TO COMMENT CLICK HERE

Payback

Dedicated to the Fools, Racists, and Ignorant

People who vote for the GOP and trump or don't vote because they claim it is not important

february 2023

400 years and they have learned nothing

8 disturbing trends that reveal the South’s battered psyche

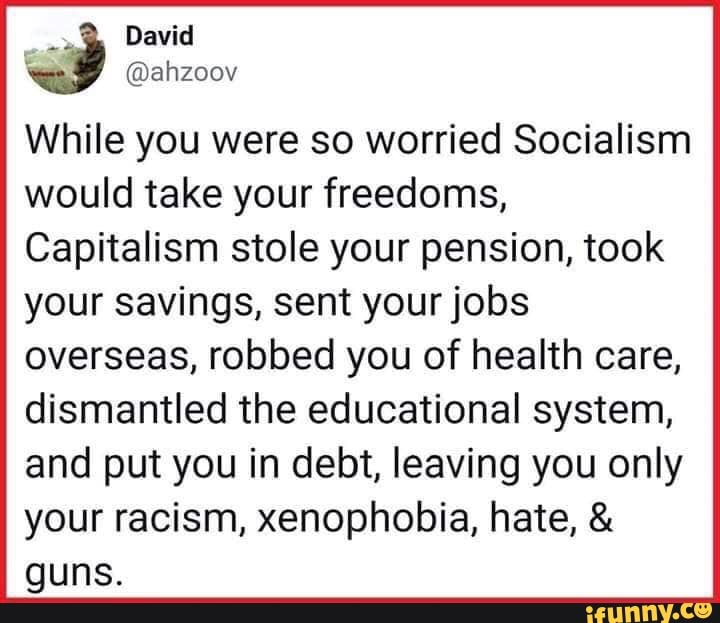

From Salon: Across red-state America, especially in the Deep South, the latest statistics show that the cycle of poverty, in its many manifestations, is unchanged and holding firm. Why is this? It’s easy to say this is how Republicans like to run states—cutting budgets, not raising the minimum wage, opposing labor unions. They let the poor and working class stew in their hardscrabble juices. Meanwhile, they distract voters by accusing liberals of waging war on the few sources of personal power in Southerners’ difficult lives: their religious beliefs and owning guns. But go back several decades when segregationist Democrats ruled; for the most part, they weren’t very different from today’s Republicans.

So what is it that perpetuates decades of poverty in the Deep South? What follows are eight bundles of statistics tracking this latest cycle of poverty. Could it be that people who historically have been treated badly, who have little money in their pockets but look to the sky and pray, expect less from others—including the public and private sector? Does that explain why red-staters cling to God, gun ownership and a “leave-me-alone” ferocity?

They expect politicians to defend their values and their pride and little more?

What’s going on here isn’t entirely political, even if it is used by red-state Republicans in their personal drive for power and influence. Look at what the following statistics reveal about red-staters trapped in deep cycles of poverty. What is the thread that connects lousy governance, bad health, evangelical religion and firearms fervor?

1. Southern states have the most poor people.

2. Deep South states have no minimum wage.

3. Deep South has lowest economic mobility.

4. South has lowest per capita spending by state government.

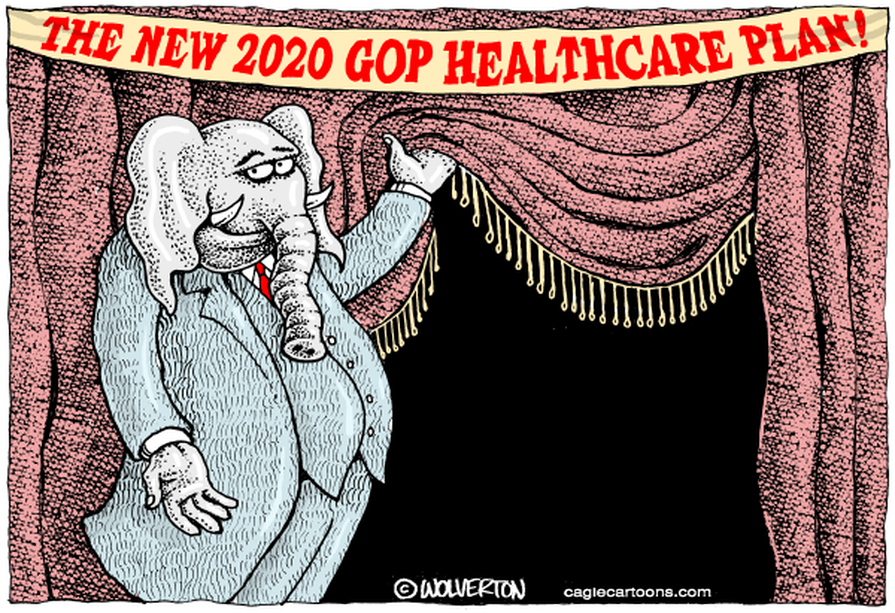

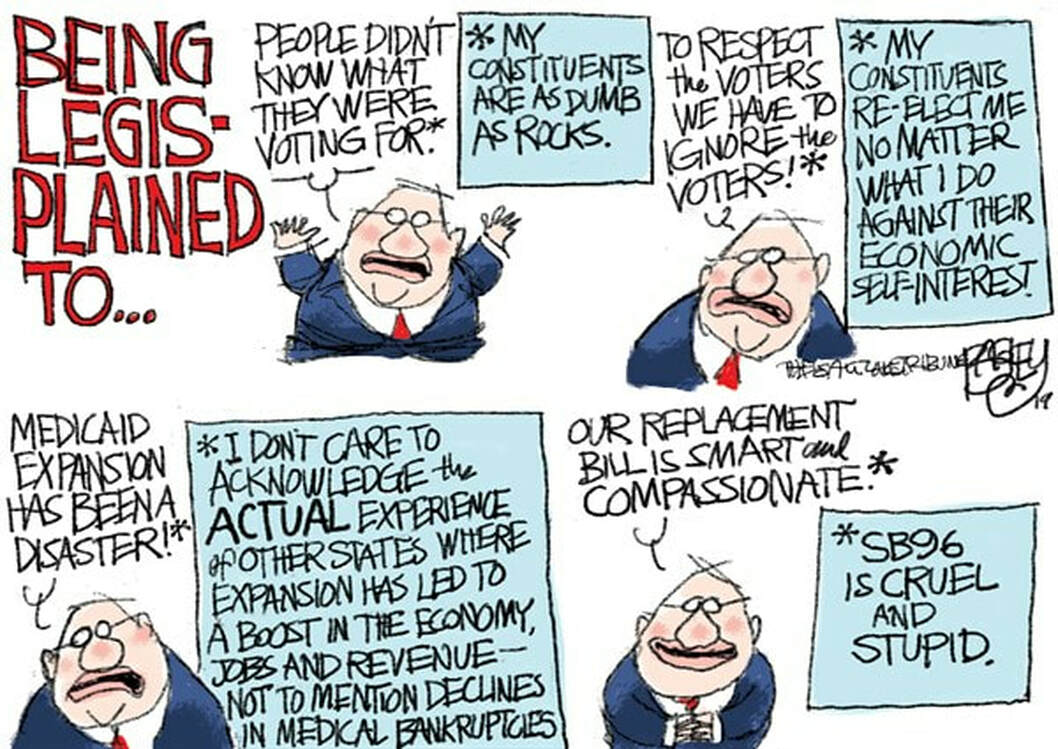

5. Forget about decent preventative healthcare.

6. One result: people self-medicate in response.

7. Forget the lottery, just pray to Jesus.

8. And hold onto that gun!

So what is it that perpetuates decades of poverty in the Deep South? What follows are eight bundles of statistics tracking this latest cycle of poverty. Could it be that people who historically have been treated badly, who have little money in their pockets but look to the sky and pray, expect less from others—including the public and private sector? Does that explain why red-staters cling to God, gun ownership and a “leave-me-alone” ferocity?

They expect politicians to defend their values and their pride and little more?

What’s going on here isn’t entirely political, even if it is used by red-state Republicans in their personal drive for power and influence. Look at what the following statistics reveal about red-staters trapped in deep cycles of poverty. What is the thread that connects lousy governance, bad health, evangelical religion and firearms fervor?

1. Southern states have the most poor people.

2. Deep South states have no minimum wage.

3. Deep South has lowest economic mobility.

4. South has lowest per capita spending by state government.

5. Forget about decent preventative healthcare.

6. One result: people self-medicate in response.

7. Forget the lottery, just pray to Jesus.

8. And hold onto that gun!

JAMES CARVILLE: on white trash

"WELL, YOU KNOW, I TOLD PEOPLE I HAVE A PHD IN WHITE TRASHOLOGY, YOU SAW REAL WHITE TRASH ON DISPLAY," SAID CARVILLE, SPEAKING TO MSNBC'S ARI MELBER. "LET ME SAY SOMETHING ABOUT CONGRESSWOMAN MARJORIE TAYLOR GREENE (R-GA), SHE DRESSES LIKE WHITE TRASH. SHE REALLY NEEDS A FASHION CONSULTANT. I RECOMMEND GEORGE SANTOS. HE COULD DO A GOOD JOB OF DRESSING UP WHERE SHE DOESN'T ANNOUNCE HER WHITE TRASHDOM BY HER OWN CLOTHES."

HE BASH BY CARVILLE IS REMINISCENT OF CONSERVATIVE MATT LEWIS WHO WROTE IN THE DAILY BEAST THAT TRUMP WOULD NEVER HAVE GREENE AS HIS VP BECAUSE SHE WAS TOO "LOW RENT" FOR HIS HIGH STYLE.

payback headlines - how you are screwed!!

*Georgia to join GOP-led states ending extra jobless aid payments

9excerpt below)

*Post reveals inundation of calls from sobbing Americans about to be evicted while the GOP plays politics(ARTICLE BELOW)

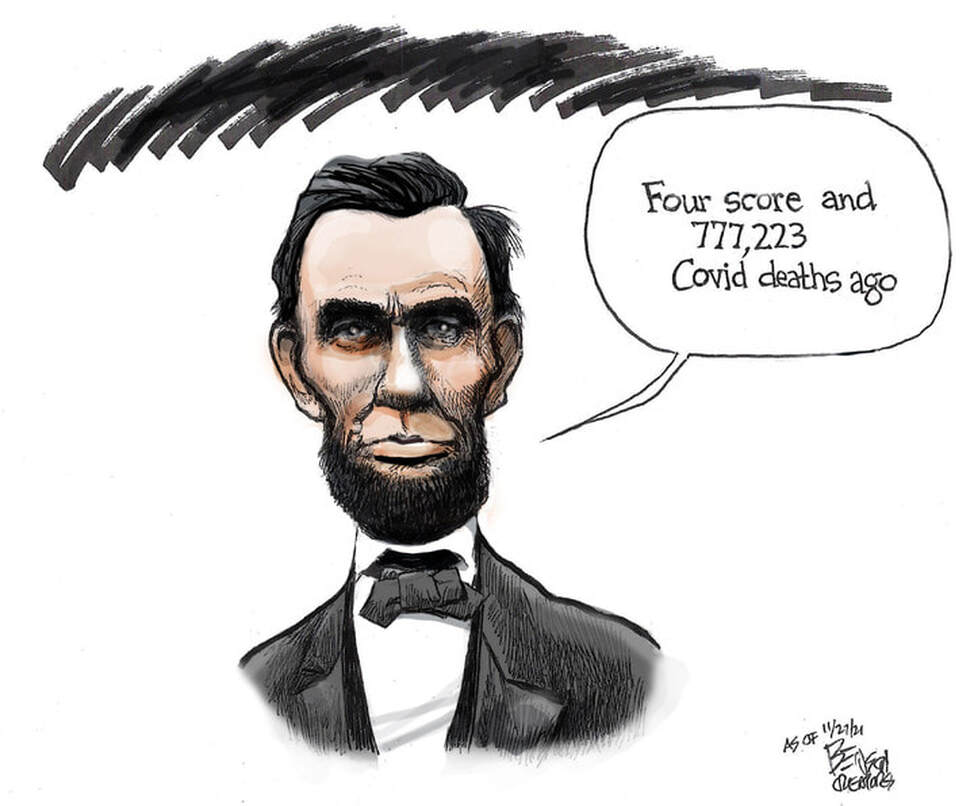

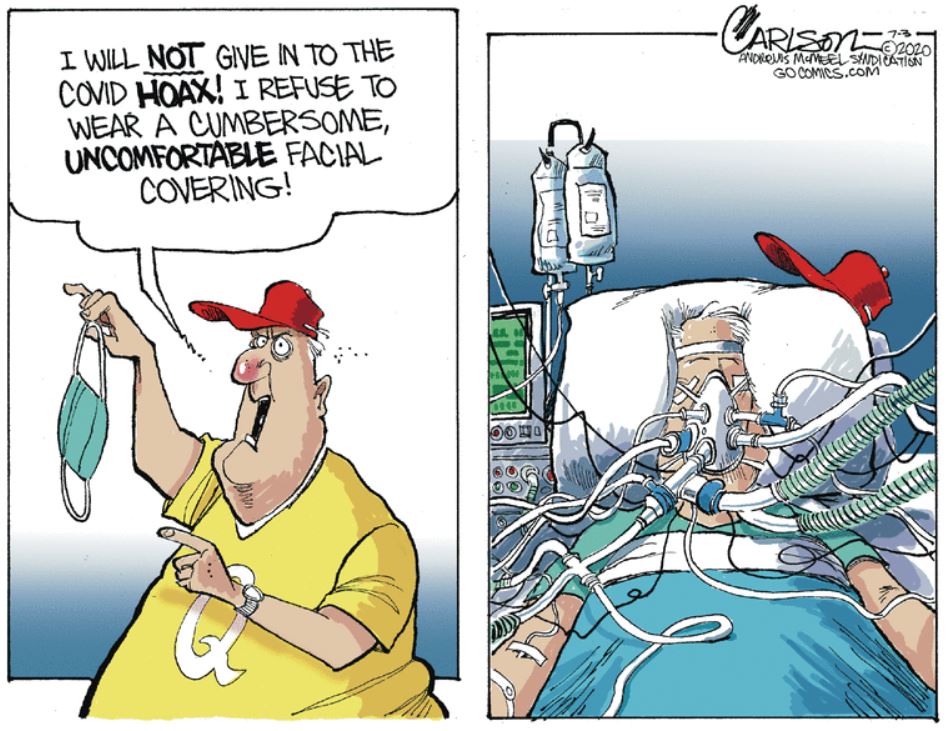

*Trump-loving former Republican official who hated face masks dies from COVID-19

(ARTICLE BELOW)

*‘The situation is dire’: As Trump takes victory lap, new jobs report reveals alarming surge in permanent unemployment(ARTICLE BELOW)

*‘WAGE THEFT’: TREASURY SIGNALS MILLIONS OF WORKERS WILL EARN LESS IN 2021 UNDER TRUMP’S PAYROLL TAX DEFERRAL(ARTICLE BELOW)

*Payroll tax cut imperils Social Security

(ARTICLE BELOW)

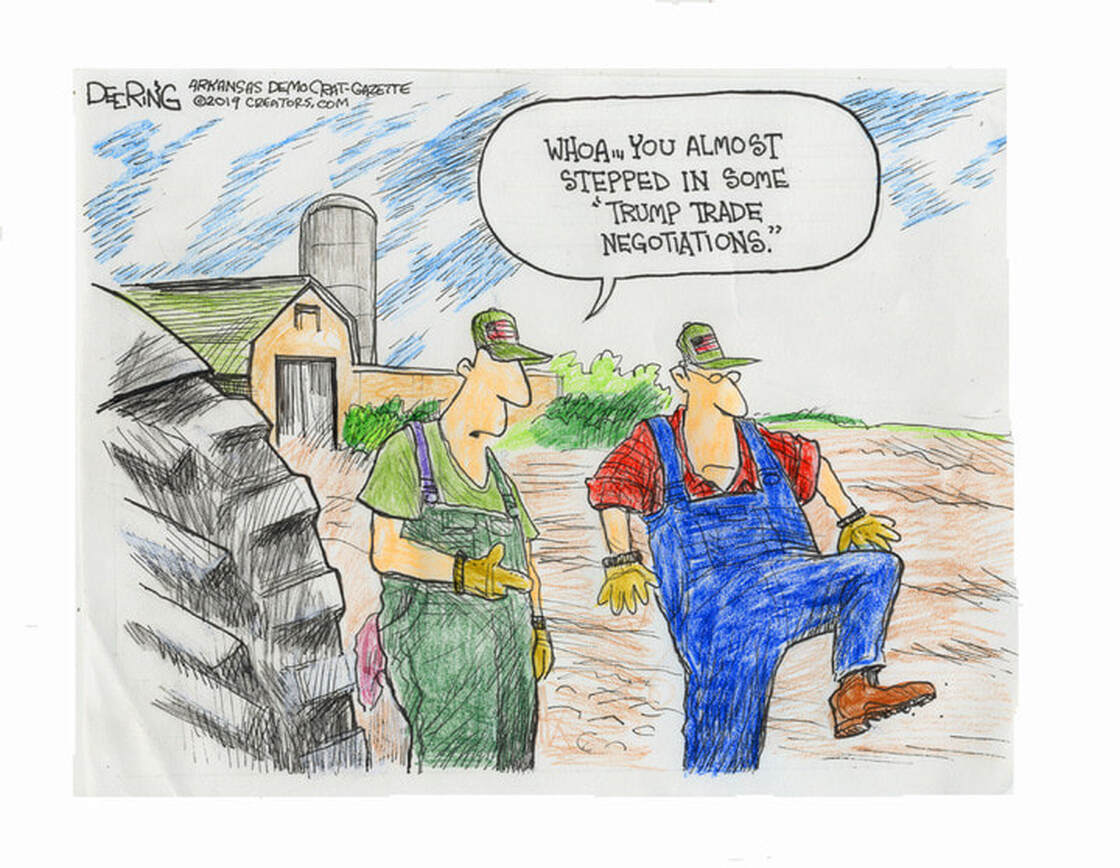

*Michigan steelworkers slam Trump for tariffs that cost them their jobs

(ARTICLE BELOW)

*Florida man who thought pandemic was ‘hysteria’ loses his wife to COVID-19

(ARTICLE BELOW)

*MEMO EXPOSES TRUMP’S UNEMPLOYMENT INSURANCE PLAN AS A FARCE

(ARTICLE BELOW)

*Trump dropped into Iowa — and didn't even try to understand the devastation

(excerpt below)

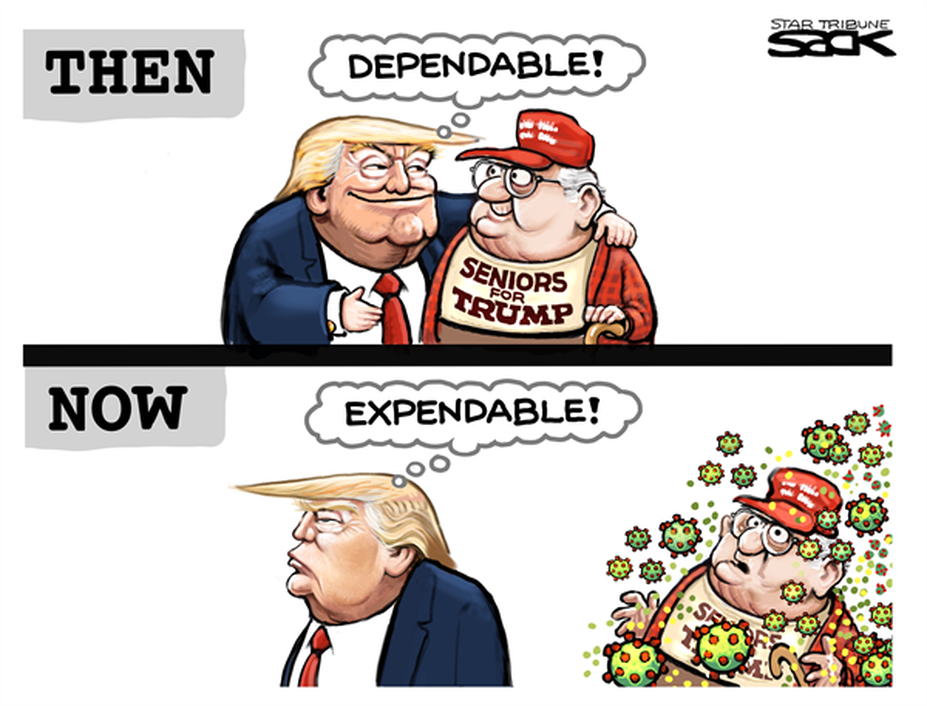

*HERE’S HOW TRUMP IS DRIVING MILLIONS OF AMERICAN SENIORS INTO POVERTY

(ARTICLE BELOW)

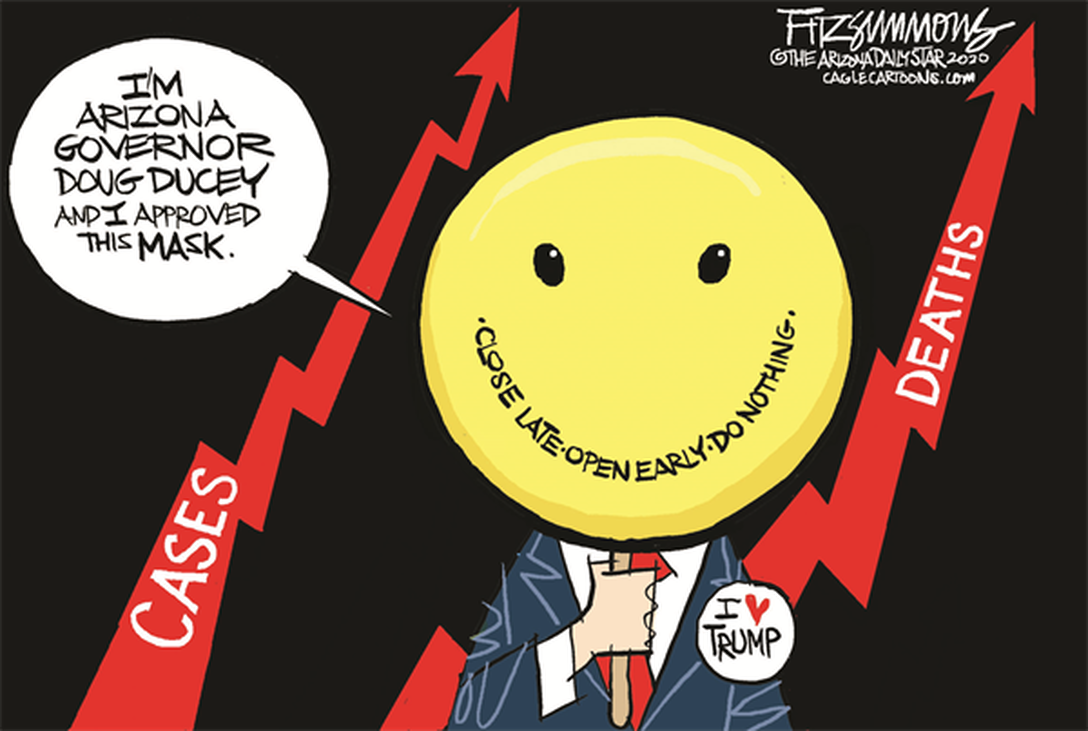

*Louisiana’s COVID-19-enabling attorney general gets tested for coronavirus before meeting Pence, tests positive(ARTICLE BELOW)

*Consumer bureau revokes payday lending restrictions

(ARTICLE BELOW)

*REVEALED: COVID-19 OUTBREAKS AT MEAT-PROCESSING PLANTS IN US BEING KEPT QUIET

(ARTICLE BELOW)

*THE TRUMP ADMINISTRATION IS WAIVING THE PUBLIC’S RIGHT TO AFFORDABLE CORONAVIRUS TREATMENTS(ARTICLE BELOW)

*TRUMP LABOR DEPARTMENT QUIETLY OFFERS UP 401(K) PLANS TO PRIVATE EQUITY VULTURES

(ARTICLE BELOW)

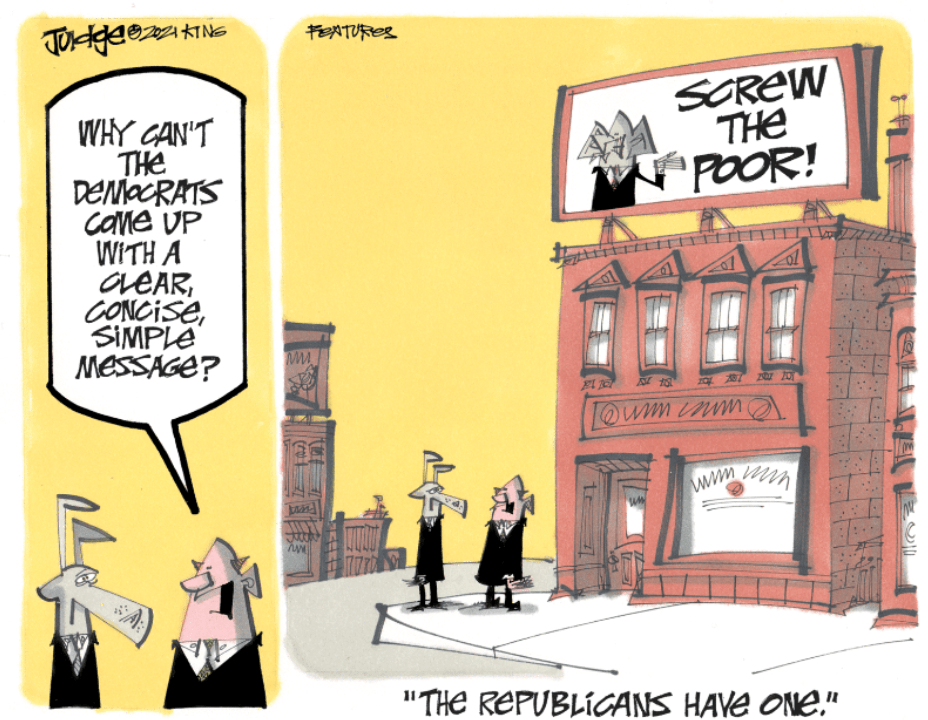

*GOP lawmakers block health care for 130,000 people in Kansas

(ARTICLE BELOW)

*NEARLY 40 MILLION ARE OUT OF WORK BUT MCCONNELL WANTS BENEFITS TO STOP ANYWAY

(ARTICLE BELOW)

*Wisconsin woman ‘kind of mad’ at Trump after she gets COVID-19 despite taking hydroxychloroquine(ARTICLE BELOW)

*Accidental Poisonings Increased After President Trump's Disinfectant Comments

(ARTICLE BELOW)

*‘Outrageous, callous, and cruel’: Seniors rip Trump for holding Covid-19 relief hostage to push cuts that threaten Social Security(ARTICLE BELOW)

*Tennessee Poison Center sees more calls, hospitalizations over disinfectants amid COVID-19(ARTICLE BELOW)

*Here’s how the GOP’s crusade against the IRS is keeping some people from getting coronavirus relief(ARTICLE BELOW)

*TRUMP’S TARIFFS ARE CRIPPLING AMERICAN MANUFACTURERS TRYING TO SURVIVE PANDEMIC DOWNTURN: REPORT(ARTICLE BELOW)

*‘Beyond predatory’: Trump Treasury Department gives banks green light to seize $1,200 stimulus checks to pay off debts(ARTICLE BELOW)

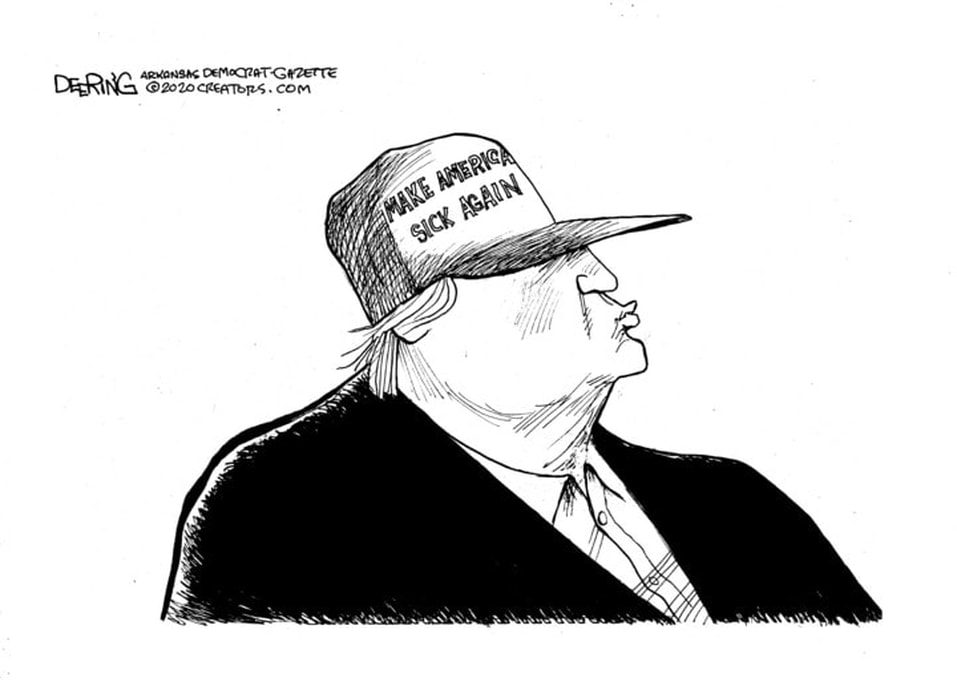

*THE CORONAVIRUS WILL SOON WREAK HAVOC IN TRUMP COUNTRY — HERE’S WHY

(ARTICLE BELOW)

*Trump administration quietly guts COVID-19 paid leave provision that already excluded 75% of workers(ARTICLE BELOW)

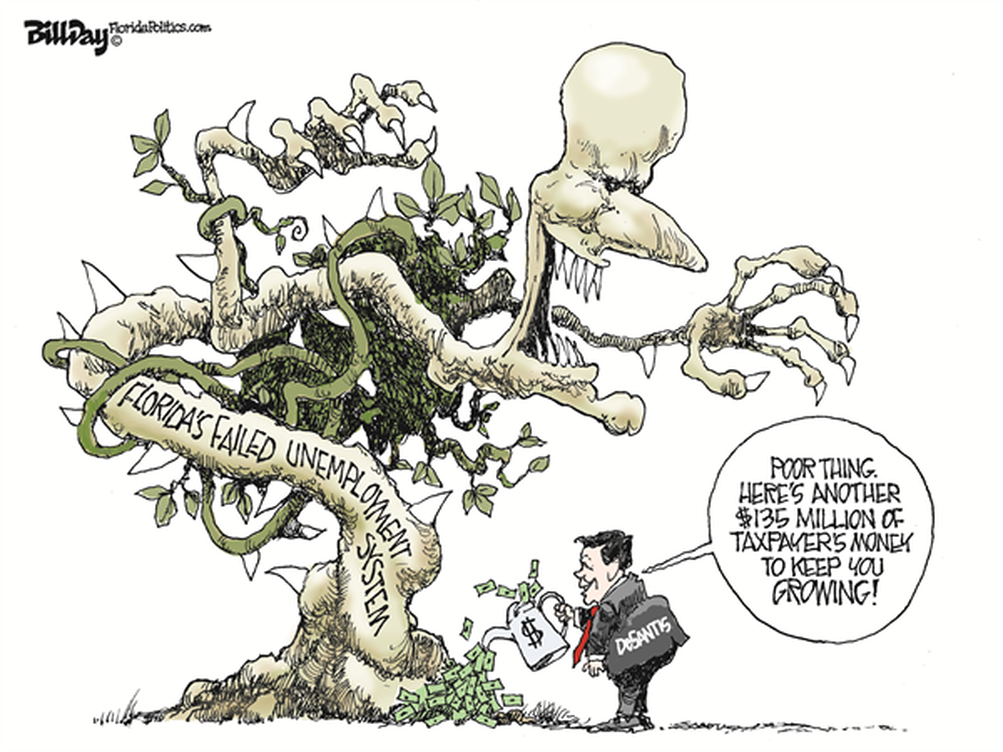

*‘MONSTERS!’ FLORIDA REPUBLICANS IGNITE FURY BY ADMITTING THEY PURPOSEFULLY MANGLED STATE UNEMPLOYMENT SYSTEM(ARTICLE BELOW)

*Right-Wing Austerity Set New Orleans Up to Be a Coronavirus Disaster Zone

(ARTICLE BELOW)

*Trump refuses to reopen Obamacare exchanges after millions of laid-off workers lose health coverage(ARTICLE BELOW)

*THE US SENT TONS OF MEDICAL SUPPLIES TO CHINA EVEN AS SENATORS WARNED OF VIRUS THREAT HERE(ARTICLE BELOW)

*Medicaid Abruptly Canceled Her Health Insurance. Then Came the Coronavirus.

(ARTICLE BELOW)

*These are the 51 GOP senators who just voted against expanding paid sick leave to protect Americans amid the coronavirus crisis(ARTICLE BELOW)

*As Trump limits guest workers from Mexico amid coronavirus, farmers warn of labor and food shortages(ARTICLE BELOW)

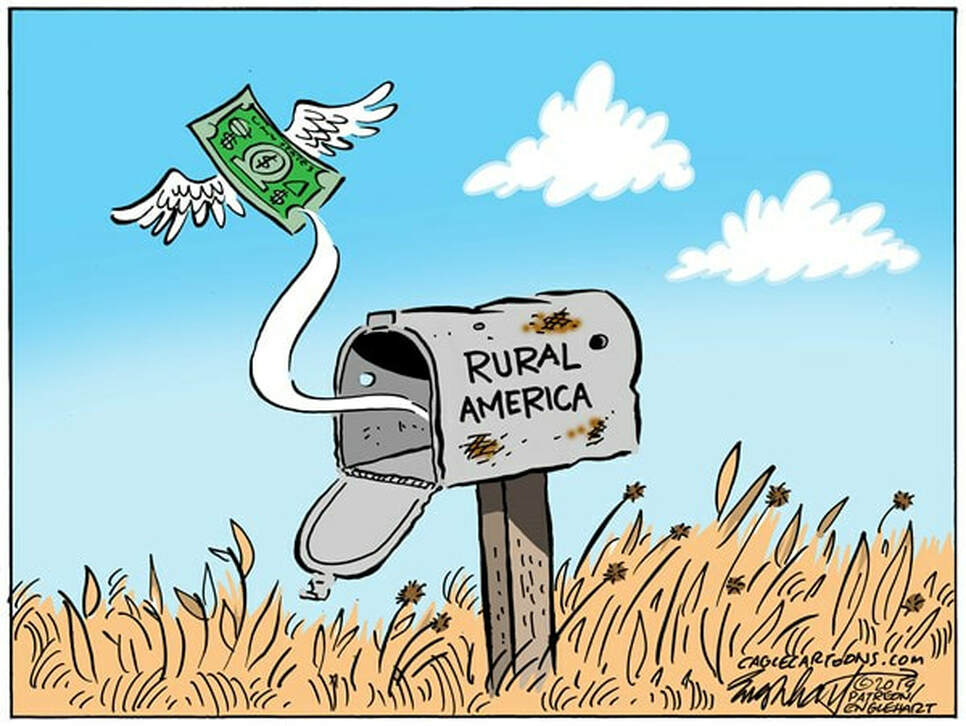

*‘A stunning betrayal’: Swing-state farmers are fuming over Trump’s latest gift to the fossil fuel industry(ARTICLE BELOW)

*‘Why are we being charged?’ Surprise bills from coronavirus testing spark calls for government to cover all costs(ARTICLE BELOW)

*TRUMP'S JUNK PLAN LEAVES FLORIDA MAN HOLDING THE BILL FOR CORONAVIRUS TESTING

(ARTICLE BELOW)

*Trump administration proposes another Social Security rule that violates the law, hurts the disabled(ARTICLE BELOW)

*‘A travesty and a disgrace’: Trump quietly issues memo that could abolish union rights for 750,000 federal workers(ARTICLE BELOW)

*Workers Face Retirement With Fear as GOP Refuses to Back Pension Protection Bill

(ARTICLE BELOW)

*Trump looks to kill student loan forgiveness program

(ARTICLE BELOW)

*THE TRUMP ADMINISTRATION HAS LAUNCHED A BRAZEN ASSAULT ON OUR PUBLIC LANDS

(ARTICLE BELOW)

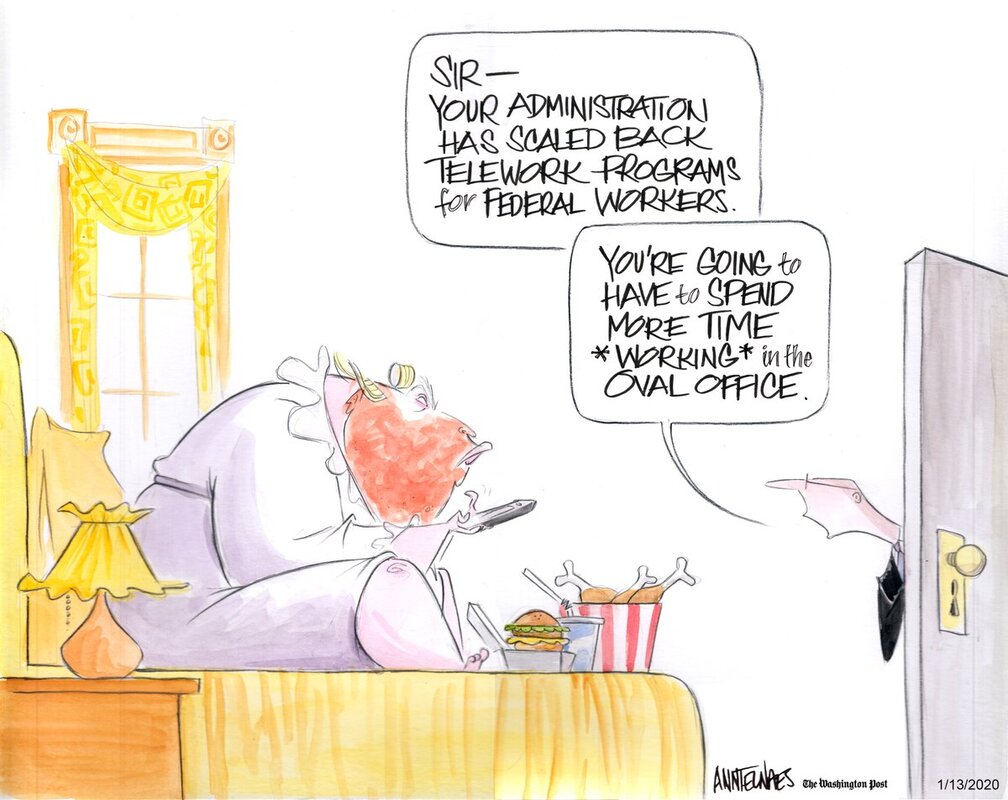

*Trump moves to cap pay raise for civilian government workers at 1 percent

(ARTICLE BELOW)

*Trump tariffs would bury US in 'fake prosciutto and fake Parmesan,' warns one food importer(ARTICLE BELOW)

*‘It’s sickening!’ 2016 Trump voter turns on the president after his wife gets deported to Mexico(ARTICLE BELOW)

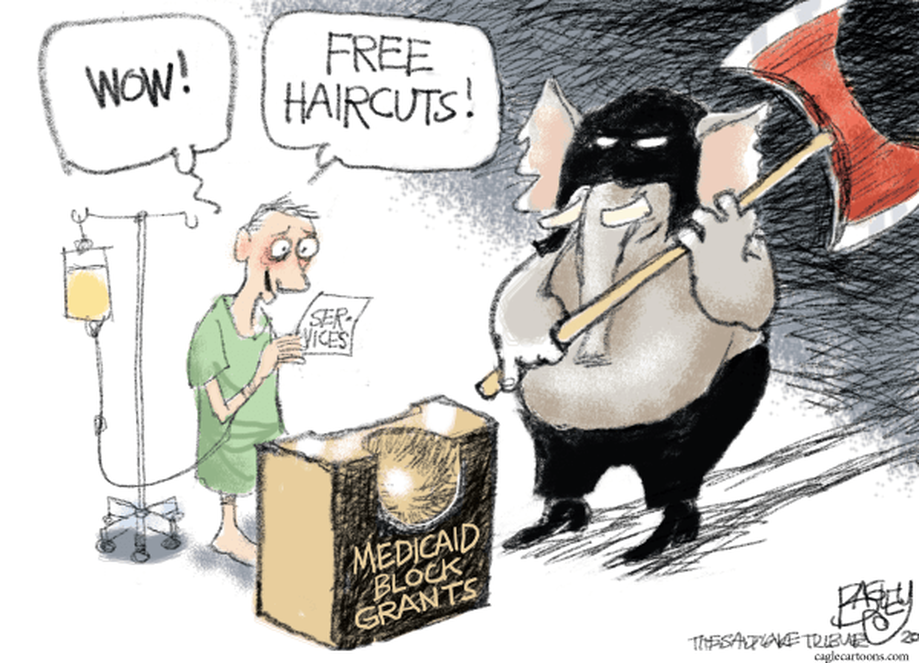

*The poor and people with disabilities ‘are going to die’: Trump takes axe to Medicaid

(ARTICLE BELOW)

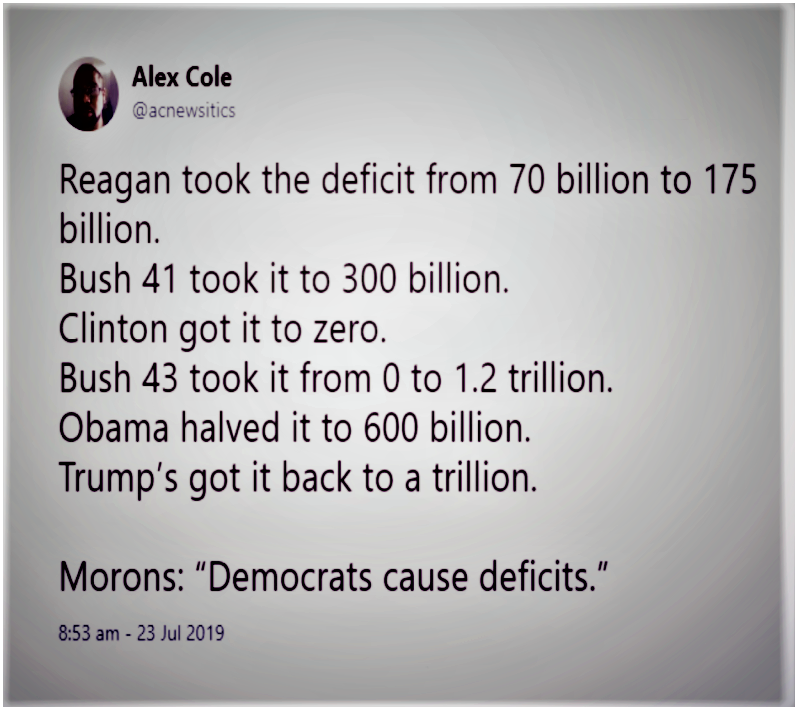

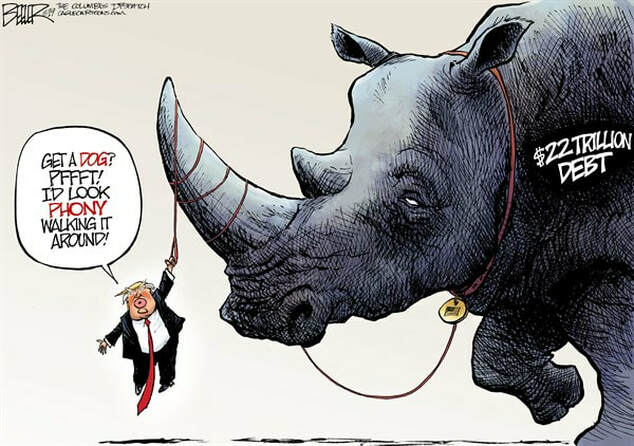

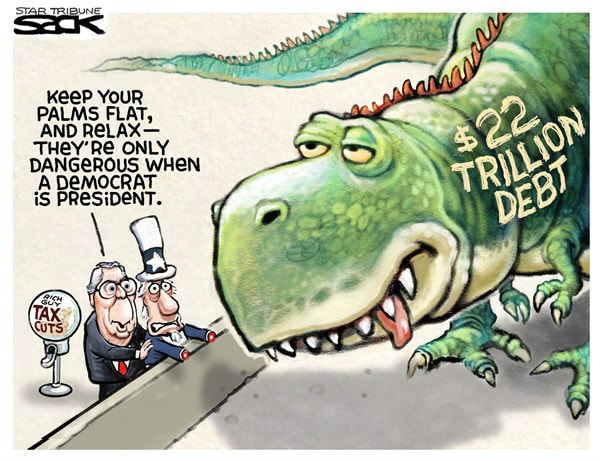

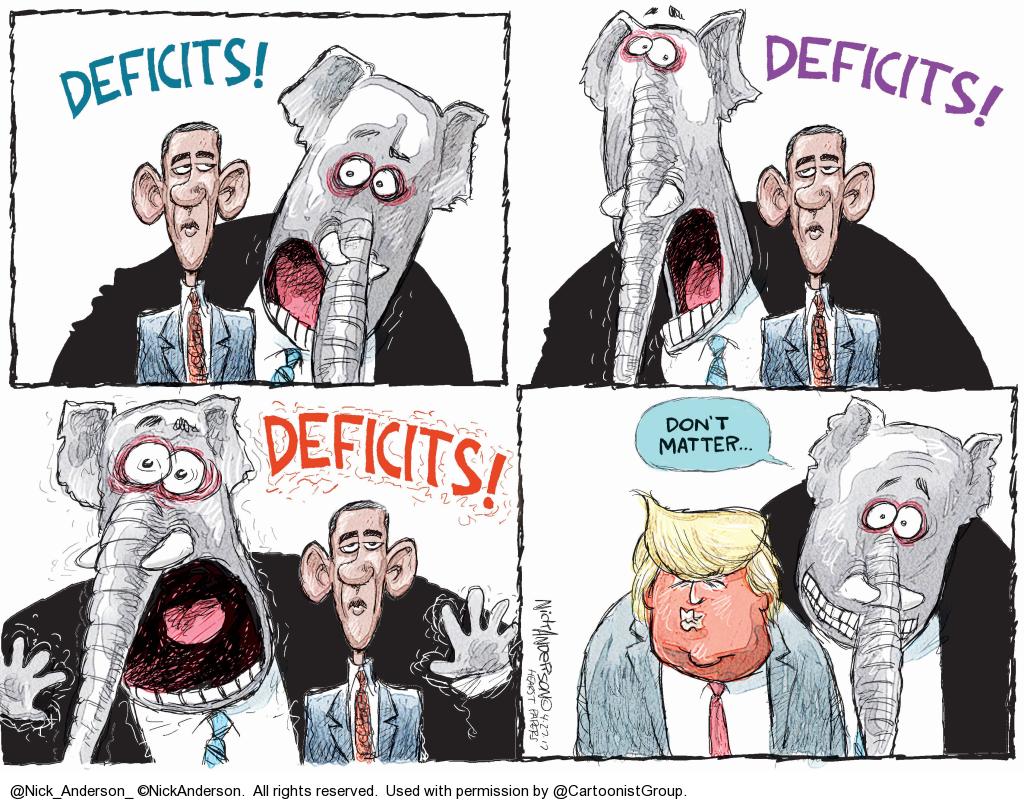

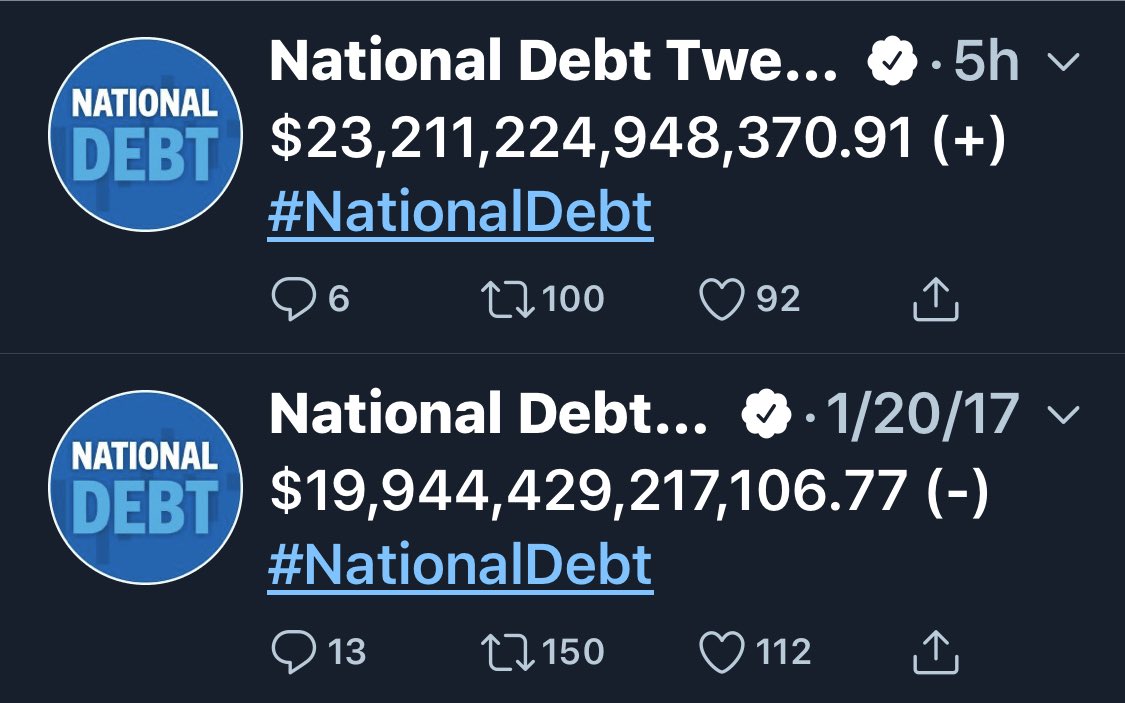

*NATIONAL DEBT INCREASED BY $3 TRILLION DURING DONALD TRUMP'S THREE YEARS AS PRESIDENT(ARTICLE BELOW)

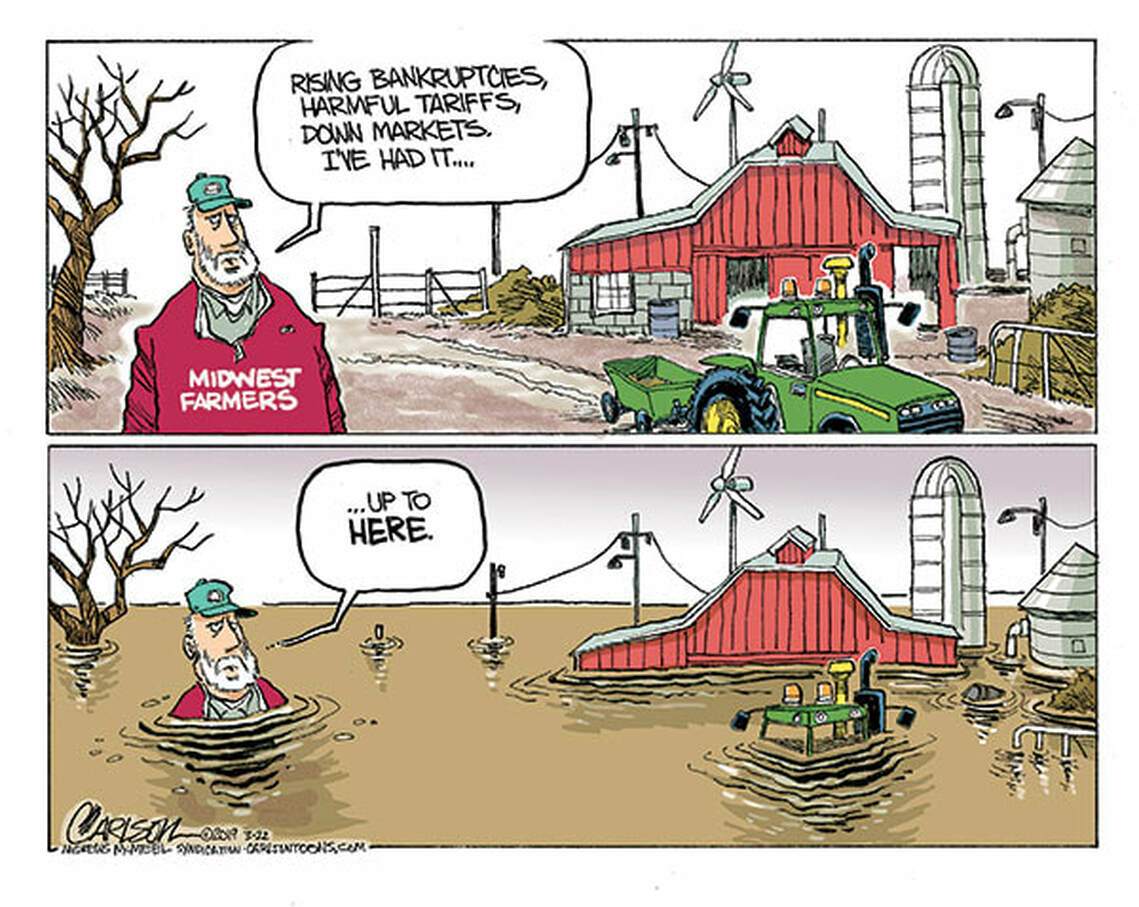

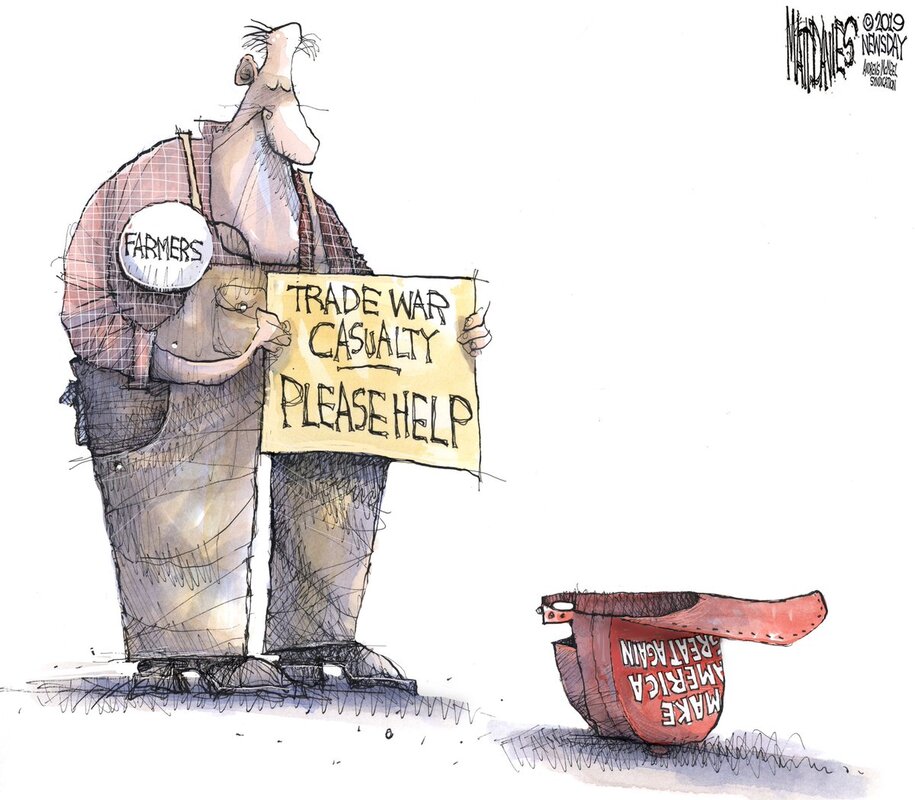

*Wisconsin lost 10% of its dairy farmers in 2019, marking its biggest decline ever as Trump's trade wars raged(ARTICLE BELOW)

*US budget deficit running 11.8% higher this year

(ARTICLE BELOW)

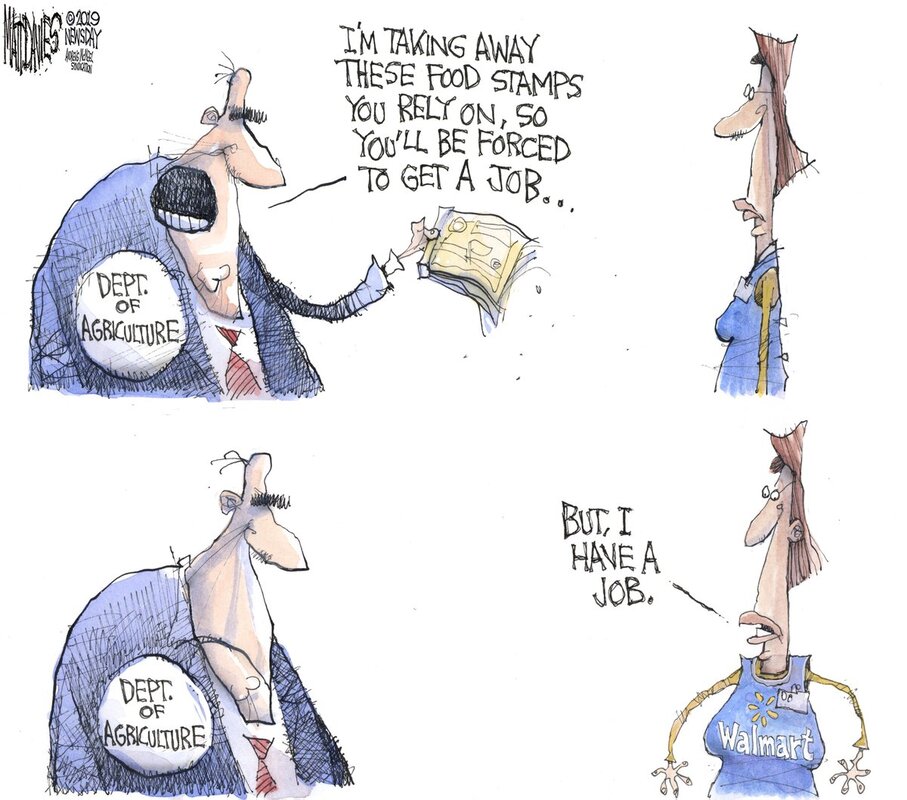

*‘We can barely eat’: West Virginia offers a chilling preview of Trump’s food stamp restrictions(ARTICLE BELOW)

*MORE DRUGMAKERS HIKE U.S. PRICES AS NEW YEAR BEGINS

(ARTICLE BELOW)

*TRUMP RUNS THE COUNTRY JUST LIKE HE RAN HIS BANKRUPTED BUSINESSES: THE NATIONAL DEBT IS SKYROCKETING WHILE ECONOMIC GROWTH IS LAGGING(ARTICLE BELOW)

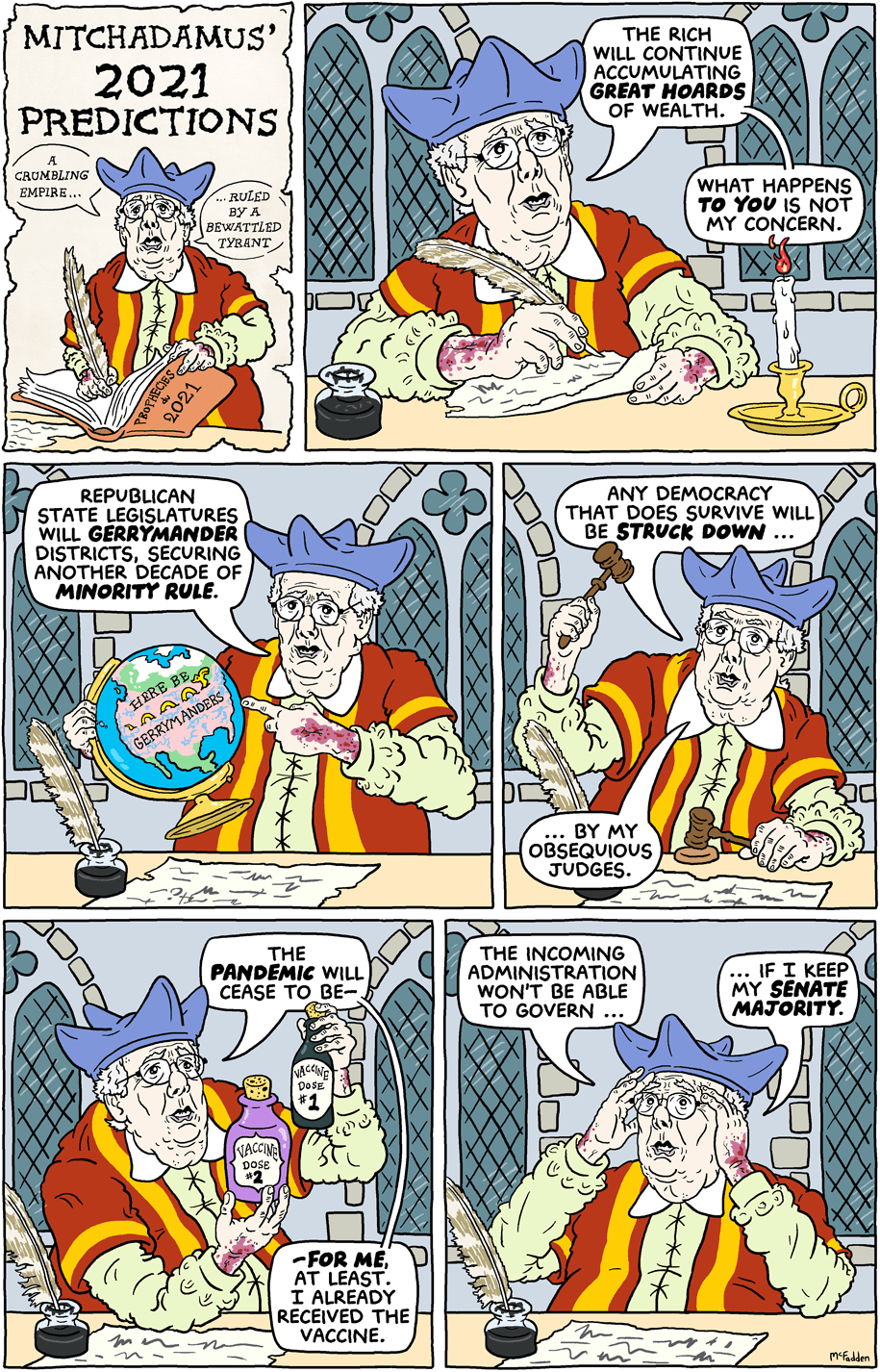

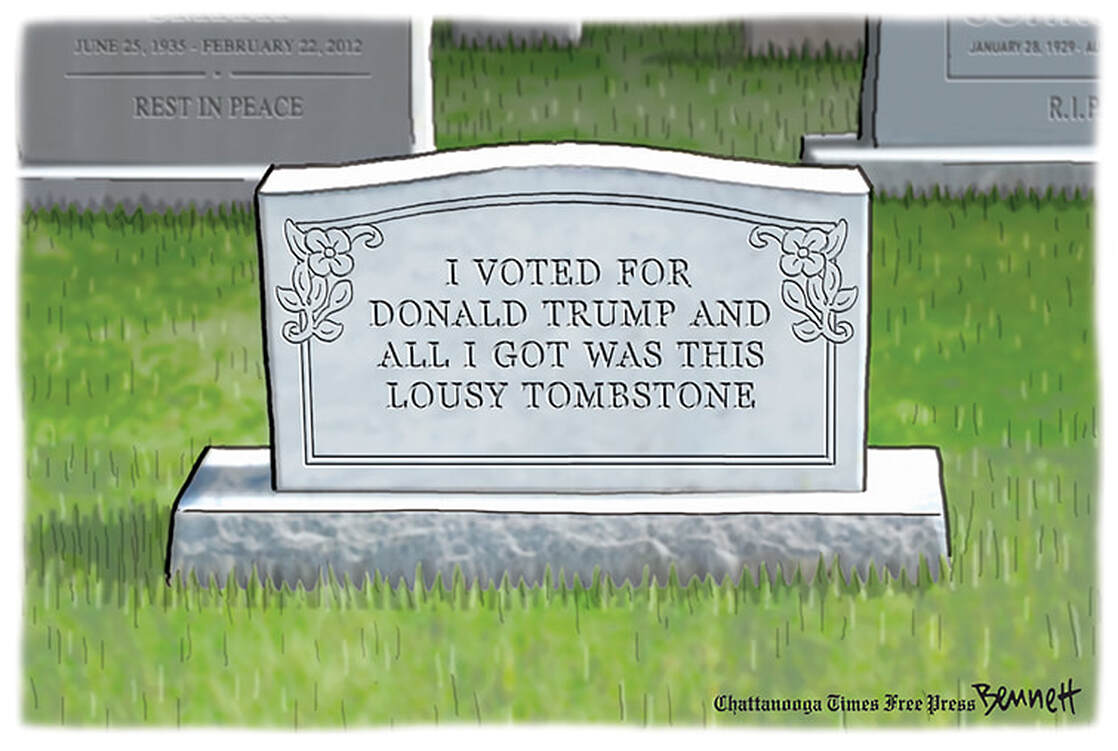

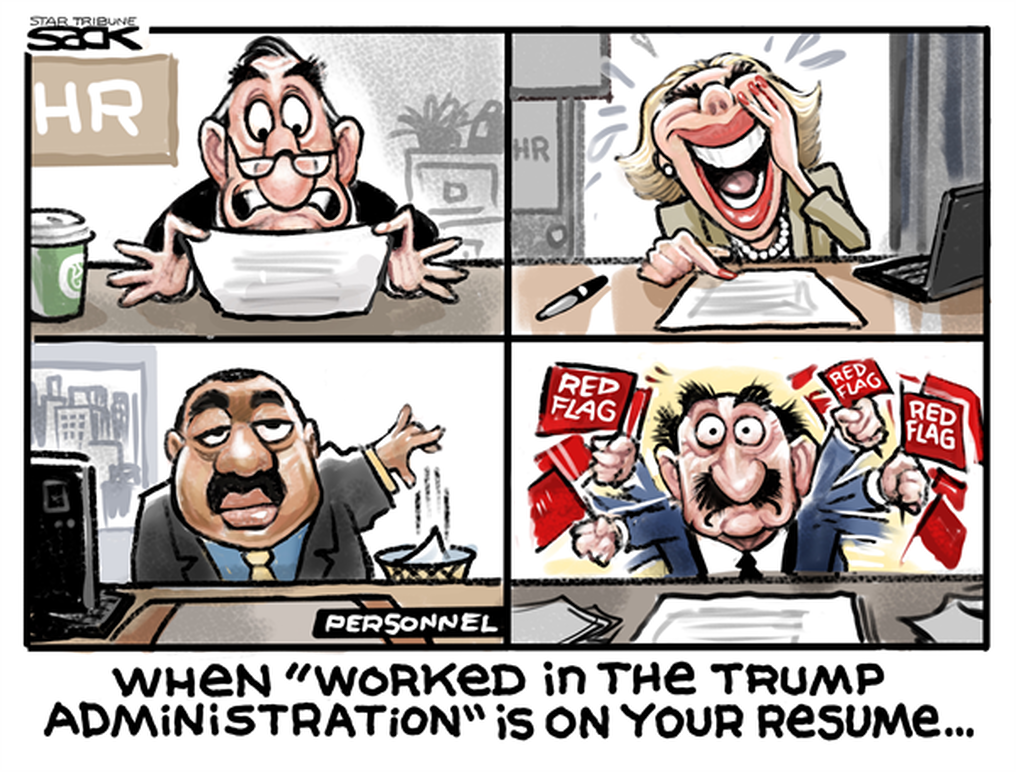

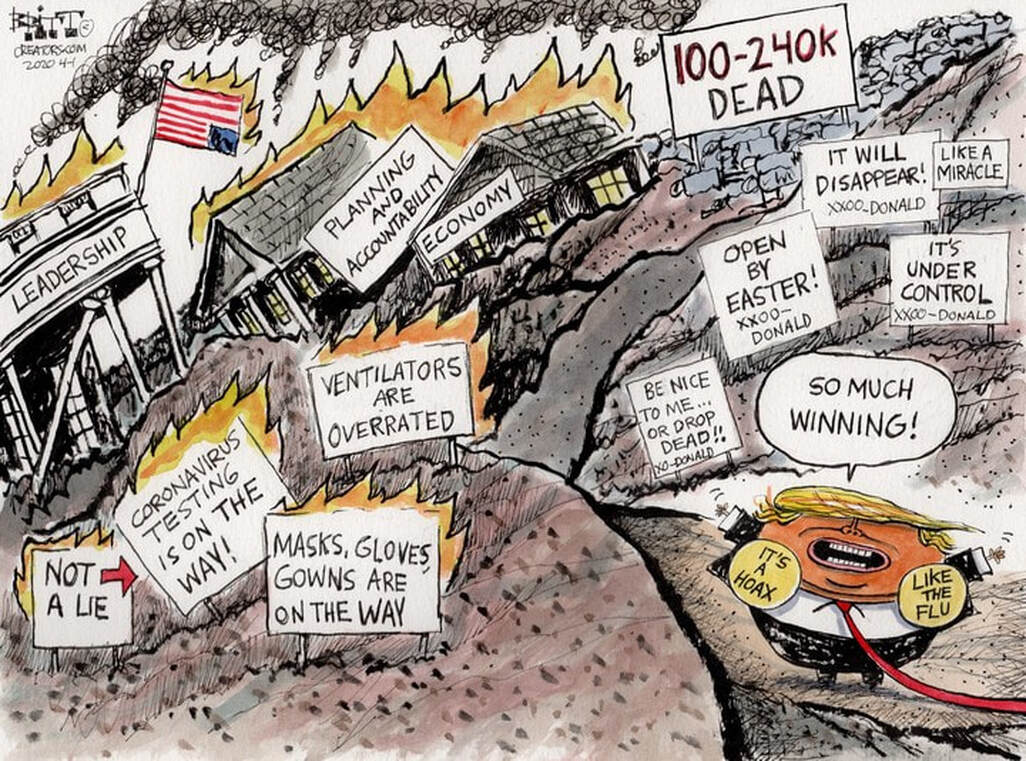

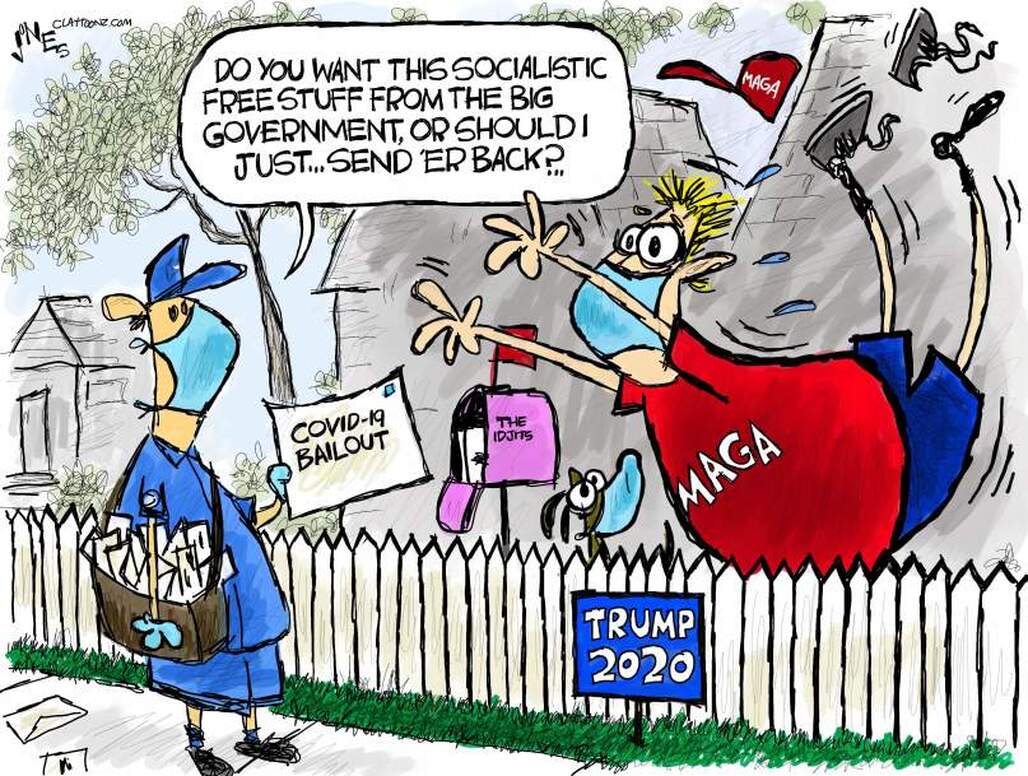

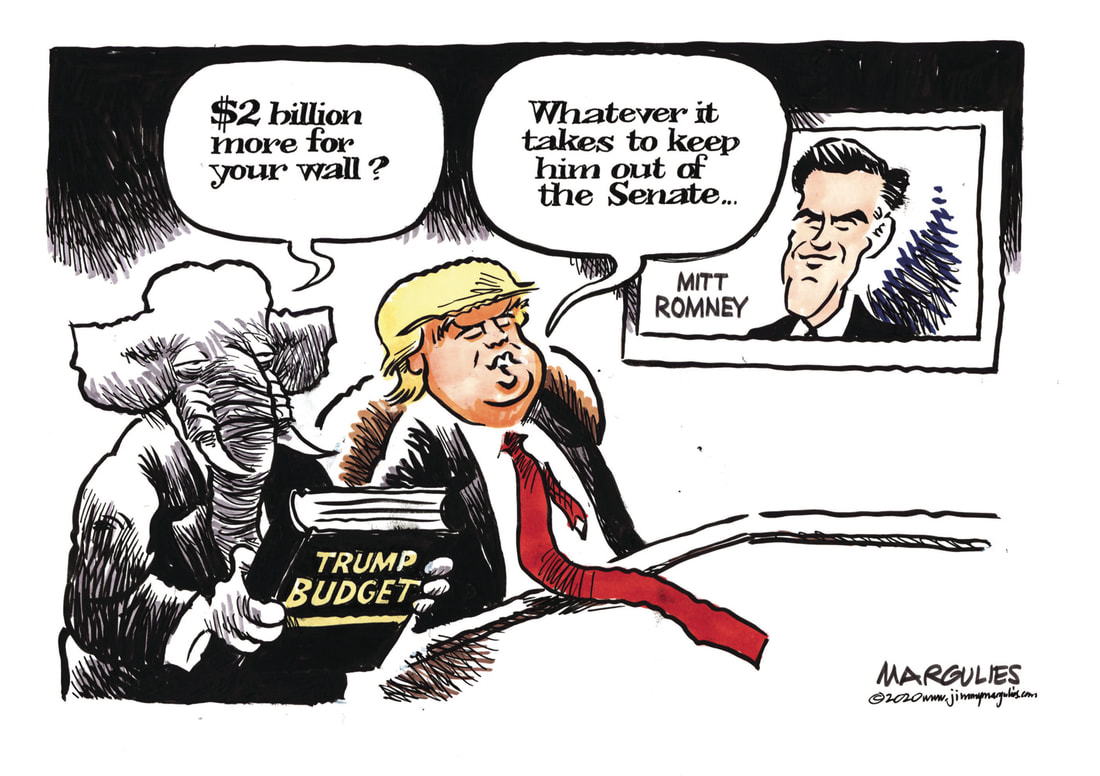

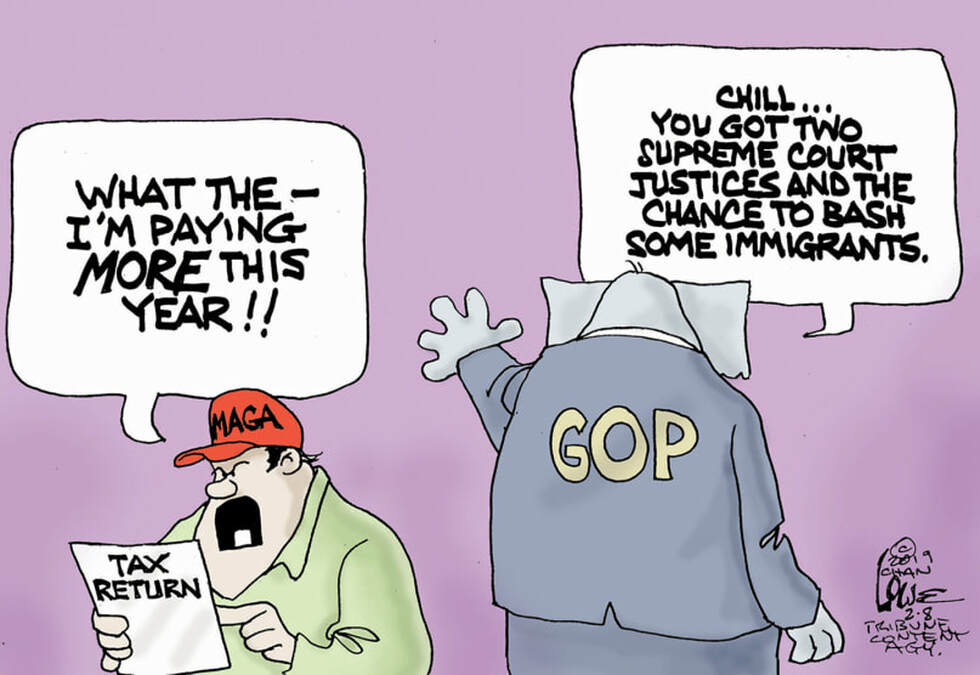

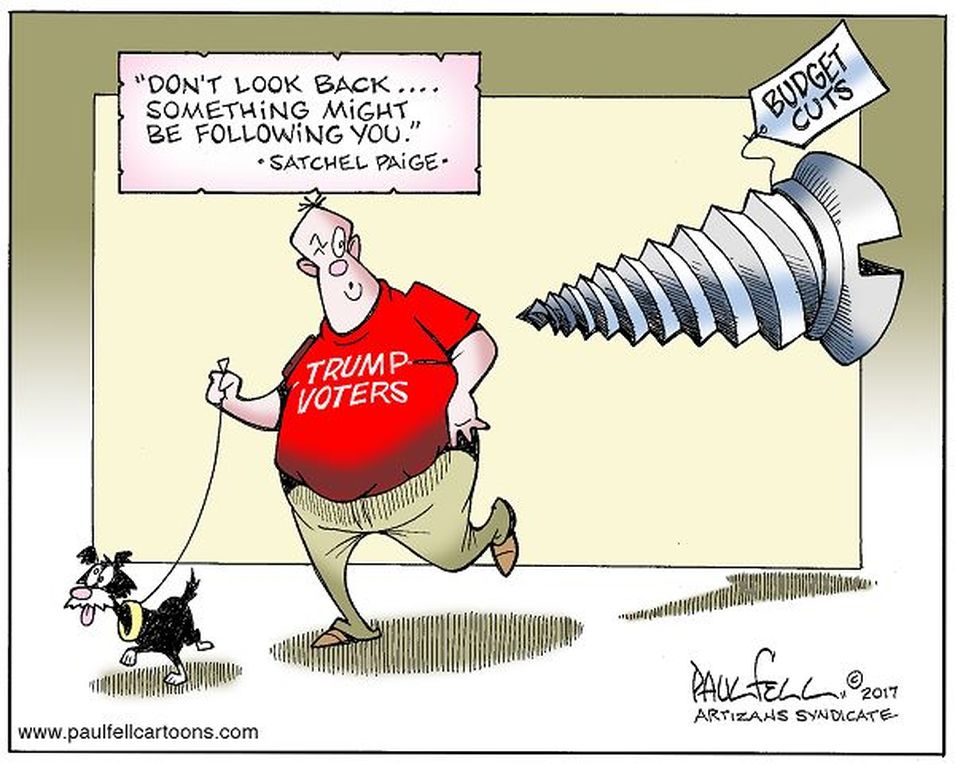

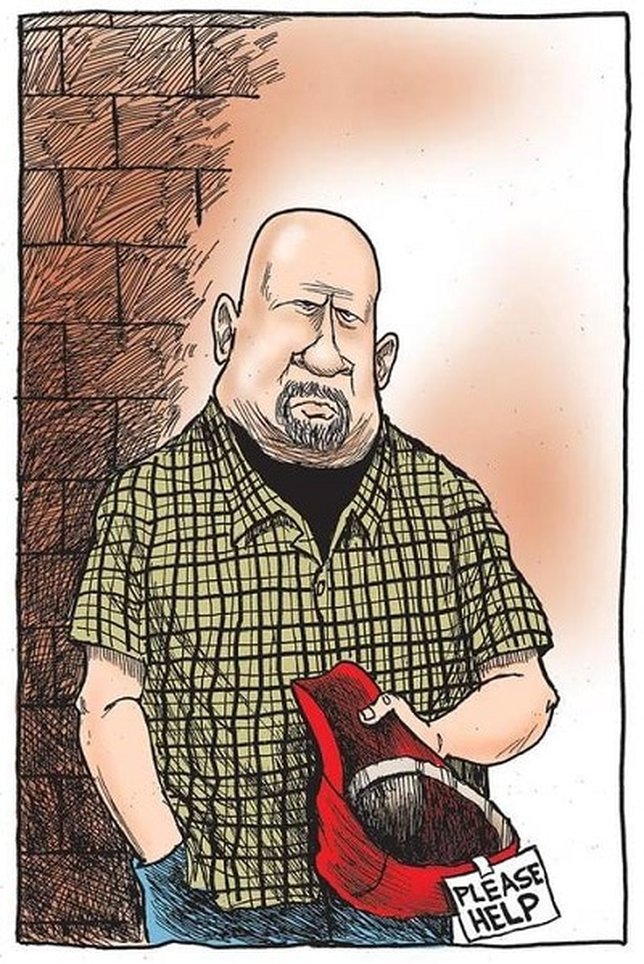

PAYBACK FUNNIES(at the end)

america's reward for voting for republicans!!!

Welcome to RepublicanDebt.org

This site tracks the current Republican Debt.

The Republican Debt is how much of the national debt of the United States

is attributable to

the presidencies of Ronald Reagan, George H. W. Bush,

George W. Bush, Donald J. Trump,

and

the Republican fiscal policy of Borrow-And-Spend.

As of Monday, October 11, 2021 at 8:25:08AM PT,

The Current Republican Debt is:

$15,365,790,543,861.30

which means that in a total of 24 years,

these four presidents have led to the creation of

94.26%

of the entire national debt

in only 9.7959% of the 245 years of the existence of the United States of America.

using the lies of low wage employers to cheat their voters!!!

Georgia to join GOP-led states ending extra jobless aid payments

By Michael E. Kanell - The Atlanta Journal-Constitution

Greg Bluestein - The Atlanta Journal-Constitution

Gov. Brian Kemp said the state will end the extra $300 in weekly jobless payments that thousands of Georgians receive on top of their unemployment checks during the pandemic, part of what he described as an effort to push more residents into the workforce.

The Republican announced the decision on Thursday in a Fox News interview, saying the incentives are “hurting our productivity not only in Georgia, but around the country.”

The subsidies are set to end in mid-to-late June.

“This is an issue I’m getting pounded on every day by our small business owners and many Georgians,” Kemp said. “They need some help.”

While small businesses called for the move, many of the people receiving benefits say the money has been essential to paying for housing and food. While many low-wage jobs are open, many of the jobless were better paid before the pandemic and are searching for something that matches their experience and abilities.

“Not everybody was a McDonalds worker before this,” said Erin Miller of Atlanta. “I have been looking for marketing jobs. I’d like to use this degree that I just paid all this money for.”

Republican governors in about a dozen states previously announced plans to cancel the extra benefits to push more people to return to work. Federal law allows states to opt out of receiving increased benefits as early as June 12.

The supporters of the extra benefits say they help blunt the impact of an economy still recovering from the pandemic, and the fallout has disproportionately affected women as many children still learn remotely. The U.S. economy in March had 7.6 million fewer people employed than before the pandemic, including a sharp drop-off among working mothers.

State law gives Butler the authority to nix the benefits, though the labor commissioner said he’s working in tandem with Kemp on a “plan to put Georgians back to work.”

Many Georgia Republicans were skeptical of the $300 weekly boosts even after the incentives were adopted amid the pandemic. But the criticism ramped up dramatically after a disappointing federal jobs report last week and growing complaints from industry groups that workers — especially those at the low end of the wage scale — were hard to find.

Studies have shown that the reasons are a mix. Some people are staying home with children, some are afraid of front-line jobs that may expose them to COVID-19. And some who had low-income work have a financial incentive to delay their return to the labor force.

In recent weeks, Kemp has repeatedly invoked conversations he’s had with business owners struggling to hire workers, particularly in logistics and lower-wage industries like retail and food service. And he’s suggested the benefits hamper hiring by discouraging Georgians from returning to the workforce.

Kemp’s decision puts Georgia in line with senior GOP officials, such as U.S. Senate Minority Leader Mitch McConnell, who accused Democrats of putting “handcuffs” on the recovery with extended jobless aid.[...]

The Republican announced the decision on Thursday in a Fox News interview, saying the incentives are “hurting our productivity not only in Georgia, but around the country.”

The subsidies are set to end in mid-to-late June.

“This is an issue I’m getting pounded on every day by our small business owners and many Georgians,” Kemp said. “They need some help.”

While small businesses called for the move, many of the people receiving benefits say the money has been essential to paying for housing and food. While many low-wage jobs are open, many of the jobless were better paid before the pandemic and are searching for something that matches their experience and abilities.

“Not everybody was a McDonalds worker before this,” said Erin Miller of Atlanta. “I have been looking for marketing jobs. I’d like to use this degree that I just paid all this money for.”

Republican governors in about a dozen states previously announced plans to cancel the extra benefits to push more people to return to work. Federal law allows states to opt out of receiving increased benefits as early as June 12.

The supporters of the extra benefits say they help blunt the impact of an economy still recovering from the pandemic, and the fallout has disproportionately affected women as many children still learn remotely. The U.S. economy in March had 7.6 million fewer people employed than before the pandemic, including a sharp drop-off among working mothers.

State law gives Butler the authority to nix the benefits, though the labor commissioner said he’s working in tandem with Kemp on a “plan to put Georgians back to work.”

Many Georgia Republicans were skeptical of the $300 weekly boosts even after the incentives were adopted amid the pandemic. But the criticism ramped up dramatically after a disappointing federal jobs report last week and growing complaints from industry groups that workers — especially those at the low end of the wage scale — were hard to find.

Studies have shown that the reasons are a mix. Some people are staying home with children, some are afraid of front-line jobs that may expose them to COVID-19. And some who had low-income work have a financial incentive to delay their return to the labor force.

In recent weeks, Kemp has repeatedly invoked conversations he’s had with business owners struggling to hire workers, particularly in logistics and lower-wage industries like retail and food service. And he’s suggested the benefits hamper hiring by discouraging Georgians from returning to the workforce.

Kemp’s decision puts Georgia in line with senior GOP officials, such as U.S. Senate Minority Leader Mitch McConnell, who accused Democrats of putting “handcuffs” on the recovery with extended jobless aid.[...]

payback is a bitch!!!

Post reveals inundation of calls from sobbing Americans about to be evicted while the GOP plays politics

December 24, 2020

Sarah K. Burris - raw story

The Washington Post revealed Thursday that their newspaper offices have been inundated with phone calls from Americans desperate for help amid the economic crisis and the global pandemic.

President Donald Trump announced that he would send the COVID-19 stimulus bill back to Congress if they didn't raise the $600 to $2,000. Senate Majority Leader Mitch McConnell has fought any stimulus checks being sent to Americans for the past nine months. While it was something that Trump said he wanted, Republicans in the House blocked the vote on the bill Thursday when Democrats brought it for a vote.

"The Washington Post has been inundated with messages and phone calls from people on the verge of losing their homes and cars and going hungry this holiday who are stunned that President Trump and Congress cannot agree on another emergency aid package. Several broke down crying in phone interviews," said the Post report.

Things were already bad for Americans. In June, the National Bureau of Economic Research reported that calculations show a U.S. recession officially began in February. Things got worse as the president continued to ignore the COVID-19 pandemic and lie to Americans that it was nothing more than "the flu."

---

"Some blamed Trump for torpedoing a $900 billion relief package at the last minute," the Post said. "Others agreed with Trump that the proposed $600 checks for over 150 million American households was too little, too late and should be raised to at least $2,000. Others blamed House Speaker Nancy Pelosi (D-CA) for not taking a deal in August."

The House was set to vote on the $2,000 by lunch on Christmas Eve, but Republicans blocked the vote. Senate Republicans have refused to hold a vote on the House bill for seven months and refused to participate in negotiations for the past nine months, until very recently.

Most people calling the Post said that they are "not political," and they can't understand how elected officials could celebrate the holidays while 14 million Americans are about to lose unemployment and millions more will lose their homes after the first of the year.

"It feels like everybody is playing politics with people's lives," said Tony Bowens, who barely survived COVID-19 earlier this year. "That $600 check wasn't much, but at least it would have been dispersed just in time."

The post introduced the world to 30-year-old Stephanie Lott, who "has had her rent covered by a friend for the past two months. Lott lives off $100 a week provided through Pandemic Unemployment Assistance." She said that the only way she's getting by is through "the good graces of friends at this point."

Moody's Analytics reported this month that a whopping 12 million renters will owe an average of $5,850 in unpaid rent and utilities as 2021 begins.

Orlando, Florida's Samara Crockett, "is supposed to get her last unemployment payment on Christmas Eve," the Post said. "She was laid off from her medical assistant job in Orlando in September. A single mom of teenagers, she receives $275 a week from unemployment. She's behind on the electric bill and had to beg the light company to keep her electricity on for Christmas."

These are just a few of the many Americans in dire straights as Republicans continue to block a vote on the COVID-19 stimulus with a $2,000 check and Trump blocks a $600 payment.

Meanwhile, many billionaires are making a fortune during the pandemic. Chuck Collins, with the Institute for Policy Studies, told NPR, "some of those are seeing their wealth go up double or 40, 50% increases in less than a year."

President Donald Trump announced that he would send the COVID-19 stimulus bill back to Congress if they didn't raise the $600 to $2,000. Senate Majority Leader Mitch McConnell has fought any stimulus checks being sent to Americans for the past nine months. While it was something that Trump said he wanted, Republicans in the House blocked the vote on the bill Thursday when Democrats brought it for a vote.

"The Washington Post has been inundated with messages and phone calls from people on the verge of losing their homes and cars and going hungry this holiday who are stunned that President Trump and Congress cannot agree on another emergency aid package. Several broke down crying in phone interviews," said the Post report.

Things were already bad for Americans. In June, the National Bureau of Economic Research reported that calculations show a U.S. recession officially began in February. Things got worse as the president continued to ignore the COVID-19 pandemic and lie to Americans that it was nothing more than "the flu."

---

"Some blamed Trump for torpedoing a $900 billion relief package at the last minute," the Post said. "Others agreed with Trump that the proposed $600 checks for over 150 million American households was too little, too late and should be raised to at least $2,000. Others blamed House Speaker Nancy Pelosi (D-CA) for not taking a deal in August."

The House was set to vote on the $2,000 by lunch on Christmas Eve, but Republicans blocked the vote. Senate Republicans have refused to hold a vote on the House bill for seven months and refused to participate in negotiations for the past nine months, until very recently.

Most people calling the Post said that they are "not political," and they can't understand how elected officials could celebrate the holidays while 14 million Americans are about to lose unemployment and millions more will lose their homes after the first of the year.

"It feels like everybody is playing politics with people's lives," said Tony Bowens, who barely survived COVID-19 earlier this year. "That $600 check wasn't much, but at least it would have been dispersed just in time."

The post introduced the world to 30-year-old Stephanie Lott, who "has had her rent covered by a friend for the past two months. Lott lives off $100 a week provided through Pandemic Unemployment Assistance." She said that the only way she's getting by is through "the good graces of friends at this point."

Moody's Analytics reported this month that a whopping 12 million renters will owe an average of $5,850 in unpaid rent and utilities as 2021 begins.

Orlando, Florida's Samara Crockett, "is supposed to get her last unemployment payment on Christmas Eve," the Post said. "She was laid off from her medical assistant job in Orlando in September. A single mom of teenagers, she receives $275 a week from unemployment. She's behind on the electric bill and had to beg the light company to keep her electricity on for Christmas."

These are just a few of the many Americans in dire straights as Republicans continue to block a vote on the COVID-19 stimulus with a $2,000 check and Trump blocks a $600 payment.

Meanwhile, many billionaires are making a fortune during the pandemic. Chuck Collins, with the Institute for Policy Studies, told NPR, "some of those are seeing their wealth go up double or 40, 50% increases in less than a year."

‘Promises made, workers betrayed’: Trump gave $425 billion in federal contracts to corporations that offshored 200,000 jobs

October 6, 2020

By Common Dreams - raw story

Despite the 2016 campaign promise that he made to voters in pivotal industrial swing states throughout the Midwest that he would end the profit-driven relocation of manufacturing jobs to lower-wage countries, President Donald Trump has awarded more than $425 billion in federal contracts to corporations responsible for offshoring 200,000 jobs held by U.S. workers, according to a new report published Monday by progressive think tank and advocacy group Public Citizen.

“Time and time again, Donald Trump has proven that he will always put his corporate friends’ profits over the lives of American workers.”

—Rep. Mark Pocan

The report (pdf), Promises Made, Workers Betrayed: Trump’s Bigly Broken Promise to Stop Job Offshoring, was released during a press conference and is based on an analysis of data from the Department of Labor on trade-related job loss as well as data on federal procurement.

Researchers at Public Citizen found that Trump’s claim that he would deny billions worth of lucrative government contracts to companies that offshored jobs in order to encourage those firms to bring jobs back to U.S. factories was an empty threat. Instead, the report reveals, eight of the top 10 corporations receiving government contracts during Trump’s time in office have participated in offshoring.

According to the analysis, of the more than 300,000 U.S. workers who have lost their jobs as a result of worsening trade deficits during the Trump presidency, just over 200,000 of those jobs were classified as offshored.

“Trump lied to America’s workers when he told them jobs were staying in the United States,” said Rep. Raúl M. Grijalva (D-Ariz.), chair of the House Committee on Natural Resources, in a statement. “Under his watch jobs have left while he continues rewarding outsourcing corporations with millions of dollars in lucrative government contracts—in the middle of a pandemic.”

At least $425.6 billion in public money has gone to firms that moved jobs overseas in the past four years, according to the analysis, which means that “at least one of every four taxpayer dollars spent by the federal government on procurement contracts during the Trump administration went to the pockets of companies that offshored American jobs.”

The report states that “the Trump administration awarded an average of 2.5 times the amount, or $10 billion more, in contracts to firms that offshored during his term than those that did not.”

“Time and time again, Donald Trump has proven that he will always put his corporate friends’ profits over the lives of American workers,” said Rep. Mark Pocan (D-Wis.). “An administration that has promised to bring jobs back to our country… has given some of the largest government contract handouts to companies known for offshoring jobs.”

According to the analysis, Boeing, General Electric (GE), and United Technologies (UT) have been among the biggest beneficiaries of government contracts during the Trump era even though all three corporations moved jobs to lower-wage locations.

Public Citizen found that during the Trump administration alone, Boeing offshored 5,800 jobs, GE offshored 2,046, and UT offshored 1,572. The latter was awarded $15.1 billion dollars in federal procurement contracts between 2017 and 2019 even while offshoring at least 1,300 jobs at its Carrier subsidiary that President-elect Trump promised to save.

“Trump lied to America’s workers when he told them jobs were staying in the United States.”

—Rep. Raúl M. Grijalva

Despite President-elect Trump’s well-publicized 2016 intervention, during which he gained national attention for pledging to prevent offshoring at Carrier, the jobs of nearly 600 unionized workers at the company’s Indianapolis plant and all 700 at its Huntington, Indiana factory were relocated to Mexico in 2017, the report explains.

“This report is more evidence that Donald Trump is the King of Offshoring,” said Sen. Elizabeth Warren (D-Mass.). “For his entire term in office, Trump has awarded billions in new government contracts to firms notorious for serial American job outsourcing, showered giant multinational corporations with tax giveaways, shrugged his shoulders while people get laid off and jobs are shipped overseas—and he keeps lying through his teeth about it all.”

Rep. Tim Ryan (D-Ohio) explained how “in 2016, Trump struck a chord with voters in my district, and across the country by promising to bring those jobs back—but he has done just the opposite.”

Trump “has failed to use any of the expansive authorities over procurement policy that all presidents have and that past presidents have employed to deliver on their policy commitments and goals,” researchers wrote in the report. “Despite authority under the Procurement Act of 1949 to enact ‘policies and directives’ for federal contracting, Trump failed to exclude offshoring firms from qualifying for federal contracts.”

“Since elected, President Trump has given tax incentives and awarded hundreds of billions of dollars in federal contracts to corporations that send jobs overseas,” Ryan said. “Enough is enough. It is past time to level the playing field and cut American workers in on the deal.”

Rep. Brendon Boyle (D-Pa.) echoed Ryan, pointing out that “working families know this economy is stacked against them as American workers face stagnant wages, benefit reductions, and unfair foreign competition… President Trump simply failed in holding up his end of the bargain when he allowed these jobs to land in foreign countries.”

Lori Wallach, director of Public Citizen’s Global Trade Watch, summarized the glaring contradiction between Trump’s ostensibly pro-worker campaign pledges and his administration’s actual corporate-friendly policies.

“This is straight up promises made, workers betrayed,” she said.

“Time and time again, Donald Trump has proven that he will always put his corporate friends’ profits over the lives of American workers.”

—Rep. Mark Pocan

The report (pdf), Promises Made, Workers Betrayed: Trump’s Bigly Broken Promise to Stop Job Offshoring, was released during a press conference and is based on an analysis of data from the Department of Labor on trade-related job loss as well as data on federal procurement.

Researchers at Public Citizen found that Trump’s claim that he would deny billions worth of lucrative government contracts to companies that offshored jobs in order to encourage those firms to bring jobs back to U.S. factories was an empty threat. Instead, the report reveals, eight of the top 10 corporations receiving government contracts during Trump’s time in office have participated in offshoring.

According to the analysis, of the more than 300,000 U.S. workers who have lost their jobs as a result of worsening trade deficits during the Trump presidency, just over 200,000 of those jobs were classified as offshored.

“Trump lied to America’s workers when he told them jobs were staying in the United States,” said Rep. Raúl M. Grijalva (D-Ariz.), chair of the House Committee on Natural Resources, in a statement. “Under his watch jobs have left while he continues rewarding outsourcing corporations with millions of dollars in lucrative government contracts—in the middle of a pandemic.”

At least $425.6 billion in public money has gone to firms that moved jobs overseas in the past four years, according to the analysis, which means that “at least one of every four taxpayer dollars spent by the federal government on procurement contracts during the Trump administration went to the pockets of companies that offshored American jobs.”

The report states that “the Trump administration awarded an average of 2.5 times the amount, or $10 billion more, in contracts to firms that offshored during his term than those that did not.”

“Time and time again, Donald Trump has proven that he will always put his corporate friends’ profits over the lives of American workers,” said Rep. Mark Pocan (D-Wis.). “An administration that has promised to bring jobs back to our country… has given some of the largest government contract handouts to companies known for offshoring jobs.”

According to the analysis, Boeing, General Electric (GE), and United Technologies (UT) have been among the biggest beneficiaries of government contracts during the Trump era even though all three corporations moved jobs to lower-wage locations.

Public Citizen found that during the Trump administration alone, Boeing offshored 5,800 jobs, GE offshored 2,046, and UT offshored 1,572. The latter was awarded $15.1 billion dollars in federal procurement contracts between 2017 and 2019 even while offshoring at least 1,300 jobs at its Carrier subsidiary that President-elect Trump promised to save.

“Trump lied to America’s workers when he told them jobs were staying in the United States.”

—Rep. Raúl M. Grijalva

Despite President-elect Trump’s well-publicized 2016 intervention, during which he gained national attention for pledging to prevent offshoring at Carrier, the jobs of nearly 600 unionized workers at the company’s Indianapolis plant and all 700 at its Huntington, Indiana factory were relocated to Mexico in 2017, the report explains.

“This report is more evidence that Donald Trump is the King of Offshoring,” said Sen. Elizabeth Warren (D-Mass.). “For his entire term in office, Trump has awarded billions in new government contracts to firms notorious for serial American job outsourcing, showered giant multinational corporations with tax giveaways, shrugged his shoulders while people get laid off and jobs are shipped overseas—and he keeps lying through his teeth about it all.”

Rep. Tim Ryan (D-Ohio) explained how “in 2016, Trump struck a chord with voters in my district, and across the country by promising to bring those jobs back—but he has done just the opposite.”

Trump “has failed to use any of the expansive authorities over procurement policy that all presidents have and that past presidents have employed to deliver on their policy commitments and goals,” researchers wrote in the report. “Despite authority under the Procurement Act of 1949 to enact ‘policies and directives’ for federal contracting, Trump failed to exclude offshoring firms from qualifying for federal contracts.”

“Since elected, President Trump has given tax incentives and awarded hundreds of billions of dollars in federal contracts to corporations that send jobs overseas,” Ryan said. “Enough is enough. It is past time to level the playing field and cut American workers in on the deal.”

Rep. Brendon Boyle (D-Pa.) echoed Ryan, pointing out that “working families know this economy is stacked against them as American workers face stagnant wages, benefit reductions, and unfair foreign competition… President Trump simply failed in holding up his end of the bargain when he allowed these jobs to land in foreign countries.”

Lori Wallach, director of Public Citizen’s Global Trade Watch, summarized the glaring contradiction between Trump’s ostensibly pro-worker campaign pledges and his administration’s actual corporate-friendly policies.

“This is straight up promises made, workers betrayed,” she said.

STUPIDITY'S REWARD!!!

Trump-loving former Republican official who hated face masks dies from COVID-19

September 21, 2020

By Brad Reed - RAW STORY

Former Nashville Council Member Tony Tenpenny, a Trump-loving Republican who posted anti-face mask memes on Facebook, has died from complications resulting from being infected from COVID-19.

The Tennessean reports that Tenpenny “was hospitalized for more than a month at one of the St. Thomas hospitals and was placed on a ventilator earlier in September” before he died over the weekend.

Nashville Mayor John Cooper expressed his condolences after hearing of Tenpenny’s passing.

“I am deeply saddened to hear of the passing of former councilman Tony Tenpenny,” he said. “I send my condolences to his wife, Robbie, their son Ira and the rest of the Tenpenny family.”

As The Tennessee Holler points out on Twitter, Tenpenny regularly railed against COVID-19 restrictions on his Facebook page, and he posted memes that attacked face masks as part of a socialist plot, while also directly accusing the Centers for Disease Control and Prevention of lying about the severity of the disease.

Tenpenny’s Facebook page was also filled with memes and content supportive of President Donald Trump.

The Tennessean reports that Tenpenny “was hospitalized for more than a month at one of the St. Thomas hospitals and was placed on a ventilator earlier in September” before he died over the weekend.

Nashville Mayor John Cooper expressed his condolences after hearing of Tenpenny’s passing.

“I am deeply saddened to hear of the passing of former councilman Tony Tenpenny,” he said. “I send my condolences to his wife, Robbie, their son Ira and the rest of the Tenpenny family.”

As The Tennessee Holler points out on Twitter, Tenpenny regularly railed against COVID-19 restrictions on his Facebook page, and he posted memes that attacked face masks as part of a socialist plot, while also directly accusing the Centers for Disease Control and Prevention of lying about the severity of the disease.

Tenpenny’s Facebook page was also filled with memes and content supportive of President Donald Trump.

‘The situation is dire’: As Trump takes victory lap, new jobs report reveals alarming surge in permanent unemployment

September 4, 2020

By Jake Johnson, Common Dreams - RAW STORY

“The pain is nowhere near over for millions of workers and their families across the country.”

President Donald Trump on Friday wasted no time taking a victory lap after the Bureau of Labor Statistics announced the U.S. unemployment rate fell to 8.4% in August, but economists warned a closer look at the new economic figures reveals an alarming surge in permanent joblessness that could portend a prolonged recession if Congress and the White House fail to quickly approve additional relief.

“The failure of the Trump administration to control the virus has led to a slower pace of job gains and, while the jobless rate fell significantly last month, it is still in recessionary territory and more job seekers are at risk of longer-term unemployment.”

—Jared Bernstein, Center on Budget and Policy Priorities

The number of Americans classified as permanently unemployed—as opposed to being on temporary furlough—grew by 534,000 in August even as the U.S. economy added 1.4 million jobs. On Twitter, Trump celebrated the latter data point as “great” and “much better than expected.”

The total number of workers who are permanently jobless is now 3.4 million, according to the bureau’s latest data. Elise Gould, senior economist at the Economic Policy Institute (EPI), wrote in a blog post Friday that contrary to the White House’s rosy spin, the new BLS report shows “the pain is nowhere near over for millions of workers and their families across the country.”

“At this point, the U.S. economy is still down 11.5 million jobs from where it was in February, before the pandemic hit,” wrote Gould. “With this kind of slowing in job growth, it will take years to return to the pre-pandemic labor market. And, without the $600 boost to unemployment insurance, jobs will return even more slowly than had policymakers stepped up and continued that vital support to workers and the economy.”

EPI’s Heidi Shierholz echoed Gould’s assessment, noting in a series of tweets that “the situation is dire” and “the labor market remains in crisis.”

On top of the growing number of Americans whose jobs have completely disappeared due to the Covid-19 pandemic and resulting economic collapse, economist Jared Bernstein noted that another “worrisome development” spotlighted by the new BLS report is “the shift to longer-term unemployment: the share of job losers unemployed for at least 15 weeks has gone from 8% in April to 60% in August.”

“In sum, the failure of the Trump administration to control the virus has led to a slower pace of job gains and, while the jobless rate fell significantly last month, it is still in recessionary territory and more job seekers are at risk of longer-term unemployment,” wrote Bernstein, a senior fellow at the Center on Budget and Policy Priorities. “Importantly, note that this shift is occurring as Congress, particularly Senate Republicans, has dropped the ball on further fiscal relief.”

“Mitch McConnell and the do-nothing Republican Senate refuse to help the working class. Pathetic.”

—Sen. Bernie Sanders

As Common Dreams reported Thursday, Senate Republicans are preparing to vote as soon as next week on a “skinny” coronavirus relief package that would provide a $300-per-week federal unemployment supplement—just half of the $600 weekly payment the GOP allowed to expire in July—as well as additional funding measures that Democratic lawmakers decried as woefully inadequate.

In a Dear Colleague letter (pdf) on Thursday, Senate Minority Leader Chuck Schumer (D-N.Y.) slammed the GOP proposal as an attempt “to ‘check the box’ and give the appearance of action rather than actually meet the truly profound needs of the American people.”

“With no money for rental assistance, no money for nutrition assistance, and no money for state and local services, the census, or safe elections,” wrote Schumer, “Senate Republicans would be making another unacceptable and ineffective attempt at providing relief.”

The Washington Post‘s Jeff Stein reported Friday that the decline in the unemployment rate “emboldens voices in White House saying more stimulus is unnecessary,” even as economists warn that failing to provide additional relief funds—including substantial aid to cash-strapped state and local governments—could have catastrophic economic consequences in the near future.

Despite several recent attempts to jumpstart negotiations, Covid-19 relief talks between the White House, Schumer, Senate Majority Leader Mitch McConnell (R-Ky.), and House Speaker Nancy Pelosi (D-Calif.) have been stalled for weeks as tens of millions of Americans attempt to meet basic needs with drastically reduced incomes.

“Nearly 30 million Americans are going hungry,” Sen. Bernie Sanders (I-Vt.) tweeted Friday. “Meanwhile, three members of the Walton family grew their wealth by $3.7 billion in a single day. Mitch McConnell and the do-nothing Republican Senate refuse to help the working class. Pathetic.”

President Donald Trump on Friday wasted no time taking a victory lap after the Bureau of Labor Statistics announced the U.S. unemployment rate fell to 8.4% in August, but economists warned a closer look at the new economic figures reveals an alarming surge in permanent joblessness that could portend a prolonged recession if Congress and the White House fail to quickly approve additional relief.

“The failure of the Trump administration to control the virus has led to a slower pace of job gains and, while the jobless rate fell significantly last month, it is still in recessionary territory and more job seekers are at risk of longer-term unemployment.”

—Jared Bernstein, Center on Budget and Policy Priorities

The number of Americans classified as permanently unemployed—as opposed to being on temporary furlough—grew by 534,000 in August even as the U.S. economy added 1.4 million jobs. On Twitter, Trump celebrated the latter data point as “great” and “much better than expected.”

The total number of workers who are permanently jobless is now 3.4 million, according to the bureau’s latest data. Elise Gould, senior economist at the Economic Policy Institute (EPI), wrote in a blog post Friday that contrary to the White House’s rosy spin, the new BLS report shows “the pain is nowhere near over for millions of workers and their families across the country.”

“At this point, the U.S. economy is still down 11.5 million jobs from where it was in February, before the pandemic hit,” wrote Gould. “With this kind of slowing in job growth, it will take years to return to the pre-pandemic labor market. And, without the $600 boost to unemployment insurance, jobs will return even more slowly than had policymakers stepped up and continued that vital support to workers and the economy.”

EPI’s Heidi Shierholz echoed Gould’s assessment, noting in a series of tweets that “the situation is dire” and “the labor market remains in crisis.”

On top of the growing number of Americans whose jobs have completely disappeared due to the Covid-19 pandemic and resulting economic collapse, economist Jared Bernstein noted that another “worrisome development” spotlighted by the new BLS report is “the shift to longer-term unemployment: the share of job losers unemployed for at least 15 weeks has gone from 8% in April to 60% in August.”

“In sum, the failure of the Trump administration to control the virus has led to a slower pace of job gains and, while the jobless rate fell significantly last month, it is still in recessionary territory and more job seekers are at risk of longer-term unemployment,” wrote Bernstein, a senior fellow at the Center on Budget and Policy Priorities. “Importantly, note that this shift is occurring as Congress, particularly Senate Republicans, has dropped the ball on further fiscal relief.”

“Mitch McConnell and the do-nothing Republican Senate refuse to help the working class. Pathetic.”

—Sen. Bernie Sanders

As Common Dreams reported Thursday, Senate Republicans are preparing to vote as soon as next week on a “skinny” coronavirus relief package that would provide a $300-per-week federal unemployment supplement—just half of the $600 weekly payment the GOP allowed to expire in July—as well as additional funding measures that Democratic lawmakers decried as woefully inadequate.

In a Dear Colleague letter (pdf) on Thursday, Senate Minority Leader Chuck Schumer (D-N.Y.) slammed the GOP proposal as an attempt “to ‘check the box’ and give the appearance of action rather than actually meet the truly profound needs of the American people.”

“With no money for rental assistance, no money for nutrition assistance, and no money for state and local services, the census, or safe elections,” wrote Schumer, “Senate Republicans would be making another unacceptable and ineffective attempt at providing relief.”

The Washington Post‘s Jeff Stein reported Friday that the decline in the unemployment rate “emboldens voices in White House saying more stimulus is unnecessary,” even as economists warn that failing to provide additional relief funds—including substantial aid to cash-strapped state and local governments—could have catastrophic economic consequences in the near future.

Despite several recent attempts to jumpstart negotiations, Covid-19 relief talks between the White House, Schumer, Senate Majority Leader Mitch McConnell (R-Ky.), and House Speaker Nancy Pelosi (D-Calif.) have been stalled for weeks as tens of millions of Americans attempt to meet basic needs with drastically reduced incomes.

“Nearly 30 million Americans are going hungry,” Sen. Bernie Sanders (I-Vt.) tweeted Friday. “Meanwhile, three members of the Walton family grew their wealth by $3.7 billion in a single day. Mitch McConnell and the do-nothing Republican Senate refuse to help the working class. Pathetic.”

payback!!!

‘Wage theft’: Treasury signals millions of workers will earn less in 2021 under Trump’s payroll tax deferral

Julia Conley / Common Dreams - alternet

August 30, 2020

Days after the payroll processor for the federal government—one of the nation’s largest employers—announced it would implement President Donald Trump’s plan to defer payroll taxes for the rest of 2020, the U.S. Treasury Department indicated that employers will be responsible for paying the deferred taxes next year.

The plan is scheduled to go into effect September 1, and companies that take part will be required to collect the taxes their employees owe from the last four months of this year at the beginning of 2021—after the general election, which Trump hopes to win with claims that he’s strengthened the economy and helped workers.

The Friday announcement from the Treasury Department could mean that millions of workers will see smaller paychecks and larger tax bills in 2021, the Washington Post reported.

The news bolstered the argument made last week by employers including automakers, retail companies, and restaurants, who called the plan “unworkable” and signaled that many will decline to implement the tax deferral.

“We are concerned that many critical questions remain unanswered, making implementation a continuing challenge,” Caroline Harris, vice president of tax policy at the U.S. Chamber of Commerce, said in a statement Friday. The Chamber, which frequently endorses pro-business, anti-worker candidates and legislation, joined the employers in raising concerns about the plan last week.

The plan has been condemned from the left as well, with progressives raising alarm that Trump ultimately plans to “terminate” the payroll tax, which funds Social Security and Medicare, as he’s threatened to do if he wins reelection.

Rep. Don Beyer (D-Va.), who represents more federal workers than any other member of Congress, slammed the president’s plan as a pre-election “gimmick” meant to “give the appearance of action as the White House continues to stall negotiations for a real stimulus package.”

“The Trump administration’s plan to initiate payroll tax deferrals for civil servants treats the federal workforce as a guinea pig for a bad policy that businesses already rejected as ‘unworkable,'” Beyer said in a statement. “This payroll tax deferral does not really put money in workers’ pockets, it simply sets up the members of the federal workforce who can least afford it for a big tax bill that many will not expect. Like Donald Trump’s other economic executive orders, this will not provide actual relief to workers.”

Julie Oliver, a Medicare for All advocate who is running for Congress in Texas’s 25th congressional district, also warned companies against implementing the payroll tax deferral.

“Trump’s payroll tax ‘deferral’ is a form of wage theft,” tweeted Oliver.

The plan is scheduled to go into effect September 1, and companies that take part will be required to collect the taxes their employees owe from the last four months of this year at the beginning of 2021—after the general election, which Trump hopes to win with claims that he’s strengthened the economy and helped workers.

The Friday announcement from the Treasury Department could mean that millions of workers will see smaller paychecks and larger tax bills in 2021, the Washington Post reported.

The news bolstered the argument made last week by employers including automakers, retail companies, and restaurants, who called the plan “unworkable” and signaled that many will decline to implement the tax deferral.

“We are concerned that many critical questions remain unanswered, making implementation a continuing challenge,” Caroline Harris, vice president of tax policy at the U.S. Chamber of Commerce, said in a statement Friday. The Chamber, which frequently endorses pro-business, anti-worker candidates and legislation, joined the employers in raising concerns about the plan last week.

The plan has been condemned from the left as well, with progressives raising alarm that Trump ultimately plans to “terminate” the payroll tax, which funds Social Security and Medicare, as he’s threatened to do if he wins reelection.

Rep. Don Beyer (D-Va.), who represents more federal workers than any other member of Congress, slammed the president’s plan as a pre-election “gimmick” meant to “give the appearance of action as the White House continues to stall negotiations for a real stimulus package.”

“The Trump administration’s plan to initiate payroll tax deferrals for civil servants treats the federal workforce as a guinea pig for a bad policy that businesses already rejected as ‘unworkable,'” Beyer said in a statement. “This payroll tax deferral does not really put money in workers’ pockets, it simply sets up the members of the federal workforce who can least afford it for a big tax bill that many will not expect. Like Donald Trump’s other economic executive orders, this will not provide actual relief to workers.”

Julie Oliver, a Medicare for All advocate who is running for Congress in Texas’s 25th congressional district, also warned companies against implementing the payroll tax deferral.

“Trump’s payroll tax ‘deferral’ is a form of wage theft,” tweeted Oliver.

Payroll tax cut imperils Social Security

Social Security fund would run out of money in 3 years if Trump eliminates payroll tax: SSA analysis

Democrats say Trump's vow would “completely decimate Social Security" as advisers try to walk back his promise

IGOR DERYSH - salon

AUGUST 29, 2020 2:00PM (UTC)

President Donald Trump claimed he would eliminate the payroll tax if he is reelected — but an analysis by the Social Security Administration found that such a move would cause the Social Security Trust Fund to run out of money by 2023.

Trump recently signed a memorandum that would temporarily stop the collection of payroll taxes, which is a 12.4% tax split evenly between employees and employers that funds the Social Security and Medicare trust funds. Only Congress can cut taxes, however, so the payroll tax savings would still have to be repaid by next year's tax deadline — though Trump said he would push to forgive the deferred taxes if he is reelected.

Trump went a step further earlier this month, vowing not just to forgive this year's payroll tax but eliminate it entirely.

"If I'm victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax. I'm going to make them all permanent," he said during a news conference at his Bedminster, N.J. golf course. "…In other words, I'll extend beyond the end of the year and terminate the tax. And so we'll see what happens."

The claim prompted alarm on Capitol Hill. Senate Minority Leader Chuck Schumer, D-N.Y., Sen. Bernie Sanders, I-Vt., and Sen. Ron Wyden, D-Ore., sent a letter to the Social Security Administration questioning how permanently eliminating the tax and making no other changes would impact the viability of the Social Security Trust Fund.

"While we would not be supportive of this hypothetical legislation, we would like to be aware of its potential implications," they wrote.

Stephen Goss, the chief actuary at the Social Security Administration, told the senators in his response that the hypothetical cut would cause the Social Security Disability Insurance Trust Fund to be depleted by mid-2021 and the Social Security Trust Fund reserves "would become permanently depleted by the middle of calendar year 2023, with no ability to pay… benefits thereafter."

Goss noted that past temporary payroll tax reductions did not affect the trust fund reserves because the Treasury Department authorized automatic transfers from its General Fund, which Treasury Secretary Steven Mnuchin vowed to do for the deferred taxes, but it is unlikely to extend beyond that.

If the payroll tax is eliminated, Congress would have to replace the funds with about $1 trillion in tax increases. Social Security benefits for retired workers average about $1,500 per month, and "these amounts could be completely eliminated" without alternative sources of funding, Forbes reported.

"While benefits scheduled in the law… are obligations, such obligations can only be met to the extent that asset reserves are available," Goss wrote.

Democrats cited the analysis to warn that Trump's promise would "completely decimate Social Security."

"The Social Security Administration has made it clear: eliminating the payroll tax, as Trump has proposed, would bankrupt Social Security and prevent seniors and people with disabilities from receiving the benefits they have earned," Sanders said in a statement. "Defunding Social Security may make sense to the billionaires at President Trump's country club, but it makes zero sense to me. Instead of dismantling Social Security, we must expand it so that every senior can retire with the dignity they deserve."

House Speaker Nancy Pelosi, D-Calif., vowed to oppose any attempt to eliminate the payroll tax.

"The new analysis today shows the swift potential devastation of President Trump's reckless call to 'terminate' the payroll tax: shattering the sacred promise of Social Security," she said in a statement.

Advocacy groups sounded the alarm as well.

"If Donald Trump is re-elected, Social Security will cease to exist before the end of his second term," Nancy Altman, president of Social Security Works, told CNBC in response to the analysis.

Trump's advisers have attempted to walk back his comments.

"There is no plan to eliminate Social Security taxes," top White House economic adviser Larry Kudlow told reporters at the White House. "I don't know where that idea came from. It's not true."

"When he referred to 'permanent,' I think what he was saying is that the deferral of the payroll tax to the end of the year will be made permanent," he told CNN. "It will be forgiven. The tax is not going to go away."

"That isn't what the president said at all," host Dana Bash responded. "He said the opposite."

Social Security advocates are alarmed at the deferral as well, noting that using the Treasury's General Fund undermines how the program is supposed to work.

"They're not a handout. They're not an entitlement," Dan Adcock, the director of government relations and policy at the National Committee to Preserve Social Security and Medicare, told CNBC. "That's why even under those circumstances we are so strongly opposed to this."

It is highly unlikely that Congress would entertain the idea of undermining the Social Security program given that even Republicans opposed Trump's repeated calls to cut the payroll tax temporarily amid the pandemic. "A majority of Senate Republicans didn't want a payroll tax cut," NBC News reported last month.

Analyses have found that two-thirds of the benefits of a payroll tax cut would go to the richest 20% of Americans while the poorest 20% of Americans would get just 2% of the benefits. It would do nothing to help the tens of millions of people out of work.

Trump called for the payroll tax deferral after negotiations with Democrats broke down, but the fate of that deferral is still up in the air.

The memorandum called for the Treasury Department to start deferring taxes starting on September 1, but that appears highly unlikely since the department has not produced guidelines for employers or payroll processors to defer the taxes.

"The deferral isn't going to be in place for September 1st," Pete Isberg, president of the National Payroll Reporting Consortium, the payroll industry's trade association, told The Washington Post.

Because the deferral is voluntary, the language in the memorandum "raises the prospect that you have to get information to 100 million people," Isberg said, and then ensure the tax is only deferred for employees who want it.

About 30 industry groups, led by the US Chamber of Commerce, called the proposal potentially "unworkable."

"Therefore, many of our members will likely decline to implement deferral, choosing instead to continue to withhold and remit to the government the payroll taxes required by law," the groups said in a letter to Congress and the White House.

The groups said that the deferral would be "unfair to employees to make a decision that would force a big tax bill on them next year."

"We hope Congress and the Administration come together on a path that supports workers instead of burdening hard-working Americans with a large tax bill next year," the letter said.

Experts say that Trump's order is unlikely to have much impact as a result.

"There's a lot of unresolved questions about the implementation of this deferral, [and] some of the unresolved questions are quite basic," Garrett Watson, a senior policy analyst at the Tax Foundation, told NBC News. "When would the deferred tax be owed back? There isn't a date specified. There are many options here that have to be clarified. The other big thing that's hanging over a lot of this is whether or not this deferral will turn into a meaningful reduction in tax liability owed."

Companies and employees that choose to opt for the deferral could have big headaches come tax time next year.

"You don't want to be in a position where you have to withhold months worth of payroll taxes from employees all at once," Eric Toder, the co-director of the Urban-Brookings Tax Policy Center, told NBC. "That would create a horrible problem for people."

Trump recently signed a memorandum that would temporarily stop the collection of payroll taxes, which is a 12.4% tax split evenly between employees and employers that funds the Social Security and Medicare trust funds. Only Congress can cut taxes, however, so the payroll tax savings would still have to be repaid by next year's tax deadline — though Trump said he would push to forgive the deferred taxes if he is reelected.

Trump went a step further earlier this month, vowing not just to forgive this year's payroll tax but eliminate it entirely.

"If I'm victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax. I'm going to make them all permanent," he said during a news conference at his Bedminster, N.J. golf course. "…In other words, I'll extend beyond the end of the year and terminate the tax. And so we'll see what happens."

The claim prompted alarm on Capitol Hill. Senate Minority Leader Chuck Schumer, D-N.Y., Sen. Bernie Sanders, I-Vt., and Sen. Ron Wyden, D-Ore., sent a letter to the Social Security Administration questioning how permanently eliminating the tax and making no other changes would impact the viability of the Social Security Trust Fund.

"While we would not be supportive of this hypothetical legislation, we would like to be aware of its potential implications," they wrote.

Stephen Goss, the chief actuary at the Social Security Administration, told the senators in his response that the hypothetical cut would cause the Social Security Disability Insurance Trust Fund to be depleted by mid-2021 and the Social Security Trust Fund reserves "would become permanently depleted by the middle of calendar year 2023, with no ability to pay… benefits thereafter."

Goss noted that past temporary payroll tax reductions did not affect the trust fund reserves because the Treasury Department authorized automatic transfers from its General Fund, which Treasury Secretary Steven Mnuchin vowed to do for the deferred taxes, but it is unlikely to extend beyond that.

If the payroll tax is eliminated, Congress would have to replace the funds with about $1 trillion in tax increases. Social Security benefits for retired workers average about $1,500 per month, and "these amounts could be completely eliminated" without alternative sources of funding, Forbes reported.

"While benefits scheduled in the law… are obligations, such obligations can only be met to the extent that asset reserves are available," Goss wrote.

Democrats cited the analysis to warn that Trump's promise would "completely decimate Social Security."

"The Social Security Administration has made it clear: eliminating the payroll tax, as Trump has proposed, would bankrupt Social Security and prevent seniors and people with disabilities from receiving the benefits they have earned," Sanders said in a statement. "Defunding Social Security may make sense to the billionaires at President Trump's country club, but it makes zero sense to me. Instead of dismantling Social Security, we must expand it so that every senior can retire with the dignity they deserve."

House Speaker Nancy Pelosi, D-Calif., vowed to oppose any attempt to eliminate the payroll tax.

"The new analysis today shows the swift potential devastation of President Trump's reckless call to 'terminate' the payroll tax: shattering the sacred promise of Social Security," she said in a statement.

Advocacy groups sounded the alarm as well.

"If Donald Trump is re-elected, Social Security will cease to exist before the end of his second term," Nancy Altman, president of Social Security Works, told CNBC in response to the analysis.

Trump's advisers have attempted to walk back his comments.

"There is no plan to eliminate Social Security taxes," top White House economic adviser Larry Kudlow told reporters at the White House. "I don't know where that idea came from. It's not true."

"When he referred to 'permanent,' I think what he was saying is that the deferral of the payroll tax to the end of the year will be made permanent," he told CNN. "It will be forgiven. The tax is not going to go away."

"That isn't what the president said at all," host Dana Bash responded. "He said the opposite."

Social Security advocates are alarmed at the deferral as well, noting that using the Treasury's General Fund undermines how the program is supposed to work.

"They're not a handout. They're not an entitlement," Dan Adcock, the director of government relations and policy at the National Committee to Preserve Social Security and Medicare, told CNBC. "That's why even under those circumstances we are so strongly opposed to this."

It is highly unlikely that Congress would entertain the idea of undermining the Social Security program given that even Republicans opposed Trump's repeated calls to cut the payroll tax temporarily amid the pandemic. "A majority of Senate Republicans didn't want a payroll tax cut," NBC News reported last month.

Analyses have found that two-thirds of the benefits of a payroll tax cut would go to the richest 20% of Americans while the poorest 20% of Americans would get just 2% of the benefits. It would do nothing to help the tens of millions of people out of work.

Trump called for the payroll tax deferral after negotiations with Democrats broke down, but the fate of that deferral is still up in the air.

The memorandum called for the Treasury Department to start deferring taxes starting on September 1, but that appears highly unlikely since the department has not produced guidelines for employers or payroll processors to defer the taxes.

"The deferral isn't going to be in place for September 1st," Pete Isberg, president of the National Payroll Reporting Consortium, the payroll industry's trade association, told The Washington Post.

Because the deferral is voluntary, the language in the memorandum "raises the prospect that you have to get information to 100 million people," Isberg said, and then ensure the tax is only deferred for employees who want it.

About 30 industry groups, led by the US Chamber of Commerce, called the proposal potentially "unworkable."

"Therefore, many of our members will likely decline to implement deferral, choosing instead to continue to withhold and remit to the government the payroll taxes required by law," the groups said in a letter to Congress and the White House.

The groups said that the deferral would be "unfair to employees to make a decision that would force a big tax bill on them next year."

"We hope Congress and the Administration come together on a path that supports workers instead of burdening hard-working Americans with a large tax bill next year," the letter said.

Experts say that Trump's order is unlikely to have much impact as a result.

"There's a lot of unresolved questions about the implementation of this deferral, [and] some of the unresolved questions are quite basic," Garrett Watson, a senior policy analyst at the Tax Foundation, told NBC News. "When would the deferred tax be owed back? There isn't a date specified. There are many options here that have to be clarified. The other big thing that's hanging over a lot of this is whether or not this deferral will turn into a meaningful reduction in tax liability owed."

Companies and employees that choose to opt for the deferral could have big headaches come tax time next year.

"You don't want to be in a position where you have to withhold months worth of payroll taxes from employees all at once," Eric Toder, the co-director of the Urban-Brookings Tax Policy Center, told NBC. "That would create a horrible problem for people."

Michigan steelworkers slam Trump for tariffs that cost them their jobs

August 25, 2020

By Tom Boggioni - RAW STORY

In interviews with MSNBC, Michigan steelworkers called out Donald Trump for his failure to come through with jobs after making big promises during campaign swings over three years ago.

In clips shared by MSNBC host Stephanie Ruhle, who explained that the rise in the stock market is having little impact on the average Americans’ life, NBC correspondent Heidi Przybyla was seen interviewing workers — all currently laid-off — about job availability particularly in light of the president’s tariff war with China.

“I sat down yesterday with a few of the recently laid-off steelworkers who told me that, you know, all of those pledges from 2016 about how Trump was going to bring back their lifestyle, bring back these good-paying jobs by cracking down on trade and tariffs — all of that didn’t work out. It did nothing to save their communities,” the correspondent explained.

“It didn’t seem like any of this was coming, it just was a total surprise,” lamented steelworker John Gies. “My son is still working there, and he can’t believe that it’s gone this direction.”

“If you get in a car accident, that cage, we make that steel,” explained Mike Miller. “We make that family safe in there and that’s the pride these guys and women have when they’re making this steel. And then all of a sudden, you know that rug has been pulled out from underneath you.”

Unemployed worker Steve Bernard was more pointed in his criticism of the president.

‘”He came to this area and said if you elect me you’ll see two and a half times, you’ll see the steel industry, you guys will be fighting off orders,” Bernard recalled. ” That’s what he said. Check it out: three years later, where are we now? These guys are out of work.”

In clips shared by MSNBC host Stephanie Ruhle, who explained that the rise in the stock market is having little impact on the average Americans’ life, NBC correspondent Heidi Przybyla was seen interviewing workers — all currently laid-off — about job availability particularly in light of the president’s tariff war with China.

“I sat down yesterday with a few of the recently laid-off steelworkers who told me that, you know, all of those pledges from 2016 about how Trump was going to bring back their lifestyle, bring back these good-paying jobs by cracking down on trade and tariffs — all of that didn’t work out. It did nothing to save their communities,” the correspondent explained.

“It didn’t seem like any of this was coming, it just was a total surprise,” lamented steelworker John Gies. “My son is still working there, and he can’t believe that it’s gone this direction.”

“If you get in a car accident, that cage, we make that steel,” explained Mike Miller. “We make that family safe in there and that’s the pride these guys and women have when they’re making this steel. And then all of a sudden, you know that rug has been pulled out from underneath you.”

Unemployed worker Steve Bernard was more pointed in his criticism of the president.

‘”He came to this area and said if you elect me you’ll see two and a half times, you’ll see the steel industry, you guys will be fighting off orders,” Bernard recalled. ” That’s what he said. Check it out: three years later, where are we now? These guys are out of work.”

Florida man who thought pandemic was ‘hysteria’ loses his wife to COVID-19

August 24, 2020

By Brad Reed - raw story

A Florida resident who at one time blew off the novel coronavirus as “hysteria” is now mourning the loss of his wife, who died from the disease this month.

BBC News reports that 46-year-old Florida resident Erin Hitchens has passed away after spending the past several months in a hospital on ventilator.

Erin and her husband, Brian Hitchens, both contracted the disease in May after Hitchens said he blew off wearing a mask and social distancing because he didn’t believe the virus was a real threat. While Hitchens eventually recovered from the disease, his wife remained in intensive care for several more months before passing away.

“We thought the government was using it to distract us, or it was to do with 5G,” he tells BBC News.

Hitchens also tells BBC News that at least his wife is “no longer suffering, but in peace.”

Hitchens in a Facebook post this past May admitted that he regretted not taking the virus seriously.

“This thing is nothing to be messed with please listen to the authorities and heed the advice of the experts,” he wrote. “Looking back I should have wore a mask in the beginning but I didn’t and perhaps I’m paying the price for it now but I know that if it was me that gave it to my wife I know that she forgives me and I know that God forgives me.”

BBC News reports that 46-year-old Florida resident Erin Hitchens has passed away after spending the past several months in a hospital on ventilator.

Erin and her husband, Brian Hitchens, both contracted the disease in May after Hitchens said he blew off wearing a mask and social distancing because he didn’t believe the virus was a real threat. While Hitchens eventually recovered from the disease, his wife remained in intensive care for several more months before passing away.

“We thought the government was using it to distract us, or it was to do with 5G,” he tells BBC News.

Hitchens also tells BBC News that at least his wife is “no longer suffering, but in peace.”

Hitchens in a Facebook post this past May admitted that he regretted not taking the virus seriously.

“This thing is nothing to be messed with please listen to the authorities and heed the advice of the experts,” he wrote. “Looking back I should have wore a mask in the beginning but I didn’t and perhaps I’m paying the price for it now but I know that if it was me that gave it to my wife I know that she forgives me and I know that God forgives me.”

Memo exposes Trump’s unemployment insurance plan as a farce

Matthew Rozsa / Salon - alternet

August 19, 2020

Though the Federal Emergency Management Agency (FEMA) has approved funding which will allow seven states to provide a $300 weekly supplement to existing unemployment benefits — a policy implemented by President Donald Trump through an executive order earlier this month — a recent memo from the same agency implies that states are only guaranteed three weeks of federal funding for the important economy-rescuing subsidy.

“FEMA will use data from the Department of Labor, as well as state data received on applications to project the overall funding distributions,” FEMA explained in a recent memo. “Approved grant applicants will receive an initial obligation of three weeks of needed funding. Additional disbursements will be made on a weekly basis in order to ensure that funding remains available for the states who apply for the grant assistance.”

The CARES Act, which provided $600 per week of federal unemployment benefits, expired in July, and Trump’s executive order was intended as a partial extension of the relief provided in that bill. Trump’s new executive order was reported as creating a $400-a-week supplement, but the federal government is responsible for only $300 of that supplemental payment. The remaining $100 per week is covered by states themselves. FEMA is overseeing the disbursement of the supplemental funds.

This means that states which receive federal funding for the new unemployment subsidy are only guaranteed that aid for three weeks. After that, the federal government will decide each week whether to continue providing assistance to states that have already received benefits.

So far the federal government has approved funding for seven states including Colorado, Louisiana, New Mexico, Arizona, Iowa, Missouri and Utah. An eighth state, South Dakota, refused to apply for assistance.

During an appearance on CNBC, Treasury Secretary Steven Mnuchin stated, “I would expect that most of the states qualify… so I hope we see the majority of the states” ultimately receive assistance. Last month Mnuchin said that Trump’s coronavirus relief plan would be predicated on the assumption that it should provide “approximately 70 percent wage replacement.”

There are longstanding concerns that this premise, which seems to have played a role in deciding how much Trump would provide in weekly unemployment benefits through his executive orders earlier this month, underestimates how badly millions of Americans are suffering as a result of the pandemic-induced recession.

Dr. Betsey Stevenson, an economist at the University of Michigan, told Salon by email earlier this month that the government’s spending and stimulus bills are “a far cry from what is needed to stave off hardship and poverty. . . . We currently have widespread unemployment, it is the reason why additional stimulus is so necessary.”

Dr. Austan Goolsbee, who served on President Barack Obama’s Council of Economic Advisers, told Salon by email in July that “cutting payments to individuals at a moment when the virus is resurgent and the unemployment rate is in double digits will threaten the recovery.”

Economists have also anticipated that the unemployment benefits may not last long enough. As American University macroeconomist Dr. Gabriel Mathy told Salon earlier this month, “the $400 unemployment extension is less than the $600 before [from the CARES Act], and it requires a 25% ($100) match from states so it may not even happen given how tight state budgets are.”