated by Medicare Advantage plans—costing the federal government as much as $140 billion annually in overpayments to private companies—explains what drives the aggressive and often unethical marketing practices, said David Lipschutz, an associate director at the Center for Medicare Advocacy.

“The fact is, there is an increasingly imbalanced playing field between Medicare Advantage and traditional Medicare,” he said. “Medicare Advantage is being favored in many ways. Medicare Advantage plans are paid more than what traditional Medicare spends on a given beneficiary. Those factors combined with the fact that they generate such profits for insurance companies, leads to those companies doing everything they can to maximize enrollment.”

Adding to the problem, Lipschutz argued, was the enormous influence of the health insurance industry in Washington. Health insurers spent more than $33 million lobbying Washington in just the first three quarters of 2023 alone.

“There is no real organized lobby for traditional Medicare, or organized advertising efforts,” he said. “During open enrollment, 80% of Medicare-related ads have to do with Medicare Advantage. We regularly encounter very well-educated and savvy folks who are tripped up by advertising and lured in by the bells and whistles. The deck is stacked against the consumer.”

Private equity firms have made a large investment in the Medicare Advantage brokerage and marketing sector, in addition to Madison Dearborn’s acquisition of Benefytt. Bain Capital, which Sen. Mitt Romney (R-Utah) co-founded, invested $150 million in Enhance Health, a Medicare Advantage broker, in 2021. The CEO of EasyHealth, another private equity-backed brokerage, told Modern Healthcare in 2021 that “Insurance distribution is our Trojan horse into healthcare services.”

As federal law requires truth in advertising, a group of advocacy organizations—led by the Center for Medicare Advocacy, Disability Rights Connecticut, and the National Health Law Project—cited what they considered blatantly deceptive marketing by UnitedHealthcare to people who are eligible for both Medicare and Medicaid, in a complaint to CMS.

UnitedHealthcare had purchased ads in the Hartford Courant asking seniors in large bold-faced type: “Eligible for Medicare and Medicaid? You could get more with UnitedHealthcare.”

People who are eligible for both Medicare and Medicaid due to their income level are better off in traditional Medicare than Medicare Advantage given that Medicaid covers their out-of-pocket costs, meaning that they have wide latitude to choose their doctors, hospitals and medical procedures.

Sheldon Toubman, an attorney with Disability Rights Connecticut who worked to draft the complaint, framed the ad in the broader context of poor marketing practices by the Medicare Advantage industry.

“I have been aware for a long time of basically fraudulent advertising in the MA insurance industry,” Toubman told HEALTH CARE un-covered. “There’s an overriding misrepresentation—they tell you how great Medicare Advantage is, and never the downsides.[...]

Amazon

Amazon duped millions into enrolling in Prime, US regulator says in lawsuit

Federal Trade Commission alleges Bezos firm used ‘manipulative and deceptive user-interface designs to trick consumers’

Guardian staff and agencies

Wed 21 Jun 2023 12.19 EDT

The US Federal Trade Commission has sued Amazon for what it called a years-long effort to enroll consumers without consent into its paid subscription program, Amazon Prime, and making it hard for them to cancel.

The FTC, the US agency charged with consumer protection, filed a federal lawsuit in Seattle, where Amazon is headquartered, alleging that the tech behemoth “ knowingly duped millions of consumers into unknowingly enrolling in Amazon Prime”.

The FTC said Amazon used “manipulative, coercive or deceptive user-interface designs known as ‘dark patterns’ to trick consumers into enrolling in automatically renewing Prime subscriptions”.

It said the option to purchase items on Amazon without subscribing to Prime was more difficult in many cases. It also said that consumers were sometimes presented with a button to complete their transactions – which didn’t clearly state it would also enroll them into Prime.

Internally, Amazon called the process “Iliad”, a reference to the ancient Greek poem about lengthy siege of Troy during the Trojan war.

Company leaders slowed or rejected changes that made canceling the subscription easier, the complaint said. It argued those patterns were in violation of the FTC Act and another law called the Restore Online Shoppers’ Confidence Act.

The FTC said that “one of Amazon’s primary business goals – and the primary business goal of Prime – is increasing subscriber numbers”.

Launched in 2005, Prime has more than 200 million members worldwide who pay $139 a year, or $14.99 a month, for faster shipping and other perks, such as free delivery, returns and the streaming service Prime Video. In the first three months of this year, Amazon reported it made $9.6bn from subscription, a 17% jump from the same period last year.

In a news release announcing the lawsuit, the FTC said though its complaint is significantly redacted, it contains “a number of allegations” that back up its accusations against Amazon. It also accused the company of attempting to hinder the agency’s investigation into Prime, which began in 2021, in several instances.

“Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money,” said Lina Khan, chair of the FTC, in a prepared statement. “These manipulative tactics harm consumers and law-abiding businesses alike.”

The tech giant has faced other lawsuits accusing its Prime cancelation process of being too complicated. Under scrutiny from the agency, the company in March provided consumers with instructions on how to cancel their Prime memberships in a blog post. Amazon did not immediately issue a statement on Wednesday.

Amazon has faced heightened regulatory scrutiny in recent years as it moved to expand its e-commerce dominance and dip its toes into other markets, including groceries and healthcare.

The lawsuit follows another Amazon-related win by the FTC just a few weeks ago. Earlier this month, Amazon agreed to pay a $25m civil penalty to settle allegations it violated a child privacy law for storing kids’ voice and location data recorded by its popular Alexa voice assistant. It also agreed to pay $5.8m in customer refunds for alleged privacy violations involving its doorbell camera Ring.

The FTC, the US agency charged with consumer protection, filed a federal lawsuit in Seattle, where Amazon is headquartered, alleging that the tech behemoth “ knowingly duped millions of consumers into unknowingly enrolling in Amazon Prime”.

The FTC said Amazon used “manipulative, coercive or deceptive user-interface designs known as ‘dark patterns’ to trick consumers into enrolling in automatically renewing Prime subscriptions”.

It said the option to purchase items on Amazon without subscribing to Prime was more difficult in many cases. It also said that consumers were sometimes presented with a button to complete their transactions – which didn’t clearly state it would also enroll them into Prime.

Internally, Amazon called the process “Iliad”, a reference to the ancient Greek poem about lengthy siege of Troy during the Trojan war.

Company leaders slowed or rejected changes that made canceling the subscription easier, the complaint said. It argued those patterns were in violation of the FTC Act and another law called the Restore Online Shoppers’ Confidence Act.

The FTC said that “one of Amazon’s primary business goals – and the primary business goal of Prime – is increasing subscriber numbers”.

Launched in 2005, Prime has more than 200 million members worldwide who pay $139 a year, or $14.99 a month, for faster shipping and other perks, such as free delivery, returns and the streaming service Prime Video. In the first three months of this year, Amazon reported it made $9.6bn from subscription, a 17% jump from the same period last year.

In a news release announcing the lawsuit, the FTC said though its complaint is significantly redacted, it contains “a number of allegations” that back up its accusations against Amazon. It also accused the company of attempting to hinder the agency’s investigation into Prime, which began in 2021, in several instances.

“Amazon tricked and trapped people into recurring subscriptions without their consent, not only frustrating users but also costing them significant money,” said Lina Khan, chair of the FTC, in a prepared statement. “These manipulative tactics harm consumers and law-abiding businesses alike.”

The tech giant has faced other lawsuits accusing its Prime cancelation process of being too complicated. Under scrutiny from the agency, the company in March provided consumers with instructions on how to cancel their Prime memberships in a blog post. Amazon did not immediately issue a statement on Wednesday.

Amazon has faced heightened regulatory scrutiny in recent years as it moved to expand its e-commerce dominance and dip its toes into other markets, including groceries and healthcare.

The lawsuit follows another Amazon-related win by the FTC just a few weeks ago. Earlier this month, Amazon agreed to pay a $25m civil penalty to settle allegations it violated a child privacy law for storing kids’ voice and location data recorded by its popular Alexa voice assistant. It also agreed to pay $5.8m in customer refunds for alleged privacy violations involving its doorbell camera Ring.

'Straight up fraud': Data confirms private insurers are stealing billions

Kenny Stancil, Common Dreams - raw story

October 10, 2022

Insurance giants are exploiting Medicare Advantage—a corporate-managed program that threatens to result in the complete privatization of traditional Medicare—to capture billions of dollars in extra profits, Saturday reporting by The New York Times confirmed.

"Medicare Advantage shouldn't exist."

The newspaper's analysis of dozens of lawsuits, inspector general reports, and watchdog investigations found that overbilling by Medicare Advantage (MA) providers is so pervasive it exceeds the budgets of entire federal agencies, prompting journalist Ryan Cooper to call the program "a straight up fraud scheme."

Nearly half of Medicare's 60 million beneficiaries are now enrolled in MA plans managed by for-profit insurance companies, and it is expected that most of the nation's seniors will be ensnared in the private-sector alternative to traditional Medicare by next year. Six weeks ago, Sen. Ron Wyden (D-Ore.) launched an inquiry into "potentially deceptive" marketing tactics used by MA providers to "take advantage" of vulnerable individuals.

---

Larry Levitt, executive vice president for health policy at Kaiser Family Foundation (KFF), which has has no connection with Kaiser Permanente, wrote on social media that "the move to privatize Medicare" has "been very profitable, in part because insurers are good at making their patients seem sicker."

Journalist Natalie Shure concurred, tweeting: "Privatized Medicare plans cherry pick healthier enrollees, fudge medical records to make them look as sick as possible, coax doctors into tacking on extra sham diagnoses to bill for, and pay themselves a profit on top of it. Medicare Advantage shouldn't exist."

"For all its faults, Medicare is a (nearly) universal program for 65+, with overhead hovering around 2%—far lower than its private counterparts," Shure added. "What inefficiencies did anyone think MA would be solving exactly[?]" she asked.

According to the Times, MA was created by congressional Republicans "two decades ago to encourage health insurers to find innovative ways to provide better care at lower cost."

Matt Bruenig, founder of the People's Policy Project, a left-wing think tank, argued that the notion that private insurers would "provide more benefit for less money" than traditional Medicare "while taking a profit" is insane on its face.

"They innovate on other margins, namely by bending and breaking rules that determine how much money Medicare gives them, as such things are hard to detect," said Bruenig, "and we are now stuck in an endless cat and mouse enforcement game with them."

As the Times reported:

The government pays Medicare Advantage insurers a set amount for each person who enrolls, with higher rates for sicker patients. And the insurers, among the largest and most prosperous American companies, have developed elaborate systems to make their patients appear as sick as possible, often without providing additional treatment, according to the lawsuits.

As a result, a program devised to help lower health care spending has instead become substantially more costly than the traditional government program it was meant to improve.

[...]

The government now spends nearly as much on Medicare Advantage's 29 million beneficiaries as on the Army and Navy combined. It's enough money that even a small increase in the average patient's bill adds up: The additional diagnoses led to $12 billion in overpayments in 2020, according to an estimate from the group that advises Medicare on payment policies—enough to cover hearing and vision care for every American over 65.

Another estimate, from a former top government health official, suggested the overpayments in 2020 were double that, more than $25 billion.

Citing a KFF study which found that companies typically rake in twice as much gross profit from MA plans as from other types of insurance, the Times pointed out that the growing privatization of Medicare is "strikingly lucrative."

MA plans "can limit patients' choice of doctors, and sometimes require jumping through more hoops before getting certain types of expensive care," the newspaper noted. "But they often have lower premiums or perks like dental benefits—extras that draw beneficiaries to the programs. The more the plans are overpaid by Medicare, the more generous to customers they can afford to be."

"By exploiting and overbilling Medicare, these companies profit off the public. Think of how this money could have been better spent."

The MA program has grown in popularity, including in Democratic strongholds, over the course of four presidential administrations. Meanwhile, regulatory and legislative efforts to rein in abuses have failed to gain traction.

Officials at the Centers for Medicare and Medicaid Services (CMS), some of whom move between the agency and industry, have not been aggressive "even as the overpayments have been described in inspector general investigations, academic research, Government Accountability Office studies, MedPAC reports, and numerous news articles," the Times reported. "Congress gave the agency the power to reduce the insurers' rates in response to evidence of systematic overbilling, but CMS has never chosen to do so."

Ted Doolittle, who served as a senior official for CMS' Center for Program Integrity from 2011 to 2014, said that "it was clear that there was some resistance coming from inside" the agency. "There was foot dragging."

Almost 80% percent of U.S. House members, many of whom are bankrolled by the insurance industry, signed a letter earlier this year indicating their readiness "to protect the program from policies that would undermine" its stability.

David Moore, co-founder of Sludge, an independent news outlet focused on the corrupting influence of corporate cash on politics, observed on social media that "members of the health subcommittee of the House Ways and Means Committee could publicly on whether they think oversight of the insurance industry has been adequate."

However, Moore pointed out, committee Chair Richard Neal (D-Mass.) "has received $3.1 million from the insurance industry, the most in the House."

As the Times noted, "Some critics say the lack of oversight has encouraged the industry to compete over who can most effectively game the system rather than who can provide the best care."

"Medicare Advantage overpayments are a political third rail," Richard Gilfillan, a former hospital and insurance executive and a former top regulator at Medicare, told the newspaper. "The big healthcare plans know it's wrong, and they know how to fix it, but they're making too much money to stop."

"There's a risk" that the increased scrutiny of MA providers "blows over because the program's beneficiaries continue to have access to doctors and hospitals," Joseph Ross, a primary care physician and health policy researcher at the Yale School of Medicine, wrote on Twitter. "But by exploiting and overbilling Medicare, these companies profit off the public."

"Think of how this money could have been better spent," said Ross. "The overbilling alone could have provided hearing and vision care to ALL Medicare beneficiaries, or been used to fund any of these agency's budgets."

"The overbilling alone could have provided hearing and vision care to ALL Medicare beneficiaries."

Despite mounting evidence of widespread fraud in MA plans, the Biden administration announced in April that MA insurers will receive one of the largest payment increases in the program's history in 2023, eliciting pushback from several congressional Democrats led by Rep. Katie Porter of California.

Progressives argue that MA is part of a broader effort to privatize Medicare and must be resisted.

Another major culprit is ACO REACH, a pilot program that critics have described as "Medicare Advantage on steroids."

The pilot—an updated version of Direct Contracting launched by the Trump administration and continued by the Biden administration—invites MA insurers and Wall Street firms to "manage" care for Medicare beneficiaries and allows the profit-maximizing middlemen to pocket as much as 40% of what they don't spend on patients, all but ensuring deadly cost-cutting.

Physicians and healthcare advocates have warned that failing to stop ACO REACH could result in the total privatization of traditional Medicare in a matter of years.

"Even though Medicare is relied on by millions of seniors across the country, and precisely because it is so necessary and cost-effective, it is under threat today from the constant efforts of private insurance companies and for-profit investors who want to privatize it and turn it into yet another shameful opportunity to make money off of peoples' health problems," Rep. Pramila Jayapal (D-Wash.) said in May.

Jayapal, chair of the Congressional Progressive Caucus, has called on the Biden administration to "fully end" ACO REACH and other privatization schemes and urged lawmakers to enact the Medicare for All Act, of which she is lead sponsor in the House.

Numerous studies have found that implementing a single-payer health insurance program would guarantee the provision of lifesaving care for every person in the country while reducing overall spending by as much as $650 billion per year.

"Medicare Advantage shouldn't exist."

The newspaper's analysis of dozens of lawsuits, inspector general reports, and watchdog investigations found that overbilling by Medicare Advantage (MA) providers is so pervasive it exceeds the budgets of entire federal agencies, prompting journalist Ryan Cooper to call the program "a straight up fraud scheme."

Nearly half of Medicare's 60 million beneficiaries are now enrolled in MA plans managed by for-profit insurance companies, and it is expected that most of the nation's seniors will be ensnared in the private-sector alternative to traditional Medicare by next year. Six weeks ago, Sen. Ron Wyden (D-Ore.) launched an inquiry into "potentially deceptive" marketing tactics used by MA providers to "take advantage" of vulnerable individuals.

---

Larry Levitt, executive vice president for health policy at Kaiser Family Foundation (KFF), which has has no connection with Kaiser Permanente, wrote on social media that "the move to privatize Medicare" has "been very profitable, in part because insurers are good at making their patients seem sicker."

Journalist Natalie Shure concurred, tweeting: "Privatized Medicare plans cherry pick healthier enrollees, fudge medical records to make them look as sick as possible, coax doctors into tacking on extra sham diagnoses to bill for, and pay themselves a profit on top of it. Medicare Advantage shouldn't exist."

"For all its faults, Medicare is a (nearly) universal program for 65+, with overhead hovering around 2%—far lower than its private counterparts," Shure added. "What inefficiencies did anyone think MA would be solving exactly[?]" she asked.

According to the Times, MA was created by congressional Republicans "two decades ago to encourage health insurers to find innovative ways to provide better care at lower cost."

Matt Bruenig, founder of the People's Policy Project, a left-wing think tank, argued that the notion that private insurers would "provide more benefit for less money" than traditional Medicare "while taking a profit" is insane on its face.

"They innovate on other margins, namely by bending and breaking rules that determine how much money Medicare gives them, as such things are hard to detect," said Bruenig, "and we are now stuck in an endless cat and mouse enforcement game with them."

As the Times reported:

The government pays Medicare Advantage insurers a set amount for each person who enrolls, with higher rates for sicker patients. And the insurers, among the largest and most prosperous American companies, have developed elaborate systems to make their patients appear as sick as possible, often without providing additional treatment, according to the lawsuits.

As a result, a program devised to help lower health care spending has instead become substantially more costly than the traditional government program it was meant to improve.

[...]

The government now spends nearly as much on Medicare Advantage's 29 million beneficiaries as on the Army and Navy combined. It's enough money that even a small increase in the average patient's bill adds up: The additional diagnoses led to $12 billion in overpayments in 2020, according to an estimate from the group that advises Medicare on payment policies—enough to cover hearing and vision care for every American over 65.

Another estimate, from a former top government health official, suggested the overpayments in 2020 were double that, more than $25 billion.

Citing a KFF study which found that companies typically rake in twice as much gross profit from MA plans as from other types of insurance, the Times pointed out that the growing privatization of Medicare is "strikingly lucrative."

MA plans "can limit patients' choice of doctors, and sometimes require jumping through more hoops before getting certain types of expensive care," the newspaper noted. "But they often have lower premiums or perks like dental benefits—extras that draw beneficiaries to the programs. The more the plans are overpaid by Medicare, the more generous to customers they can afford to be."

"By exploiting and overbilling Medicare, these companies profit off the public. Think of how this money could have been better spent."

The MA program has grown in popularity, including in Democratic strongholds, over the course of four presidential administrations. Meanwhile, regulatory and legislative efforts to rein in abuses have failed to gain traction.

Officials at the Centers for Medicare and Medicaid Services (CMS), some of whom move between the agency and industry, have not been aggressive "even as the overpayments have been described in inspector general investigations, academic research, Government Accountability Office studies, MedPAC reports, and numerous news articles," the Times reported. "Congress gave the agency the power to reduce the insurers' rates in response to evidence of systematic overbilling, but CMS has never chosen to do so."

Ted Doolittle, who served as a senior official for CMS' Center for Program Integrity from 2011 to 2014, said that "it was clear that there was some resistance coming from inside" the agency. "There was foot dragging."

Almost 80% percent of U.S. House members, many of whom are bankrolled by the insurance industry, signed a letter earlier this year indicating their readiness "to protect the program from policies that would undermine" its stability.

David Moore, co-founder of Sludge, an independent news outlet focused on the corrupting influence of corporate cash on politics, observed on social media that "members of the health subcommittee of the House Ways and Means Committee could publicly on whether they think oversight of the insurance industry has been adequate."

However, Moore pointed out, committee Chair Richard Neal (D-Mass.) "has received $3.1 million from the insurance industry, the most in the House."

As the Times noted, "Some critics say the lack of oversight has encouraged the industry to compete over who can most effectively game the system rather than who can provide the best care."

"Medicare Advantage overpayments are a political third rail," Richard Gilfillan, a former hospital and insurance executive and a former top regulator at Medicare, told the newspaper. "The big healthcare plans know it's wrong, and they know how to fix it, but they're making too much money to stop."

"There's a risk" that the increased scrutiny of MA providers "blows over because the program's beneficiaries continue to have access to doctors and hospitals," Joseph Ross, a primary care physician and health policy researcher at the Yale School of Medicine, wrote on Twitter. "But by exploiting and overbilling Medicare, these companies profit off the public."

"Think of how this money could have been better spent," said Ross. "The overbilling alone could have provided hearing and vision care to ALL Medicare beneficiaries, or been used to fund any of these agency's budgets."

"The overbilling alone could have provided hearing and vision care to ALL Medicare beneficiaries."

Despite mounting evidence of widespread fraud in MA plans, the Biden administration announced in April that MA insurers will receive one of the largest payment increases in the program's history in 2023, eliciting pushback from several congressional Democrats led by Rep. Katie Porter of California.

Progressives argue that MA is part of a broader effort to privatize Medicare and must be resisted.

Another major culprit is ACO REACH, a pilot program that critics have described as "Medicare Advantage on steroids."

The pilot—an updated version of Direct Contracting launched by the Trump administration and continued by the Biden administration—invites MA insurers and Wall Street firms to "manage" care for Medicare beneficiaries and allows the profit-maximizing middlemen to pocket as much as 40% of what they don't spend on patients, all but ensuring deadly cost-cutting.

Physicians and healthcare advocates have warned that failing to stop ACO REACH could result in the total privatization of traditional Medicare in a matter of years.

"Even though Medicare is relied on by millions of seniors across the country, and precisely because it is so necessary and cost-effective, it is under threat today from the constant efforts of private insurance companies and for-profit investors who want to privatize it and turn it into yet another shameful opportunity to make money off of peoples' health problems," Rep. Pramila Jayapal (D-Wash.) said in May.

Jayapal, chair of the Congressional Progressive Caucus, has called on the Biden administration to "fully end" ACO REACH and other privatization schemes and urged lawmakers to enact the Medicare for All Act, of which she is lead sponsor in the House.

Numerous studies have found that implementing a single-payer health insurance program would guarantee the provision of lifesaving care for every person in the country while reducing overall spending by as much as $650 billion per year.

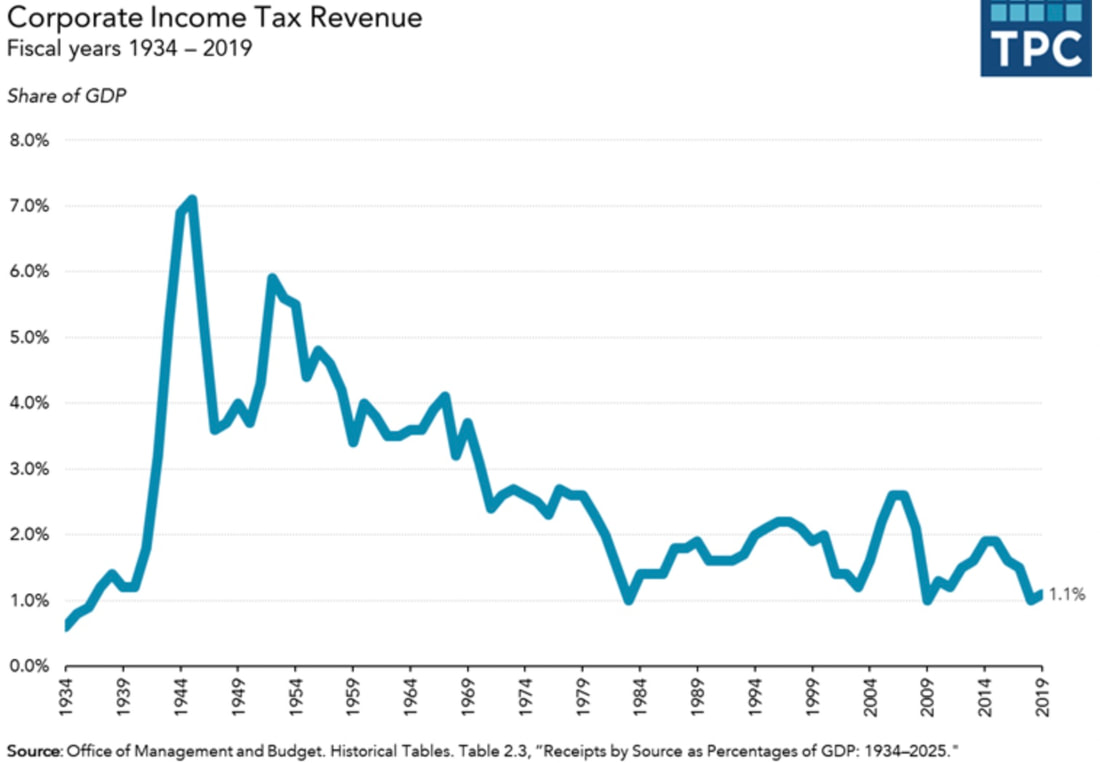

How to Decimate the Corporate Tax-Avoidance Industry

DEAN BAKER - dc report

August 22, 2022

A Simple Shift in What’s Taxed Would Raise More Money

The Inflation Reduction Act includes a remarkable innovation. Share buybacks will be taxed at a 1% rate. This is a huge deal, not only because it taxes money that was often escaping taxation at the individual level, but it is a move away from basing the corporate income tax on profits, which can be easily manipulated, to taxing returns to shareholders.

It is time for a major and simple overhaul of the corporate income tax system. The main problem with the current system is that it is focused on the wrong target. Instead of taxing corporate profits, we should be taxing stock returns to investors.

The big issue here is that corporate profits are not a well-defined concept. A thousand issues arise in determining profit, all of which depend to a substantial extent on judgment calls by accountants. Depreciation of capital is the most obvious problem, but there are many others.

What’s Visible, What’s Not

While profits are something that we cannot see, returns to shareholders can be easily seen. This is simply the increase in market capitalization, plus whatever money is paid out in dividends. This information is readily available on dozens of financial websites.

Before explaining how this alternative would work, it is worth going through some recent history.

Democrats in Congress were unanimous in opposing the Tax Cut and Jobs Act (TCJA) the Republicans pushed through Congress in 2017. However, there is one aspect of that tax cut law that nearly all Democratic economists would favor: lowering the corporate tax rate in exchange for limiting tax deductions.

Prior to the 2017 tax cut, the corporate income tax rate was 35%. However, few companies paid anything close to this rate. Actual tax collections were typically around 20%-22% of corporate profits.

While the 35% nominal tax rate put the U.S. at the top of OECD countries, our effective tax rate was slightly below the median.

Trump’s Failed Tax Promise

It makes little sense to have a high tax rate that is easily avoided or evaded. This simply encourages companies to spend large amounts of money gaming the system. This gaming is a complete waste from an economic perspective. We have many highly skilled people spending their time finding ways to play tax tricks rather than doing something that is economically productive. This is why almost all economists would prefer to have a lower tax rate that is actually collected.

Unfortunately, the TCJA that Trump signed into law did not deliver on this promise. While it did sharply lower the nominal tax rate—from 35% to 21%—companies still find it easy to avoid paying taxes. In 2019, the overall effective tax rate was just 13.3%, not even close to the posted rate.

Although the Trump administration probably had little interest in actually cutting down on tax avoidance and evasion, the taxation of stock returns gives us a surefire way to accomplish this reform. We simply apply whatever tax rate we are targeting to the returns that shareholders receive in a given year.

Tax Shelter Industry

There is also nothing that corporations can do to hide the returns on their stock unless they want to rip off their shareholders in addition to ripping off the government. If we want to have a 25% corporate income tax, for example, we can simply tax the returns to shareholders at a 25% rate, and we know exactly what we will get. (We could allow averaging, say over five-year periods, to smooth out tax payments.)

In addition to making the corporate income tax more easily collectible, shifting the basis of the tax from reported profits to returns to shareholders will radically reduce the size of the tax shelter industry. As it stands now, companies spend tens of billions of dollars each year hiring lawyers and accountants to minimize their tax burden.

Fostering Inequality

These expenditures on tax dodges are a complete waste of resources and undermine the purpose of the corporate income tax. As the Modern Monetary Theory crew reminds us, the purpose of taxes at the national level is to reduce demand in the economy. Insofar as companies spend large amounts of money trying to avoid paying taxes, the goal of the corporate income tax is undermined.

The tax avoidance industry is also a major source of inequality. Creative tax lawyers and accountants can make huge salaries by developing innovative tax dodges. We can put many of these people out of business by basing the corporate income tax on stock returns, which are completely transparent.

Conjuring Numbers

The taxation of share buybacks in the Inflation Reduction Act is a small but important step in this direction.

It shows that we do not have to use profit as the basis for the corporate income tax. After it has been in place for a few years, and we have the opportunity to see how effective it is in raising revenue, perhaps we can shift the basis for the rest of the corporate income tax to the stock returns we can all see, rather than the profit statements that are conjured up by accountants.

The Inflation Reduction Act includes a remarkable innovation. Share buybacks will be taxed at a 1% rate. This is a huge deal, not only because it taxes money that was often escaping taxation at the individual level, but it is a move away from basing the corporate income tax on profits, which can be easily manipulated, to taxing returns to shareholders.

It is time for a major and simple overhaul of the corporate income tax system. The main problem with the current system is that it is focused on the wrong target. Instead of taxing corporate profits, we should be taxing stock returns to investors.

The big issue here is that corporate profits are not a well-defined concept. A thousand issues arise in determining profit, all of which depend to a substantial extent on judgment calls by accountants. Depreciation of capital is the most obvious problem, but there are many others.

What’s Visible, What’s Not

While profits are something that we cannot see, returns to shareholders can be easily seen. This is simply the increase in market capitalization, plus whatever money is paid out in dividends. This information is readily available on dozens of financial websites.

Before explaining how this alternative would work, it is worth going through some recent history.

Democrats in Congress were unanimous in opposing the Tax Cut and Jobs Act (TCJA) the Republicans pushed through Congress in 2017. However, there is one aspect of that tax cut law that nearly all Democratic economists would favor: lowering the corporate tax rate in exchange for limiting tax deductions.

Prior to the 2017 tax cut, the corporate income tax rate was 35%. However, few companies paid anything close to this rate. Actual tax collections were typically around 20%-22% of corporate profits.

While the 35% nominal tax rate put the U.S. at the top of OECD countries, our effective tax rate was slightly below the median.

Trump’s Failed Tax Promise

It makes little sense to have a high tax rate that is easily avoided or evaded. This simply encourages companies to spend large amounts of money gaming the system. This gaming is a complete waste from an economic perspective. We have many highly skilled people spending their time finding ways to play tax tricks rather than doing something that is economically productive. This is why almost all economists would prefer to have a lower tax rate that is actually collected.

Unfortunately, the TCJA that Trump signed into law did not deliver on this promise. While it did sharply lower the nominal tax rate—from 35% to 21%—companies still find it easy to avoid paying taxes. In 2019, the overall effective tax rate was just 13.3%, not even close to the posted rate.

Although the Trump administration probably had little interest in actually cutting down on tax avoidance and evasion, the taxation of stock returns gives us a surefire way to accomplish this reform. We simply apply whatever tax rate we are targeting to the returns that shareholders receive in a given year.

Tax Shelter Industry

There is also nothing that corporations can do to hide the returns on their stock unless they want to rip off their shareholders in addition to ripping off the government. If we want to have a 25% corporate income tax, for example, we can simply tax the returns to shareholders at a 25% rate, and we know exactly what we will get. (We could allow averaging, say over five-year periods, to smooth out tax payments.)

In addition to making the corporate income tax more easily collectible, shifting the basis of the tax from reported profits to returns to shareholders will radically reduce the size of the tax shelter industry. As it stands now, companies spend tens of billions of dollars each year hiring lawyers and accountants to minimize their tax burden.

Fostering Inequality

These expenditures on tax dodges are a complete waste of resources and undermine the purpose of the corporate income tax. As the Modern Monetary Theory crew reminds us, the purpose of taxes at the national level is to reduce demand in the economy. Insofar as companies spend large amounts of money trying to avoid paying taxes, the goal of the corporate income tax is undermined.

The tax avoidance industry is also a major source of inequality. Creative tax lawyers and accountants can make huge salaries by developing innovative tax dodges. We can put many of these people out of business by basing the corporate income tax on stock returns, which are completely transparent.

Conjuring Numbers

The taxation of share buybacks in the Inflation Reduction Act is a small but important step in this direction.

It shows that we do not have to use profit as the basis for the corporate income tax. After it has been in place for a few years, and we have the opportunity to see how effective it is in raising revenue, perhaps we can shift the basis for the rest of the corporate income tax to the stock returns we can all see, rather than the profit statements that are conjured up by accountants.

PFAS

‘They all knew’: textile company misled regulators about use of toxic PFAS, documents show

Thousands more residents outside the original contamination zone may be drinking tainted water

Tom Perkins - the guardians

Fri 5 Aug 2022 05.00 EDT

A French industrial fabric producer that poisoned drinking water supplies with PFAS “forever chemicals” across 65 sq miles (168 sq km) of southern New Hampshire misled regulators about the amount of toxic substance it used, a group of state lawmakers and public health advocates charge.

The company, Saint Gobain, now admits it used far more PFAS than regulators previously knew, and officials fear thousands more residents outside the contamination zone’s boundaries may be drinking tainted water in a region plagued by cancer clusters and other health problems thought to stem from PFAS pollution.

Saint Gobain in 2018 agreed to provide clean drinking water in the 65-sq-mile area as part of a consent agreement with New Hampshire regulators, and damning evidence suggesting it used more PFAS than previously admitted surfaced in a trove of documents released in a separate class-action lawsuit.

“People are sick, there are really high cancer rates and people literally have died, so when you see what’s happening and the company acts like this – it’s really upsetting,” said Mindi Messmer, a former state representative who analyzed the documents and sent them to the New Hampshire attorney general and state regulators.

Saint Gobain has denied wrongdoing. PFAS, or per- and polyfluoroalkyl substances, are a class of about 12,000 chemicals used across dozens of industries to make products resist water, stains and heat. The highly toxic compounds don’t naturally break down, and are linked to cancer, thyroid disease, kidney problems, decreased immunity, birth defects and other serious health problems. They have been called “forever chemicals” due to their longevity in the environment.

Saint Gobain Performance Plastics’ Merrimack, New Hampshire, plant had for decades treated its products with PFOA, one type of PFAS, to make them stronger. The company released PFOA from its smokestacks and the chemicals, once on the ground, moved through the soil and into aquifers. Hundreds of residential and municipal wells pull from the groundwater.

As the company and New Hampshire department of environmental services (DES) negotiated the 2018 consent agreement, company officials repeatedly said they didn’t use pure PFOA, or didn’t have a record of using it, but instead used a diluted PFOA mixture of which the toxic chemical only comprised about 2%.

In a 2016 letter to state regulators, Saint Gobain wrote that it “never used [pure PFOA] as a raw material at any point in time” in Merrimack, and in 2014 told the EPA it “is not and never has been a … user of PFOA per se anywhere in the United States.”

The diluted PFOA wouldn’t spread as widely as pure PFOA, and the modeling that determined the boundaries within which Saint Gobain would be responsible for providing clean drinking water supplies and remediating contamination was developed with the diluted solution as an input.

But the documents released as part of the lawsuit show Saint Gobain knew it used pure PFOA years before the consent decree.

Among the evidence are 2003 emails between company employees explicitly stating the Merrimack facility treated its fabric with pure PFOA. Meanwhile, a former Saint Gobain attorney who is now whistleblowing testified that sales records from 3M, which sold PFOA to Saint Gobain, show the company bought “hundreds if not thousands” of pounds of pure PFOA. The 3M sales records are under seal in the class-action suit.

And a salesman for DuPont, which also sold PFAS products to Saint Gobain, last year testified that he had “learned that they were using [pure PFOA] … and adding it to our products”.

The modeling used to develop the original contamination zone’s boundaries is “fundamentally flawed” because it did not account for the pure PFOA, an engineer hired by Saint Gobain testified in February.

Saint Gobain no longer denies that it used pure PFOA; however, in a statement to the Guardian, the company wrote it “vehemently denies any allegation it withheld data, or misled, the New Hampshire Department of Environmental Services”. The information was “not new” because it was in 90,000 documents it gave the DES since 2016, the company wrote.

Messmer said she’s skeptical of that explanation: “If you throw 90,000 papers at someone, is that really notifying them?”

In response to a follow-up question about why it developed the consent decree modeling assuming diluted PFOA instead of pure PFOA, the company said the type of PFOA was only “one factor considered in setting the boundaries”.

In their July letter to the attorney general’s office and DES, Messmer and other lawmakers asked for an investigation and to expand the boundaries of the contamination zone. The state has “sound legal basis to hold Saint Gobain fully accountable for their pollution, including beyond the current [boundary]”, the letter reads. The attorney general’s office told the Guardian it is reviewing the documents while the DES did not immediately respond to a request for comment.

Some are also frustrated with the DES. Documents show it knew it didn’t have Saint Gobain’s complete PFAS purchase records from before 2004, but still entered into the consent agreement.

“The regulatory agency is broken, and I’m really angry with the state departments that are supposed to be there to protect the environment and residents,” said Laurene Allen, a Merrimack resident and clean water activist. “Think of the harm that could have been prevented.”

The documents reveal a company executive stating in 2006 that Saint Gobain “ought to downplay the potential health risks” of PFOA relative to other PFAS, and argue there are “no proven” health risks. But a 1995 company memo shows management had issued a decree to stop using PFOA “because of its toxicity and long half-life”.

The company had also in 2006 conducted blood tests for PFOA on its employees but the results remain under seal, and the plant’s previous owner in 1980 investigated why its male employees were experiencing impotence and “polymer fever”.

“They all knew,” Messmer said.

The company, Saint Gobain, now admits it used far more PFAS than regulators previously knew, and officials fear thousands more residents outside the contamination zone’s boundaries may be drinking tainted water in a region plagued by cancer clusters and other health problems thought to stem from PFAS pollution.

Saint Gobain in 2018 agreed to provide clean drinking water in the 65-sq-mile area as part of a consent agreement with New Hampshire regulators, and damning evidence suggesting it used more PFAS than previously admitted surfaced in a trove of documents released in a separate class-action lawsuit.

“People are sick, there are really high cancer rates and people literally have died, so when you see what’s happening and the company acts like this – it’s really upsetting,” said Mindi Messmer, a former state representative who analyzed the documents and sent them to the New Hampshire attorney general and state regulators.

Saint Gobain has denied wrongdoing. PFAS, or per- and polyfluoroalkyl substances, are a class of about 12,000 chemicals used across dozens of industries to make products resist water, stains and heat. The highly toxic compounds don’t naturally break down, and are linked to cancer, thyroid disease, kidney problems, decreased immunity, birth defects and other serious health problems. They have been called “forever chemicals” due to their longevity in the environment.

Saint Gobain Performance Plastics’ Merrimack, New Hampshire, plant had for decades treated its products with PFOA, one type of PFAS, to make them stronger. The company released PFOA from its smokestacks and the chemicals, once on the ground, moved through the soil and into aquifers. Hundreds of residential and municipal wells pull from the groundwater.

As the company and New Hampshire department of environmental services (DES) negotiated the 2018 consent agreement, company officials repeatedly said they didn’t use pure PFOA, or didn’t have a record of using it, but instead used a diluted PFOA mixture of which the toxic chemical only comprised about 2%.

In a 2016 letter to state regulators, Saint Gobain wrote that it “never used [pure PFOA] as a raw material at any point in time” in Merrimack, and in 2014 told the EPA it “is not and never has been a … user of PFOA per se anywhere in the United States.”

The diluted PFOA wouldn’t spread as widely as pure PFOA, and the modeling that determined the boundaries within which Saint Gobain would be responsible for providing clean drinking water supplies and remediating contamination was developed with the diluted solution as an input.

But the documents released as part of the lawsuit show Saint Gobain knew it used pure PFOA years before the consent decree.

Among the evidence are 2003 emails between company employees explicitly stating the Merrimack facility treated its fabric with pure PFOA. Meanwhile, a former Saint Gobain attorney who is now whistleblowing testified that sales records from 3M, which sold PFOA to Saint Gobain, show the company bought “hundreds if not thousands” of pounds of pure PFOA. The 3M sales records are under seal in the class-action suit.

And a salesman for DuPont, which also sold PFAS products to Saint Gobain, last year testified that he had “learned that they were using [pure PFOA] … and adding it to our products”.

The modeling used to develop the original contamination zone’s boundaries is “fundamentally flawed” because it did not account for the pure PFOA, an engineer hired by Saint Gobain testified in February.

Saint Gobain no longer denies that it used pure PFOA; however, in a statement to the Guardian, the company wrote it “vehemently denies any allegation it withheld data, or misled, the New Hampshire Department of Environmental Services”. The information was “not new” because it was in 90,000 documents it gave the DES since 2016, the company wrote.

Messmer said she’s skeptical of that explanation: “If you throw 90,000 papers at someone, is that really notifying them?”

In response to a follow-up question about why it developed the consent decree modeling assuming diluted PFOA instead of pure PFOA, the company said the type of PFOA was only “one factor considered in setting the boundaries”.

In their July letter to the attorney general’s office and DES, Messmer and other lawmakers asked for an investigation and to expand the boundaries of the contamination zone. The state has “sound legal basis to hold Saint Gobain fully accountable for their pollution, including beyond the current [boundary]”, the letter reads. The attorney general’s office told the Guardian it is reviewing the documents while the DES did not immediately respond to a request for comment.

Some are also frustrated with the DES. Documents show it knew it didn’t have Saint Gobain’s complete PFAS purchase records from before 2004, but still entered into the consent agreement.

“The regulatory agency is broken, and I’m really angry with the state departments that are supposed to be there to protect the environment and residents,” said Laurene Allen, a Merrimack resident and clean water activist. “Think of the harm that could have been prevented.”

The documents reveal a company executive stating in 2006 that Saint Gobain “ought to downplay the potential health risks” of PFOA relative to other PFAS, and argue there are “no proven” health risks. But a 1995 company memo shows management had issued a decree to stop using PFOA “because of its toxicity and long half-life”.

The company had also in 2006 conducted blood tests for PFOA on its employees but the results remain under seal, and the plant’s previous owner in 1980 investigated why its male employees were experiencing impotence and “polymer fever”.

“They all knew,” Messmer said.

How Medicare Advantage Scammers Get Away With It

Buying a Medicare Advantage policy is a leap in the dark, and the federal government generally is not there to catch you: forewarned is forearmed

Thom Hartmann

6/14/2022

In my multiple writings on the Medicare Advantage scam, the most common two responses I get (besides, “Thanks, you may have saved my life!”) are, “I’ve never had a problem with my Advantage plan,” and “If it’s so bad, how come so few people are saying so?”

Both are honest, good-faith questions and highlight how easy it is for insurance companies to get away with their Medicare Advantage scams. The answer to both boils down to the unique nature of insurance being the only “product” we buy where we have no idea if it’s any good until something bad happens — which can take years.

Every state in the union has an insurance commissioner. But why?

Why would any state go to the trouble and expense of creating a new layer of bureaucracy?

We don’t have “auto dealership commissioners” or “big-box retailer commissioners”: only insurance has an elected or appointed overseer.

Why would a state want to elect or appoint a very well-paid person to a new position in state government? Why would they appropriate money for a staff, for offices, in some cases even for buildings for a state insurance commissioner?

It turns out the answer is quite simple. One of the easiest scams in the history of scams, going all the way back centuries before Alfred Ponzi set up shop in Pie Alley, is done with insurance.

Here’s how it works.

If you have insurance, you send them a check every month. You think you’re covered and they’ll be there for you when you need them.

But you have no way of knowing if they’ll really be there for you when you need them because you’ve never used the service in a real health crisis.

It’s completely different from going to the store and buying a toaster. When you get home, you plug it in, and you know right away if it works or not.

Insurance, on the other hand, is the only “product” in existence where you buy it but have no idea if it really works and will be there for you until years later when you need it — and then it’s too late to do anything about it.

Because of this, thousands of insurance schemes and scams were run across the United States, particularly during the late 19th and early 20th century.

In almost every case they sold policies but after a year or two simply closed up shop and moved to some other town taking all the money with them.

If it was life insurance, nobody had died during that time. If it was home fire insurance, nobody’s house caught on fire. If it was theft insurance, nobody who was insured got robbed.

And even if somebody did have a claim in one of those categories, paying it would’ve been a relatively small expense relative to all the money that had been collected before they fled the state.

Insurance was such an easy and lucrative way to commit fraud that state after state decided that anybody selling it would have to be licensed and there would have to be an entire level of state bureaucracy to make sure that the insurance companies weren’t ripping people off.

Medicare advantage or Medicare part C has now become a variation on that kind of 19th century scam, as I document in detail in The Hidden History of American Healthcare: Why Sickness Bankrupts You and Makes Others Insanely Rich.

This privatized insurance deceptively sold under the Medicare name (thanks, George W. Bush) allows the corporations that sell it to challenge every single doctor’s recommendation, drug, procedure, or surgery, and also refuse to pay for doctors or hospitalizations that are “out of network.”

They get away with it because when people choose to sign up for Medicare Advantage at 65 they’re typically not sick. They have no idea all the hassles, hoops, and troubles they might have to jump through when they do get sick, have an accident, or otherwise need medical assistance.

And since the last three years of life are typically the most expensive years for healthcare, the insurance denials are more likely to happen then — long after the person’s signed up with the Advantage company.

So it takes a few years for people to figure out how badly they got screwed by not going with regular Medicare but instead putting themselves in the hands of private insurance companies.

The New York Times did an exposé of the problem earlier this year, in an article titled “Medicare Advantage Plans Often Deny Needed Care, Federal Report Finds.” It tells the story of “Kurt Pauker, an 87-year-old Holocaust survivor in Indianapolis” who’d bought an Advantage policy from Humana:

“In spite of recommendations from Mr. Pauker’s doctors, his family said, Humana has repeatedly denied authorization for inpatient rehabilitation after hospitalization, saying at times he was too healthy and at times too ill to benefit.”

This is not at all uncommon, the Times notes:

“Tens of millions of denials are issued each year for both authorization and reimbursements, and audits of the private insurers show evidence of ‘widespread and persistent problems related to inappropriate denials of services and payment,’ the investigators found.”

If you have “real” Medicare with a heavily regulated Medigap policy to cover the 20% Medicare doesn’t, you never have to worry.

Your bills get paid, you can use any doctor or hospital in the country who takes Medicare, and neither Medicare nor your Medigap provider will ever try to collect from you or force you to pay for what you thought was covered.

Neither you or your doctor will ever have to do the “pre-authorization” dance with real Medicare: those terrible experiences are part of the past.

But if you have Medicare Advantage — which is not Medicare, but privatized insurance that came about because of George W. Bush’s 2003 law to privatize Medicare — you’re on your own.

As the Times laid out:

“About 18 percent of [Advantage] payments were denied despite meeting Medicare coverage rules, an estimated 1.5 million payments for all of 2019. In some cases, plans ignored prior authorizations or other documentation necessary to support the payment. These denials may delay or even prevent a Medicare Advantage beneficiary from getting needed care…”

Buying a Medicare Advantage policy is a leap in the dark, and the federal government generally is not there to catch you. And it’s all perfectly legal, thanks to Bush’s 2003 law, so your state insurance commissioner usually can’t or won’t help.

And don’t even bother fantasizing that Joe Namath or another of the well-paid hustlers will be there for you: they don’t even disclose in their TV ads that if you sign up for Advantage and hold the policy for more than a year it can be extraordinarily difficult to get back on “real” Medicare or buy a Medigap policy.

Forewarned is forearmed.

Both are honest, good-faith questions and highlight how easy it is for insurance companies to get away with their Medicare Advantage scams. The answer to both boils down to the unique nature of insurance being the only “product” we buy where we have no idea if it’s any good until something bad happens — which can take years.

Every state in the union has an insurance commissioner. But why?

Why would any state go to the trouble and expense of creating a new layer of bureaucracy?

We don’t have “auto dealership commissioners” or “big-box retailer commissioners”: only insurance has an elected or appointed overseer.

Why would a state want to elect or appoint a very well-paid person to a new position in state government? Why would they appropriate money for a staff, for offices, in some cases even for buildings for a state insurance commissioner?

It turns out the answer is quite simple. One of the easiest scams in the history of scams, going all the way back centuries before Alfred Ponzi set up shop in Pie Alley, is done with insurance.

Here’s how it works.

If you have insurance, you send them a check every month. You think you’re covered and they’ll be there for you when you need them.

But you have no way of knowing if they’ll really be there for you when you need them because you’ve never used the service in a real health crisis.

It’s completely different from going to the store and buying a toaster. When you get home, you plug it in, and you know right away if it works or not.

Insurance, on the other hand, is the only “product” in existence where you buy it but have no idea if it really works and will be there for you until years later when you need it — and then it’s too late to do anything about it.

Because of this, thousands of insurance schemes and scams were run across the United States, particularly during the late 19th and early 20th century.

In almost every case they sold policies but after a year or two simply closed up shop and moved to some other town taking all the money with them.

If it was life insurance, nobody had died during that time. If it was home fire insurance, nobody’s house caught on fire. If it was theft insurance, nobody who was insured got robbed.

And even if somebody did have a claim in one of those categories, paying it would’ve been a relatively small expense relative to all the money that had been collected before they fled the state.

Insurance was such an easy and lucrative way to commit fraud that state after state decided that anybody selling it would have to be licensed and there would have to be an entire level of state bureaucracy to make sure that the insurance companies weren’t ripping people off.

Medicare advantage or Medicare part C has now become a variation on that kind of 19th century scam, as I document in detail in The Hidden History of American Healthcare: Why Sickness Bankrupts You and Makes Others Insanely Rich.

This privatized insurance deceptively sold under the Medicare name (thanks, George W. Bush) allows the corporations that sell it to challenge every single doctor’s recommendation, drug, procedure, or surgery, and also refuse to pay for doctors or hospitalizations that are “out of network.”

They get away with it because when people choose to sign up for Medicare Advantage at 65 they’re typically not sick. They have no idea all the hassles, hoops, and troubles they might have to jump through when they do get sick, have an accident, or otherwise need medical assistance.

And since the last three years of life are typically the most expensive years for healthcare, the insurance denials are more likely to happen then — long after the person’s signed up with the Advantage company.

So it takes a few years for people to figure out how badly they got screwed by not going with regular Medicare but instead putting themselves in the hands of private insurance companies.

The New York Times did an exposé of the problem earlier this year, in an article titled “Medicare Advantage Plans Often Deny Needed Care, Federal Report Finds.” It tells the story of “Kurt Pauker, an 87-year-old Holocaust survivor in Indianapolis” who’d bought an Advantage policy from Humana: