welcome to oil

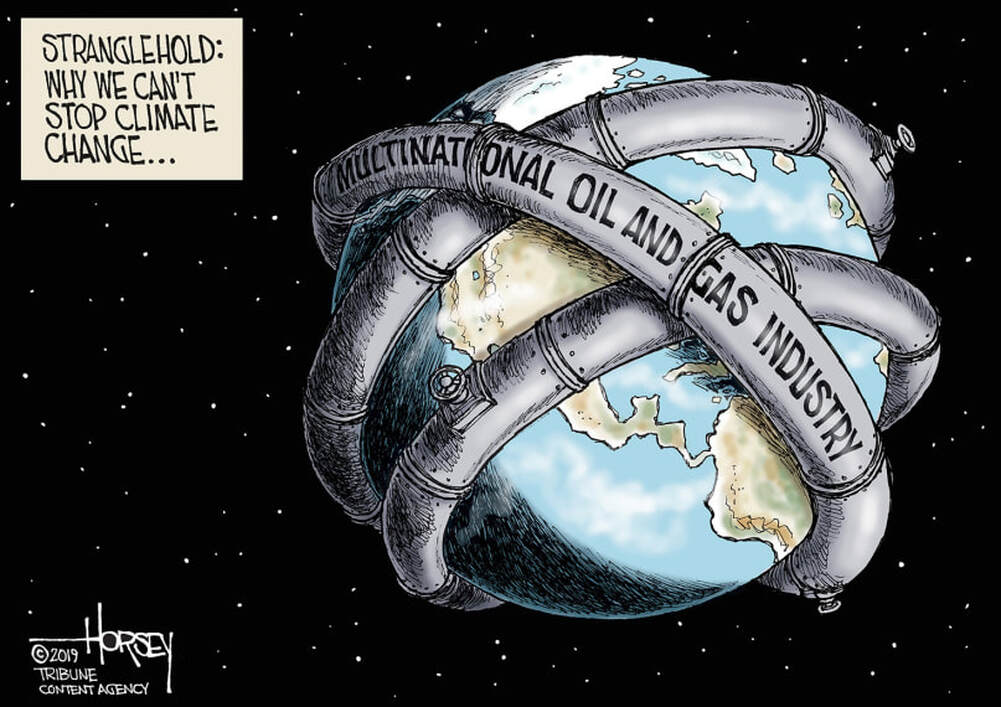

explore how the resource industry's greed and desire for profit is destroying the world

MARCH 2023

If a man walks in the woods for love of them half of each day, he is in danger of being

regarded as a loafer. But if he spends his days as a speculator, shearing off those

woods and making the earth bald before her time, he is deemed an industrious and

enterprising citizen.

Henry David Thoreau

*articles*

*FOSSIL FUELS KILL MORE PEOPLE THAN COVID. WHY ARE WE SO BLIND TO THE HARMS OF OIL AND GAS?(ARTICLE BELOW)

*BIG OIL DOUBLES PROFITS IN BLOCKBUSTER 2022

(ARTICLE BELOW)

*INTERNAL DOCUMENTS REVEAL BIG OIL’S PLAN FOR PROFITING AMID CLIMATE PRESSURES

(ARTICLE BELOW)

*CUSTOMERS SHIVER AS ENERGY GIANTS REAP $14 BILLION IN PROFITS

THAT'S FOURTEEN BILLION WITH A B.(ARTICLE BELOW)

*OIL COMPANY PROFITS BOOM AS AMERICANS REEL FROM HIGH FUEL PRICES

(ARTICLE BELOW)

*US OIL FIRMS SET TO REAP UP TO $126 BILLION IN EXTRA PROFITS AMID WAR ON UKRAINE

(ARTICLE BELOW)

*THE FOSSIL FUEL INDUSTRY DOESN'T CREATE NEARLY AS MANY JOBS AS IT SAYS IT DOES

(ARTICLE BELOW)

*Louisiana energy firm to pay millions following oil spill that began 17 years ago

(ARTICLE BELOW)

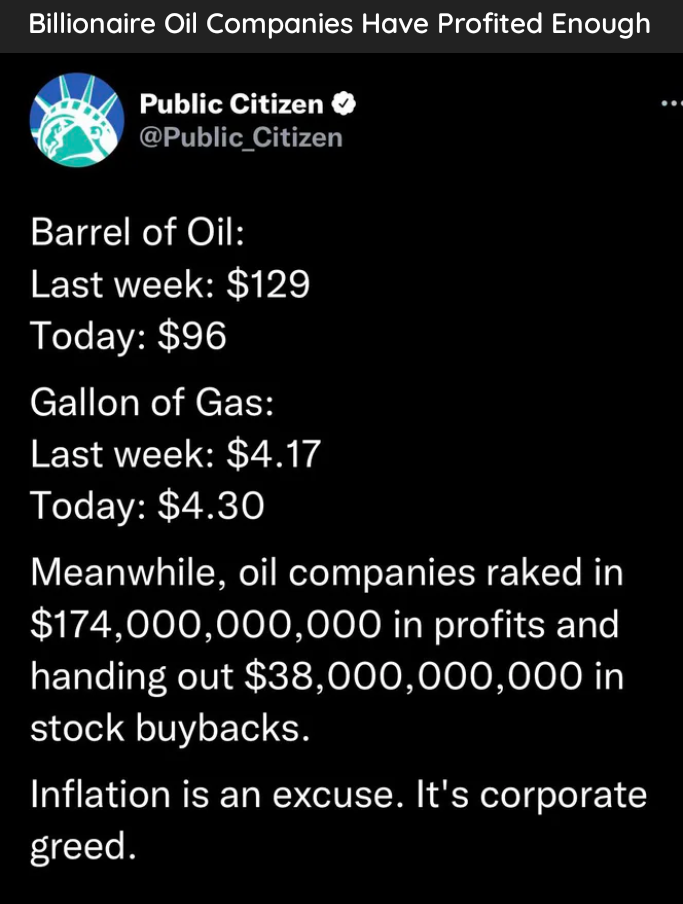

*EXCLUSIVE: OIL COMPANIES’ PROFITS SOARED TO $174BN THIS YEAR AS US GAS PRICES ROSE

(ARTICLE BELOW)

*REVEALED: 60% OF AMERICANS SAY OIL FIRMS ARE TO BLAME FOR THE CLIMATE CRISIS

(ARTICLE BELOW)

*HOW ECONOMISTS HELPED BIG OIL OBSTRUCT CLIMATE ACTION FOR DECADES

(ARTICLE BELOW)

*In Anti-Reconciliation Blitz, Exxon Spent $275,000 on Facebook Ads in One Week

(ARTICLE BELOW)

*HURRICANE IDA MAKES A MOCKERY OF BIG OIL’S PHILANTHROPY

(ARTICLE BELOW)

*BIG OIL FOUGHT CYBERSECURITY REGULATIONS, MAKING PIPELINE ATTACKS EASIER

(ARTICLE BELOW)

*150 years of spills: Philadelphia refinery cleanup highlights toxic legacy of fossil fuels(ARTICLE BELOW)

*'INVISIBLE KILLER': FOSSIL FUELS CAUSED 8.7M DEATHS GLOBALLY IN 2018, RESEARCH FINDS

(ARTICLE BELOW)

*TRUMP ADMINISTRATION ACCUSED OF TRYING TO BULLY BANKS INTO FINANCING ARCTIC FOSSIL FUEL EXTRACTION(ARTICLE BELOW)

*BIG OIL'S ANSWER TO MELTING ARCTIC: COOLING THE GROUND SO IT CAN KEEP DRILLING

(ARTICLE BELOW)

*EXXONMOBIL MISLED THE PUBLIC ABOUT THE CLIMATE CRISIS. NOW THEY'RE TRYING TO SILENCE CRITICS(ARTICLE BELOW)

*A NEWLY UNEARTHED JOURNAL FROM 1966 SHOWS THE COAL INDUSTRY, LIKE THE OIL INDUSTRY, WAS LONG AWARE OF THE THREAT OF CLIMATE CHANGE.(ARTICLE BELOW)

*Oil and gas industry rewards US lawmakers who oppose environmental protections – study(ARTICLE BELOW)

*Oil and gas firms 'have had far worse climate impact than thought'

(ARTICLE BELOW)

*Revealed: big oil's profits since 1990 total nearly $2tn

(ARTICLE BELOW)

*10 US oil refineries exceeding limits for cancer-causing benzene, report finds

(ARTICLE BELOW)

*How Big Oil exploited a loophole in the law to bilk the United States out of billions

(ARTICLE BELOW)

*Our Tax System Rewards Polluters

(ARTICLE BELOW)

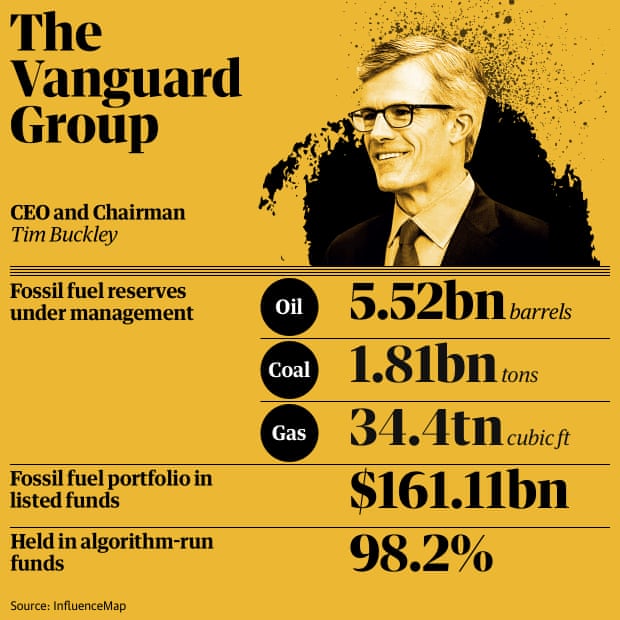

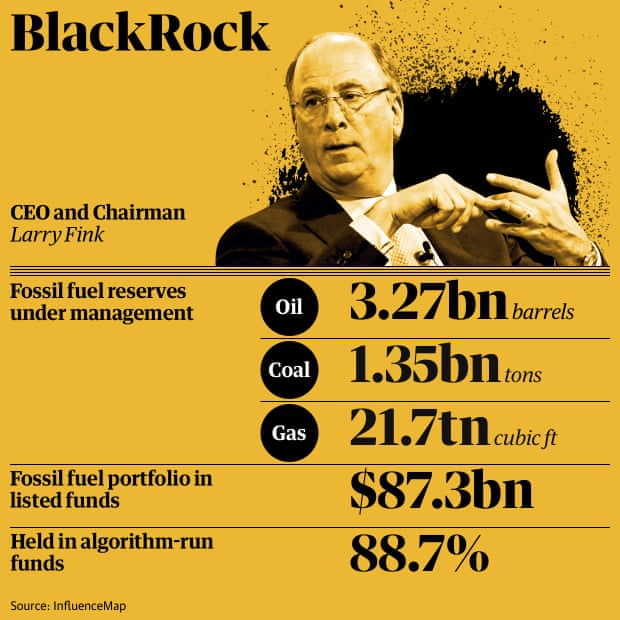

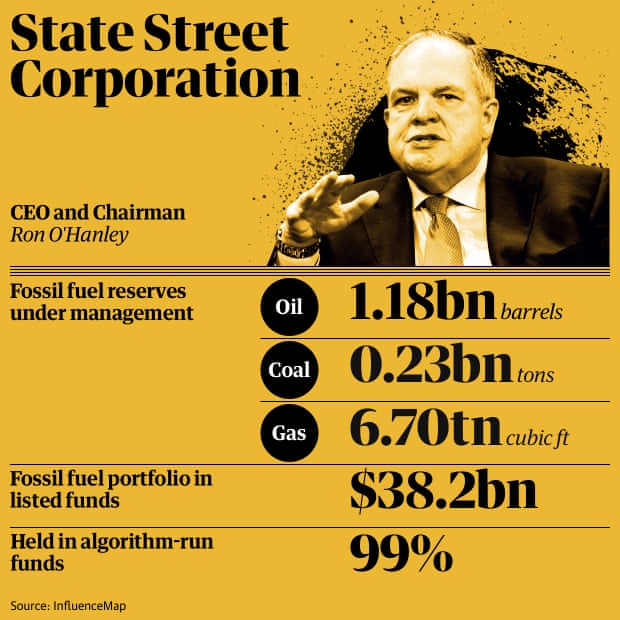

*World's top three asset managers oversee $300bn fossil fuel investments

(ARTICLE BELOW)

*The dark side of America's rise to oil superpower(ARTICLE BELOW)

*ON ITS HUNDREDTH BIRTHDAY IN 1959, EDWARD TELLER WARNED THE OIL INDUSTRY ABOUT GLOBAL WARMING(article below)

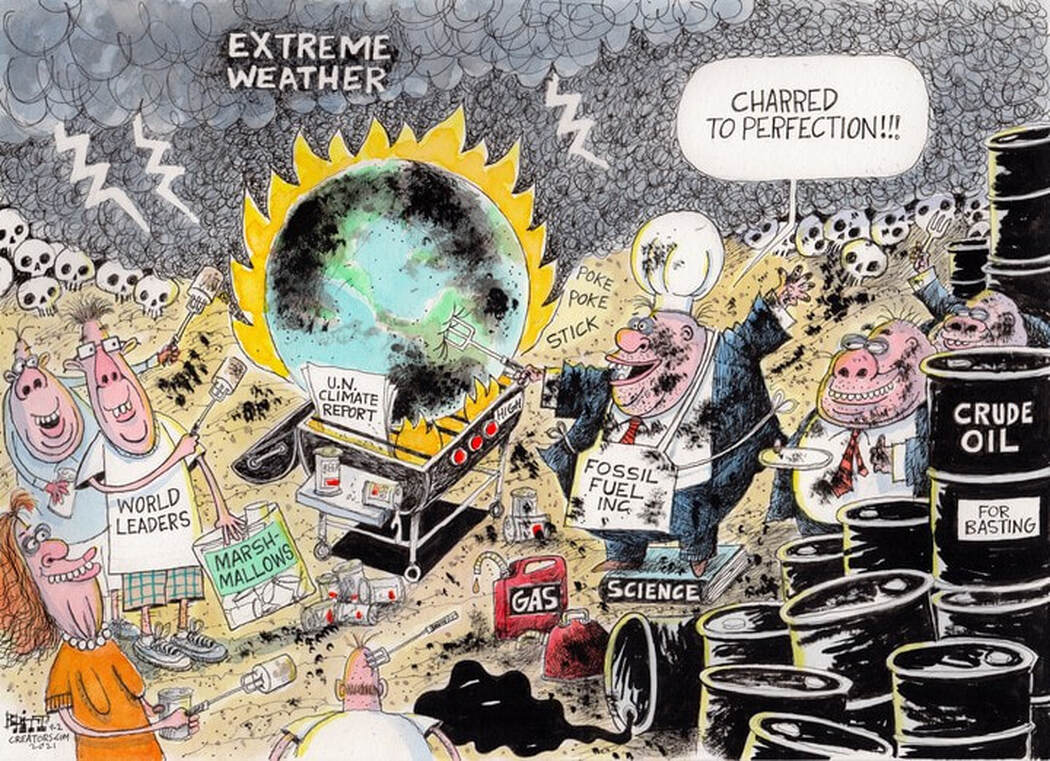

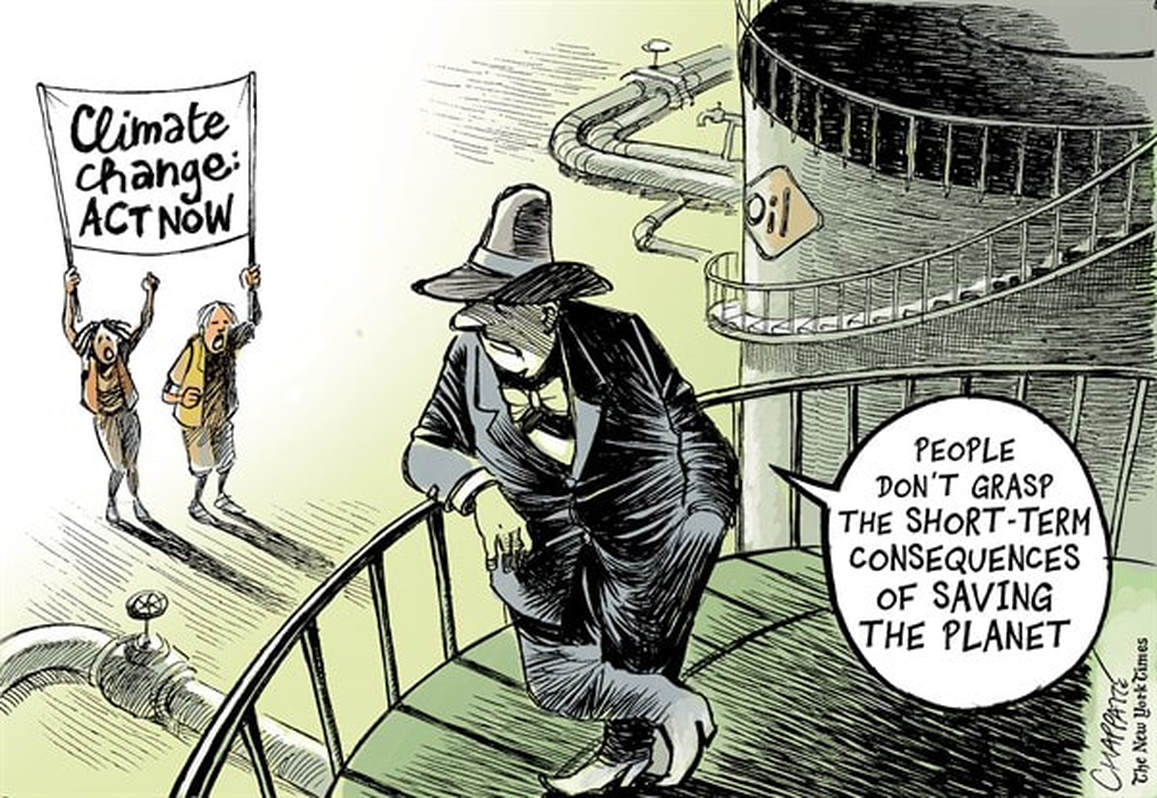

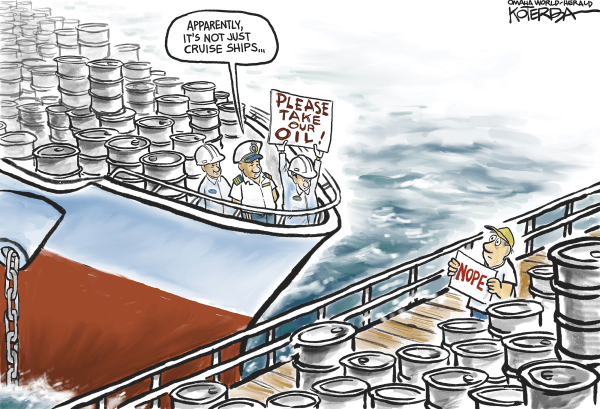

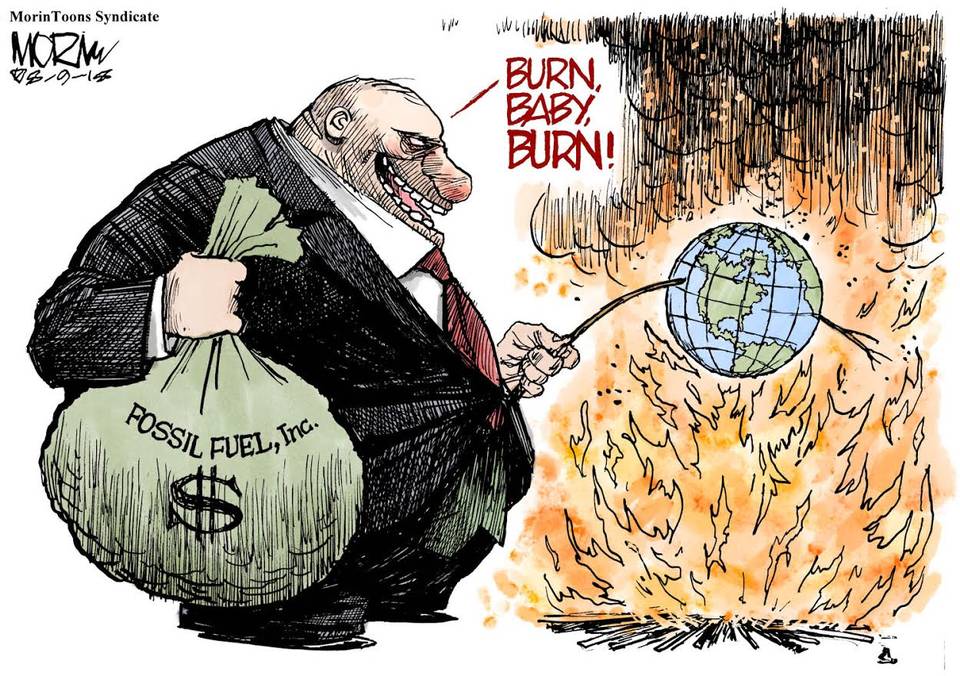

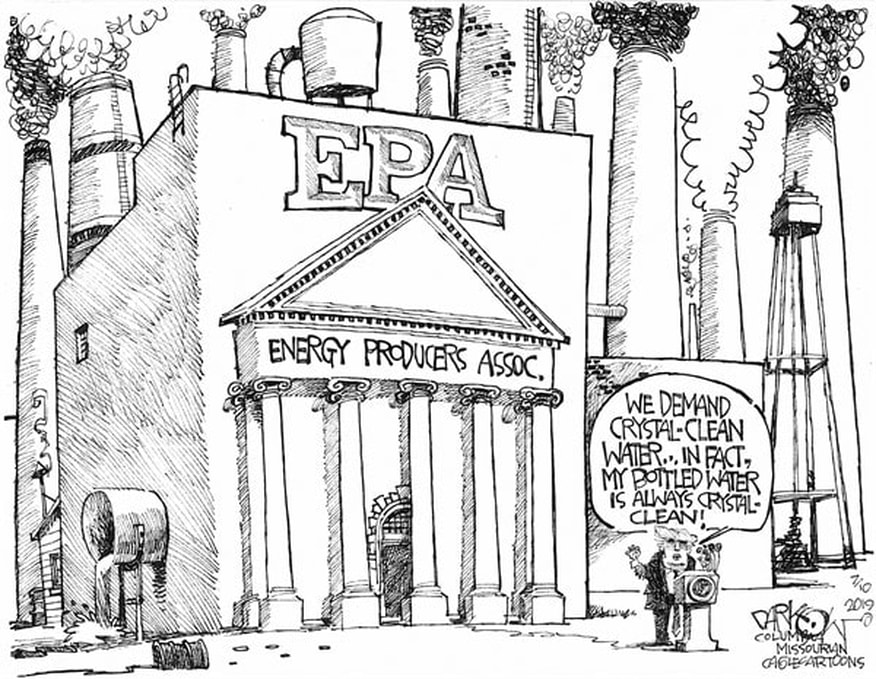

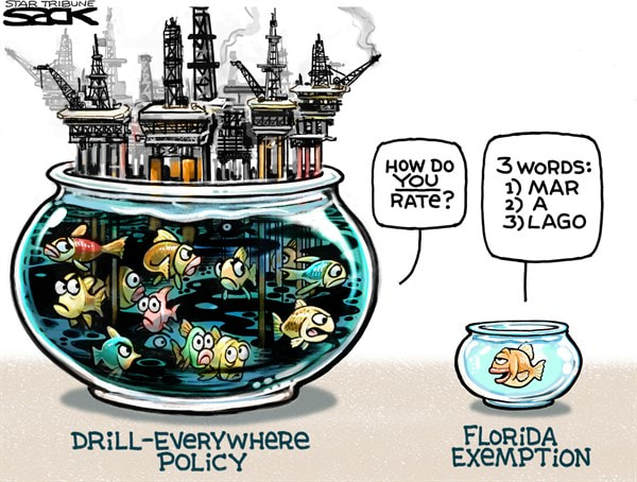

oil funnies(at the end)

Opinion

Fossil fuels

Fossil fuels kill more people than Covid. Why are we so blind to the harms of oil and gas?

Rebecca Solnit - the guardian

2/28/2023

If fossil fuel use and impact had suddenly appeared overnight, their catastrophic poisonousness and destructiveness would be obvious. But they have so incrementally become part of everyday life nearly everywhere on Earth that those impacts are largely accepted or ignored (that they’ve also corroded our politics helps this lack of alarm). This has real consequences for the climate crisis. Were we able to perceive afresh the sheer scale of fossil fuel impact we might be horrified. But because this is an old problem too many don’t see it as a problem.

Human beings are good at regarding new and unfamiliar phenomena as dangerous or unacceptable. But long-term phenomena become acceptable merely because of our capacity to adjust. Violence against women (the leading form of violence worldwide) and slower forms of environmental destruction have been going on so long that they’re easy to overlook and hard to get people to regard as a crisis. We saw this with Covid-19, where in the first months most people were fearful and eager to do what it took to avoid contracting or spreading the disease, and then grew increasingly casual about the risks and apparently oblivious to the impacts (the WHO charts almost 7 million deaths in little over three years).

To normalize is to turn something into the status quo, into something no longer seen as a problem, and this in turn undermines the impetus to pursue a solution. The very term crisis often implies a turning point or a decisive moment; these are problems with no turning point in sight, a long succession of indecisive moments as the damage mounts. Often what activists need to do is turn the status quo back into a crisis, as US Civil Rights Movement organizers so ably did in the 1960s by making racial inequality, exclusion and violence more dramatically visible and more unacceptable, as well as insisting that the world could be different, that change was possible.

The fossil fuel industry through airborne particulate matter alone annually kills far more people every year than Covid-19 has in three years. Recent studies conclude that nearly 9 million people a year die from inhaling these particulates produced by burning fossil fuel. It’s only one of the many ways fossil fuel is deadly, from black lung among coal miners and cancer and respiratory problems among those near refineries to fatalities from climate-driven catastrophes such as wildfire, extreme heat and floods.

The way we befouled our water, air and land, allowed manufacturers to introduce dangerous materials – lead, PCBs, PFAs (sometimes called “forever chemicals”), dioxin, high-level radioactive waste, microplastics, pesticides and herbicides – may seem to later generations shocking, stupid and amoral. Often the deployment of these substances offered short-term and specific advantages while leaving long-term and widespread damage; often the few benefited and the many paid. But all this was normalized.

One consequence of these habits of mind is the hostile reaction to the impact of renewables. Renewables require mining; the total amount of mining they require is far less than the fossil-fuel mining that goes on all around us and has for a long time. As a scientific paper put it in 2021: “The transition from fossil fuels to renewable energy systems involves enormous decreases in materials, mining, and political risk. Since renewable systems need no fuel, they depend on trade only for the acquisition of materials and components during construction. Once the system is operating, no trade is required to sustain it. Therefore renewable energy production is not exposed to the political risks that plague fossil fuel production.” That is, you don’t have to cozy up to Russia or Saudi Arabia to keep going.

The climate movement has spent decades trying to stop one kind of extraction; I wish I could say that we could end the age of extraction altogether, but the billions of people on Earth cannot all revert to a pre-industrial state. With renewables the materials need to be extracted once and then are used for many years and are thereafter, in many cases, recyclable; with fossil fuel we burn it up as we go, so constant new interjections of coal, oil or gas are needed. They literally go up in smoke.

Battery technology is rapidly advancing, and much research on making batteries from more readily available materials than lithium is under way. Just last week came the announcement that “Volkswagen’s joint venture with JAC in China has produced the first electric car powered by the nascent sodium-ion battery technology.” So while it is urgent to pursue existing means for electrifying everything, it also seems clear that we are early in a technological revolution likely to provide new and better ways of doing what needs to be done. Or as Greta Thunberg once put it: “Avoiding climate breakdown will require cathedral thinking. We must lay the foundation while we may not know exactly how to build the ceiling.”

Obviously it matters where materials are extracted. Endangered species, significant habitat, local communities and indigenous sovereignty should be respected. They are not respected by fossil fuel extraction – just think of the gigantic festering expanse of Alberta’s tar sands, which have hugely impacted wildlife and encroached on traditional lands of several First Nations groups. As Inside Climate News put it: “Oil and gas companies like ExxonMobil and the Canadian giant Suncor have transformed Alberta’s tar sands – also called oil sands – into one of the world’s largest industrial developments. They have built sprawling waste ponds that leach heavy metals into groundwater, and processing plants that spew nitrogen and sulfur oxides into the air, sending a sour stench for miles.” To consider another example, a report in Bloomberg News stated last fall, “A roughly Taiwan-sized area of Alaska’s Arctic will be auctioned for oil and gas development …”

Astroturf organizations backed by conservatives and fossil-fuel interests have pushed false claims about health threats and organized locals against both wind turbines and solar installations. But the space they take up can be far less than that occupied by fossil fuel, and many turbines and solar panels coexist with agriculture. (Studies shows that sheep and solar panels can be mutually beneficial; elsewhere farmers adding turbines to their farms reap good income.) Bloomberg News recently published a piece mismeasuring the scale of renewables versus fossils: “A 200-megawatt wind farm, for instance, might require spreading turbines over 13 sq miles (36 sq km). A natural-gas power plant with that same generating capacity could fit onto a single city block.” But the wind farm is actually generating the energy it uses, and quite possibly coexisting with other land uses, while the gas plant depends on ceaseless mining for methane elsewhere that may permanently damage and poison the land. The way we have long operated was always destructive, and it’s now a crisis larger than any in human history. Change needs to come, swiftly, and though practical change is crucial, so are changes in imagination, perception and values. The two go together, and they always have.

Human beings are good at regarding new and unfamiliar phenomena as dangerous or unacceptable. But long-term phenomena become acceptable merely because of our capacity to adjust. Violence against women (the leading form of violence worldwide) and slower forms of environmental destruction have been going on so long that they’re easy to overlook and hard to get people to regard as a crisis. We saw this with Covid-19, where in the first months most people were fearful and eager to do what it took to avoid contracting or spreading the disease, and then grew increasingly casual about the risks and apparently oblivious to the impacts (the WHO charts almost 7 million deaths in little over three years).

To normalize is to turn something into the status quo, into something no longer seen as a problem, and this in turn undermines the impetus to pursue a solution. The very term crisis often implies a turning point or a decisive moment; these are problems with no turning point in sight, a long succession of indecisive moments as the damage mounts. Often what activists need to do is turn the status quo back into a crisis, as US Civil Rights Movement organizers so ably did in the 1960s by making racial inequality, exclusion and violence more dramatically visible and more unacceptable, as well as insisting that the world could be different, that change was possible.

The fossil fuel industry through airborne particulate matter alone annually kills far more people every year than Covid-19 has in three years. Recent studies conclude that nearly 9 million people a year die from inhaling these particulates produced by burning fossil fuel. It’s only one of the many ways fossil fuel is deadly, from black lung among coal miners and cancer and respiratory problems among those near refineries to fatalities from climate-driven catastrophes such as wildfire, extreme heat and floods.

The way we befouled our water, air and land, allowed manufacturers to introduce dangerous materials – lead, PCBs, PFAs (sometimes called “forever chemicals”), dioxin, high-level radioactive waste, microplastics, pesticides and herbicides – may seem to later generations shocking, stupid and amoral. Often the deployment of these substances offered short-term and specific advantages while leaving long-term and widespread damage; often the few benefited and the many paid. But all this was normalized.

One consequence of these habits of mind is the hostile reaction to the impact of renewables. Renewables require mining; the total amount of mining they require is far less than the fossil-fuel mining that goes on all around us and has for a long time. As a scientific paper put it in 2021: “The transition from fossil fuels to renewable energy systems involves enormous decreases in materials, mining, and political risk. Since renewable systems need no fuel, they depend on trade only for the acquisition of materials and components during construction. Once the system is operating, no trade is required to sustain it. Therefore renewable energy production is not exposed to the political risks that plague fossil fuel production.” That is, you don’t have to cozy up to Russia or Saudi Arabia to keep going.

The climate movement has spent decades trying to stop one kind of extraction; I wish I could say that we could end the age of extraction altogether, but the billions of people on Earth cannot all revert to a pre-industrial state. With renewables the materials need to be extracted once and then are used for many years and are thereafter, in many cases, recyclable; with fossil fuel we burn it up as we go, so constant new interjections of coal, oil or gas are needed. They literally go up in smoke.

Battery technology is rapidly advancing, and much research on making batteries from more readily available materials than lithium is under way. Just last week came the announcement that “Volkswagen’s joint venture with JAC in China has produced the first electric car powered by the nascent sodium-ion battery technology.” So while it is urgent to pursue existing means for electrifying everything, it also seems clear that we are early in a technological revolution likely to provide new and better ways of doing what needs to be done. Or as Greta Thunberg once put it: “Avoiding climate breakdown will require cathedral thinking. We must lay the foundation while we may not know exactly how to build the ceiling.”

Obviously it matters where materials are extracted. Endangered species, significant habitat, local communities and indigenous sovereignty should be respected. They are not respected by fossil fuel extraction – just think of the gigantic festering expanse of Alberta’s tar sands, which have hugely impacted wildlife and encroached on traditional lands of several First Nations groups. As Inside Climate News put it: “Oil and gas companies like ExxonMobil and the Canadian giant Suncor have transformed Alberta’s tar sands – also called oil sands – into one of the world’s largest industrial developments. They have built sprawling waste ponds that leach heavy metals into groundwater, and processing plants that spew nitrogen and sulfur oxides into the air, sending a sour stench for miles.” To consider another example, a report in Bloomberg News stated last fall, “A roughly Taiwan-sized area of Alaska’s Arctic will be auctioned for oil and gas development …”

Astroturf organizations backed by conservatives and fossil-fuel interests have pushed false claims about health threats and organized locals against both wind turbines and solar installations. But the space they take up can be far less than that occupied by fossil fuel, and many turbines and solar panels coexist with agriculture. (Studies shows that sheep and solar panels can be mutually beneficial; elsewhere farmers adding turbines to their farms reap good income.) Bloomberg News recently published a piece mismeasuring the scale of renewables versus fossils: “A 200-megawatt wind farm, for instance, might require spreading turbines over 13 sq miles (36 sq km). A natural-gas power plant with that same generating capacity could fit onto a single city block.” But the wind farm is actually generating the energy it uses, and quite possibly coexisting with other land uses, while the gas plant depends on ceaseless mining for methane elsewhere that may permanently damage and poison the land. The way we have long operated was always destructive, and it’s now a crisis larger than any in human history. Change needs to come, swiftly, and though practical change is crucial, so are changes in imagination, perception and values. The two go together, and they always have.

the big thief!!!

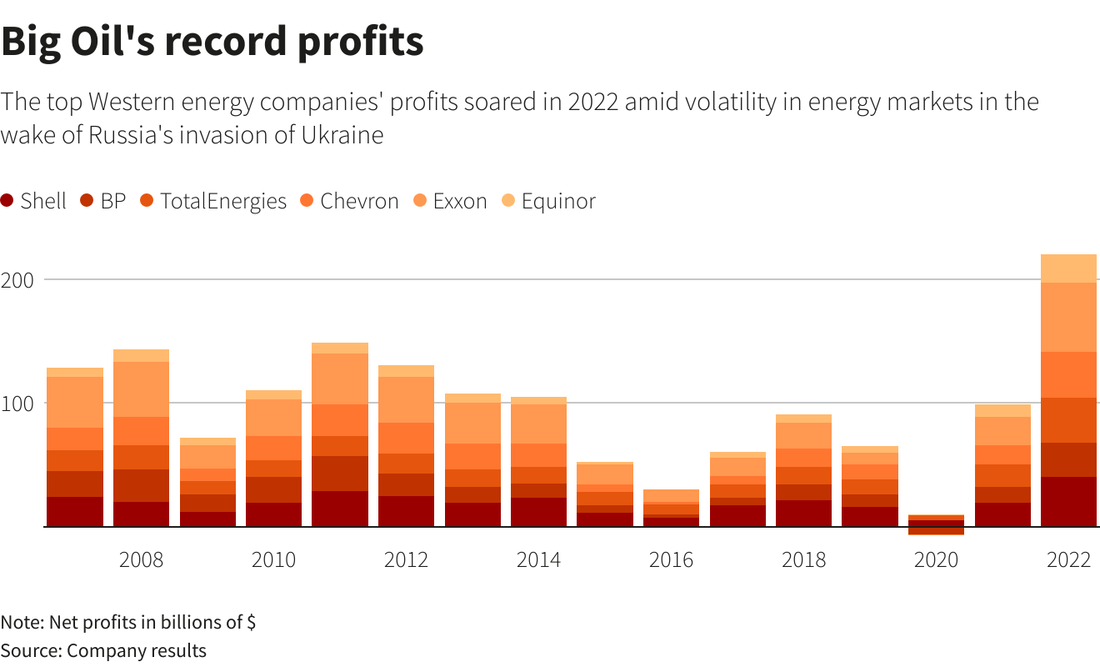

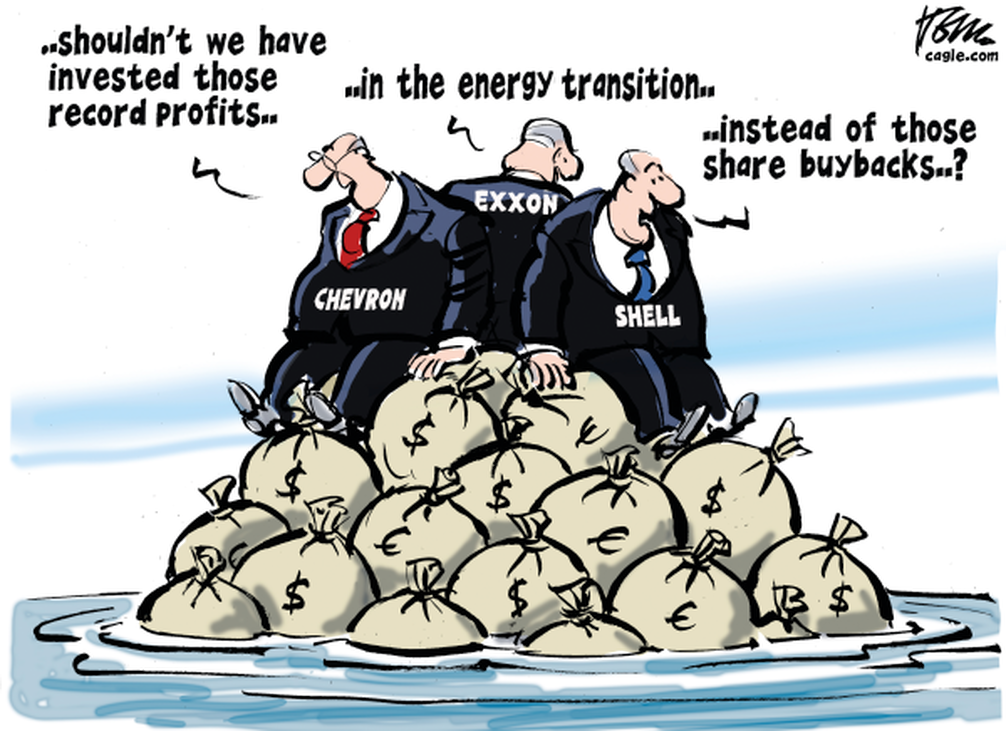

Big Oil doubles profits in blockbuster 2022

By Ron Bousso - reuters

2/8/2023

LONDON, Feb 8 (Reuters) - Big Oil more than doubled its profits in 2022 to $219 billion, smashing previous records in a year of volatile energy prices where Russia's invasion of Ukraine reshaped global energy markets and, in some cases, the industry's climate ambitions.

The profit surge gave the oil companies scope to increase spending on oil and gas projects, and a chance for some to rethink energy transition strategies to meet new demands for security of supply.

The combined $219 billion in profits allowed BP (BP.L), Chevron (CVX.N), Equinor (EQNR.OL), Exxon Mobil (XOM.N), Shell (SHEL.L) and TotalEnergies (TTEF.PA) to shower shareholders with cash.

The top Western oil companies paid out a record $110 billion in dividends and share repurchases to investors in 2022, spurring outraged calls on governments to impose windfall taxes on the industry to help consumers with surging energy costs.

Norway's Equinor on Wednesday reported a doubling of adjusted operating profit in 2022 to $74.9 billion on the back of a surge in European natural gas prices and as it became Europe's largest gas supplier after Russia's Gazprom (GAZP.MM) cut deliveries amid the West's support for Ukraine.

Oil companies last year also pulled out of Russia, a major energy producer, leading to huge writedowns, including BP's $24 billion exit from its 19.75% stake in Kremlin-controlled oil giant Rosneft (ROSN.MM).

LOW DEBT

The sharp rise in oil and gas prices, falling debt levels and the abrupt drop in Russian supplies to Europe also drove boards to increase spending on fossil fuel production as governments prioritised security of supply.

TotalEnergies Chief Executive Patrick Pouyanne said after the French company reported record profits of $36.2 billion on Wednesday that the global backdrop remained very favourable for energy companies, with the relaxing of COVID-19 measures in China pushing up demand for 2023.

"We wouldn't be surprised to see oil back to $100 a barrel," Pouyanne said. Benchmark oil prices are currently near $85 a barrel.

European companies that have outlined plans to reduce or slow oil and gas investments and build large renewables and low-carbon businesses to cut greenhouse gas emissions adjusted their strategies.

None were more stark than BP Chief Executive Bernard Looney's move to row back on plans to reduce the British company's oil and gas output and carbon emissions by 2030.

"We need lower carbon energy, but we also need secure energy, and we need affordable energy. And that's what governments and society around the world are asking for," Looney said on Tuesday.

BP's shares hit their highest in three and a half years on Wednesday, building on a 7.6% gain a day earlier following the results and shift in strategy.

Bernstein analyst Oswald Clint called BP "a lesson in pragmatism, prioritisation and performance", rating it "outperform".

"Pragmatism takes priority this week as a world short energy together with governments begging for more from companies like BP causes a response. BP will lean more into oil & gas for the remainder of this decade," Clint said in a note.

The profit surge gave the oil companies scope to increase spending on oil and gas projects, and a chance for some to rethink energy transition strategies to meet new demands for security of supply.

The combined $219 billion in profits allowed BP (BP.L), Chevron (CVX.N), Equinor (EQNR.OL), Exxon Mobil (XOM.N), Shell (SHEL.L) and TotalEnergies (TTEF.PA) to shower shareholders with cash.

The top Western oil companies paid out a record $110 billion in dividends and share repurchases to investors in 2022, spurring outraged calls on governments to impose windfall taxes on the industry to help consumers with surging energy costs.

Norway's Equinor on Wednesday reported a doubling of adjusted operating profit in 2022 to $74.9 billion on the back of a surge in European natural gas prices and as it became Europe's largest gas supplier after Russia's Gazprom (GAZP.MM) cut deliveries amid the West's support for Ukraine.

Oil companies last year also pulled out of Russia, a major energy producer, leading to huge writedowns, including BP's $24 billion exit from its 19.75% stake in Kremlin-controlled oil giant Rosneft (ROSN.MM).

LOW DEBT

The sharp rise in oil and gas prices, falling debt levels and the abrupt drop in Russian supplies to Europe also drove boards to increase spending on fossil fuel production as governments prioritised security of supply.

TotalEnergies Chief Executive Patrick Pouyanne said after the French company reported record profits of $36.2 billion on Wednesday that the global backdrop remained very favourable for energy companies, with the relaxing of COVID-19 measures in China pushing up demand for 2023.

"We wouldn't be surprised to see oil back to $100 a barrel," Pouyanne said. Benchmark oil prices are currently near $85 a barrel.

European companies that have outlined plans to reduce or slow oil and gas investments and build large renewables and low-carbon businesses to cut greenhouse gas emissions adjusted their strategies.

None were more stark than BP Chief Executive Bernard Looney's move to row back on plans to reduce the British company's oil and gas output and carbon emissions by 2030.

"We need lower carbon energy, but we also need secure energy, and we need affordable energy. And that's what governments and society around the world are asking for," Looney said on Tuesday.

BP's shares hit their highest in three and a half years on Wednesday, building on a 7.6% gain a day earlier following the results and shift in strategy.

Bernstein analyst Oswald Clint called BP "a lesson in pragmatism, prioritisation and performance", rating it "outperform".

"Pragmatism takes priority this week as a world short energy together with governments begging for more from companies like BP causes a response. BP will lean more into oil & gas for the remainder of this decade," Clint said in a note.

Internal Documents Reveal Big Oil’s Plan for Profiting Amid Climate Pressures

The largest oil and gas companies are leveraging the climate crisis to further entrench their domination of energy markets.

By Mike Ludwig , TRUTHOUT

PublishedDecember 14, 2022

Democrats on the House Oversight Committee recently released internal fuel company documents providing an insider’s view of what they say is a multi-year effort by four leading fossil fuel firms to greenwash their public image. The documents show employees and executives discussing climate policies and pledges they knew would do more to protect their business model than secure a meaningful reduction in pollution.

At first glance, the committee’s accompanying report on the climate disinformation is a partisan project and somewhat unsurprising given the fossil fuel industry’s history of misleading the public. However, a closer look reveals that the largest oil and gas companies are leveraging the climate crisis to further entrench their domination of energy markets across the world. The documents raise thorny questions for climate-minded Democrats, who found that industry groups will support liberal climate priorities such as methane regulation if that keeps oil and gas relevant and protects profits in the long run. Oil companies also “resist and block” environmental rules for pollution control they don’t like, as one employee of BP America observed in a 2016 email to executives obtained by the committee.

Democrats say Shell, BP, Chevron and Exxon sell a climate-friendly image that obscures their failure to make meaningful investments in the transition to cleaner energy despite blockbuster profits. Their report is the result of a months-long investigation and bitter wrangling over subpoenas seeking internal company documents.

Fossil fuel executives say one thing in public and another behind closed doors, according to House Democrats, who accused the companies of withholding information from the committee. While energy firms make public commitments to reduce emissions and divest from fossil fuels, the industry’s major players are moving aggressively to build new infrastructure and influence public policy in order to lock in oil and gas production for decades.

“The cynicism was breathtaking, and unfortunately, it was quite successful,” said Rep. Ro Khanna, a progressive Democrat from California, on NBC News. “It’s been a successful PR strategy.”

For Democrats, the report and release of internal company communications was one last chance to hold Big Oil accountable before the Republican majority takes over next month. Not a single Republican signed onto the report, which GOP lawmakers dismissed as partisan theatrics. Democrats called it “explosive.”

Among the revelations: Executives at Shell and BP admitted privately that plans to divest oil and gas assets might lower an individual company’s emissions but would not reduce emissions globally, because smaller companies are likely to buy them and continue extracting fossil fuels. In one email, a BP executive said divesting is an “important part of our strategy” for meeting climate commitments but cautioned that “these divestments may not directly lead to a reduction in absolute global emissions.”

“What exactly are we supposed to do instead of divesting,” wrote a Shell executive in an internal company email. “Pour concrete over the oil sands and burn the deed to the land so no one can buy them?”

“For the oil and gas industry, delay and distraction are the new denial,” said Anusha Narayanan, climate campaign director at Greenpeace USA, in a statement Monday. “The House Oversight Committee report shows that Exxon, Chevron, Shell, and BP continue their decades-long campaign of roadblocking true, science-based climate solutions that address the damage they are doing to our health and the destruction of the planet.”

The oil and gas industry disagrees. Megan Bloomgren, senior vice president of the American Petroleum Institute, said her industry is focused on both providing affordable energy and “tackling” climate change, and “any allegations to the contrary are false.”

“The U.S. natural gas and oil industry has contributed to the significant progress the U.S. has made in reducing America’s CO2 emissions to near generational lows with the increased use of natural gas,” Bloomgren told Truthout in an email.

However, methane emissions from the industry’s fracking boom are now a major greenhouse gas concern. API represents around 600 U.S. companies that extract and process oil and gas, and appears multiple times in the oversight committee’s report. In a March 2021 memorandum to API’s board, CEO Mike Sommers explained that API strategically supports limited regulations to reduce methane pollution from fracking, which provides “an opportunity to further secure the industry’s license to operate.” Democrats seized on “license to operate,” arguing that API’s support for mitigating methane from oil and gas wells, which is regularly “flared” or burned into the open air, is “intended to secure social acceptance for the continued production of fossil fuels.”

According to Democrats, this amounts to doing the right thing for the wrong reason, and that’s misleading to the public. API included methane regulations in a “climate action framework” now published on the group’s website, part of a broader push by the industry to keep a seat at the climate policy table. The Environmental Protection Agency has been developing regulations to reduce methane and other pollution since the Biden administration took over, and the industry likely sees the writing on the wall. Fracking for natural gas has helped lower carbon dioxide emissions by replacing coal, but methane in the Earth’s atmosphere has spiked to alarming levels at a result. Methane is a far more potent greenhouse gas than carbon dioxide, and its impacts do not take centuries to appear. Environmentalists argue this essentially cancels the progress made on carbon.

“Big Oil doesn’t want the public to know that efforts to reduce emissions without phasing out oil and gas production are not enough to keep our planet livable,” Narayanan said.

Still, a major industry group has come out in support of sweeping pollution regulations that Democrats and environmentalists championed for years. House Democrats argue API’s support of certain regulations is politically convenient, but there are reasons to rally the industry behind the rules besides public relations. Like API, a certain sector of the industry — particularly large companies such as Shell and BP — also support the rules, which require investments in new infrastructure to trap and process methane instead of venting into the air. Wealthy companies can absorb the costs much more easily than smaller competitors, who are much more likely to oppose the rules. An internal presentation for Chevron’s Board of Directors from July 2021 noted that “traditional energy business competitors are retreating” and the company should take advantage of market “consolidation,” according to the report.

Despite public assurances that natural gas is a “bridge fuel” between coal and renewables, Democrats say the big four fossil fuel companies have privately doubled down on long-term reliance on fossil fuels. The United States and other wealthy countries have pledged to reach net zero greenhouse gas emissions by 2050, which requires a steep decline in fossil fuel use, but the largest companies will not stop drilling for oil and gas on their own.

“Even though Big Oil CEOs admitted to my committee that their products are causing a climate emergency, today’s documents reveal that the industry has no real plans to clean up its act and is barreling ahead with plans to pump more dirty fuels for decades to come,” said Oversight Committee Chairwoman Rep. Carolyn B. Maloney in a statement.

Bloomgren, on the other hand, said the American Petroleum Institute will continue to work with lawmakers on both sides of the aisle to reduce climate-warming pollution.

The oil and gas industry, of course, is a dominant source of that pollution. Behind closed doors, executives wagered that agreeing to reduce at least some emissions will secure the social and political “license” to keep drilling.

At first glance, the committee’s accompanying report on the climate disinformation is a partisan project and somewhat unsurprising given the fossil fuel industry’s history of misleading the public. However, a closer look reveals that the largest oil and gas companies are leveraging the climate crisis to further entrench their domination of energy markets across the world. The documents raise thorny questions for climate-minded Democrats, who found that industry groups will support liberal climate priorities such as methane regulation if that keeps oil and gas relevant and protects profits in the long run. Oil companies also “resist and block” environmental rules for pollution control they don’t like, as one employee of BP America observed in a 2016 email to executives obtained by the committee.

Democrats say Shell, BP, Chevron and Exxon sell a climate-friendly image that obscures their failure to make meaningful investments in the transition to cleaner energy despite blockbuster profits. Their report is the result of a months-long investigation and bitter wrangling over subpoenas seeking internal company documents.

Fossil fuel executives say one thing in public and another behind closed doors, according to House Democrats, who accused the companies of withholding information from the committee. While energy firms make public commitments to reduce emissions and divest from fossil fuels, the industry’s major players are moving aggressively to build new infrastructure and influence public policy in order to lock in oil and gas production for decades.

“The cynicism was breathtaking, and unfortunately, it was quite successful,” said Rep. Ro Khanna, a progressive Democrat from California, on NBC News. “It’s been a successful PR strategy.”

For Democrats, the report and release of internal company communications was one last chance to hold Big Oil accountable before the Republican majority takes over next month. Not a single Republican signed onto the report, which GOP lawmakers dismissed as partisan theatrics. Democrats called it “explosive.”

Among the revelations: Executives at Shell and BP admitted privately that plans to divest oil and gas assets might lower an individual company’s emissions but would not reduce emissions globally, because smaller companies are likely to buy them and continue extracting fossil fuels. In one email, a BP executive said divesting is an “important part of our strategy” for meeting climate commitments but cautioned that “these divestments may not directly lead to a reduction in absolute global emissions.”

“What exactly are we supposed to do instead of divesting,” wrote a Shell executive in an internal company email. “Pour concrete over the oil sands and burn the deed to the land so no one can buy them?”

“For the oil and gas industry, delay and distraction are the new denial,” said Anusha Narayanan, climate campaign director at Greenpeace USA, in a statement Monday. “The House Oversight Committee report shows that Exxon, Chevron, Shell, and BP continue their decades-long campaign of roadblocking true, science-based climate solutions that address the damage they are doing to our health and the destruction of the planet.”

The oil and gas industry disagrees. Megan Bloomgren, senior vice president of the American Petroleum Institute, said her industry is focused on both providing affordable energy and “tackling” climate change, and “any allegations to the contrary are false.”

“The U.S. natural gas and oil industry has contributed to the significant progress the U.S. has made in reducing America’s CO2 emissions to near generational lows with the increased use of natural gas,” Bloomgren told Truthout in an email.

However, methane emissions from the industry’s fracking boom are now a major greenhouse gas concern. API represents around 600 U.S. companies that extract and process oil and gas, and appears multiple times in the oversight committee’s report. In a March 2021 memorandum to API’s board, CEO Mike Sommers explained that API strategically supports limited regulations to reduce methane pollution from fracking, which provides “an opportunity to further secure the industry’s license to operate.” Democrats seized on “license to operate,” arguing that API’s support for mitigating methane from oil and gas wells, which is regularly “flared” or burned into the open air, is “intended to secure social acceptance for the continued production of fossil fuels.”

According to Democrats, this amounts to doing the right thing for the wrong reason, and that’s misleading to the public. API included methane regulations in a “climate action framework” now published on the group’s website, part of a broader push by the industry to keep a seat at the climate policy table. The Environmental Protection Agency has been developing regulations to reduce methane and other pollution since the Biden administration took over, and the industry likely sees the writing on the wall. Fracking for natural gas has helped lower carbon dioxide emissions by replacing coal, but methane in the Earth’s atmosphere has spiked to alarming levels at a result. Methane is a far more potent greenhouse gas than carbon dioxide, and its impacts do not take centuries to appear. Environmentalists argue this essentially cancels the progress made on carbon.

“Big Oil doesn’t want the public to know that efforts to reduce emissions without phasing out oil and gas production are not enough to keep our planet livable,” Narayanan said.

Still, a major industry group has come out in support of sweeping pollution regulations that Democrats and environmentalists championed for years. House Democrats argue API’s support of certain regulations is politically convenient, but there are reasons to rally the industry behind the rules besides public relations. Like API, a certain sector of the industry — particularly large companies such as Shell and BP — also support the rules, which require investments in new infrastructure to trap and process methane instead of venting into the air. Wealthy companies can absorb the costs much more easily than smaller competitors, who are much more likely to oppose the rules. An internal presentation for Chevron’s Board of Directors from July 2021 noted that “traditional energy business competitors are retreating” and the company should take advantage of market “consolidation,” according to the report.

Despite public assurances that natural gas is a “bridge fuel” between coal and renewables, Democrats say the big four fossil fuel companies have privately doubled down on long-term reliance on fossil fuels. The United States and other wealthy countries have pledged to reach net zero greenhouse gas emissions by 2050, which requires a steep decline in fossil fuel use, but the largest companies will not stop drilling for oil and gas on their own.

“Even though Big Oil CEOs admitted to my committee that their products are causing a climate emergency, today’s documents reveal that the industry has no real plans to clean up its act and is barreling ahead with plans to pump more dirty fuels for decades to come,” said Oversight Committee Chairwoman Rep. Carolyn B. Maloney in a statement.

Bloomgren, on the other hand, said the American Petroleum Institute will continue to work with lawmakers on both sides of the aisle to reduce climate-warming pollution.

The oil and gas industry, of course, is a dominant source of that pollution. Behind closed doors, executives wagered that agreeing to reduce at least some emissions will secure the social and political “license” to keep drilling.

Customers Shiver As Energy Giants Reap $14 Billion In Profits

That's fourteen billion with a B.

Common Dreams — crooks & liars

December 13, 2022

With colder winter weather looming, a new analysis released Tuesday shows that the nine largest energy utility companies in the U.S. raked in nearly $14 billion in combined profits during the first three quarters of this year—and dished out roughly $11 billion to their wealthy shareholders—as tens of millions of U.S. households struggled to pay their utility bills due to soaring costs.

The watchdog group Accountable.US found that NextEra Energy, Duke Energy, Southern Company, Dominion Energy, Constellation Energy, Eversource Energy, Entergy Corporation, DTE Energy, and CMS Energy Corporation brought in $13.8 billion in the first nine months of this fiscal year. The firms, the nine largest in the U.S. by market capitalization, returned over $11.2 billion to shareholders during that period in the form of dividends and stock buybacks.

The utility giants' massive profits have come at a cost to U.S. households, roughly 20 million of which are behind on their utility payments as providers continue to raise rates across the U.S., pushing home energy costs to unaffordable levels and prompting warnings of a "tsunami of shutoffs."

The Center for Biological Diversity recently estimated that utilities have shut off households' power 440,000 times across 15 states that have made their rates publicly available, a large increase from last year.

"Well-heeled utility company CEOs are holding consumers' feet to the fire with exorbitant energy prices," Liz Zelnick, director of Accountable.US' Economic Security and Corporate Power program, said in a statement Tuesday. "Not because they have to, judging by their own high profits and generous giveaways to wealthy investors—but because they can with colder weather on the horizon."

"To prey on families who use a necessary service with unreasonable and unjustified rate hikes is corporate greed at its worst," Zelnick added.

The Accountable.US analysis shows that the same large utility companies raking in huge profits and paying their executives massive pay packages are driving price increases nationwide.

Southern Company's Georgia subsidiary, for instance, "had a near-12% rate hike approved in June 2022—and in August 2022, its Tennessee subsidiary was granted a rate hike that would result in typical monthly home heating bills rising by about 25%," the analysis notes.

NBC News reported in October that "nationwide, investor-owned utilities have requested rate increases amounting to nearly $12 billion from the beginning of the year through the end of August."

Zelnick argued that utility giants' price hikes are part of a broader trend of corporate price-gouging, a practice that companies frequently excuse by pointing to higher overall inflation throughout the economy.

NBC News reported in October that "nationwide, investor-owned utilities have requested rate increases amounting to nearly $12 billion from the beginning of the year through the end of August."

Zelnick argued that utility giants' price hikes are part of a broader trend of corporate price-gouging, a practice that companies frequently excuse by pointing to higher overall inflation throughout the economy.

"Like so many other industries during the pandemic, utility companies have chased higher and higher profits and enriched investors rather than keep prices stable for working families," said Zelnick. "While the economy is seeing signs of slowing inflation, it is clear corporate greed continues to be a primary driver of high costs on everything from groceries to heating bills—a problem that won't be solved by the Fed's one-track-minded policy of excessive interest rate hikes that threaten millions of jobs."

Utility firms' greedy behavior throughout the coronavirus pandemic has drawn the attention of progressive lawmakers such as Reps. Cori Bush (D-Mo.), Rashida Tlaib (D-Mich.), and Jamaal Bowman (D-N.Y.), who in September introduced a resolution that would recognize access to utilities such as electricity and heating as a basic human right.

The Resolution Recognizing the Human Rights to Utilities has not yet received a vote.

"Utilities are the foundation we build our lives upon," Tlaib said in a statement upon introduction of the measure. "In the richest country the world has ever known, it is an outrage that millions of Americans struggle with utility insecurity, substandard and dangerous services, and inhumane shutoffs."

"It's time to change the conversation around what we all deserve, take the profit motive out of providing the basics of a good life, and give every American the opportunity to thrive," Tlaib added.

The watchdog group Accountable.US found that NextEra Energy, Duke Energy, Southern Company, Dominion Energy, Constellation Energy, Eversource Energy, Entergy Corporation, DTE Energy, and CMS Energy Corporation brought in $13.8 billion in the first nine months of this fiscal year. The firms, the nine largest in the U.S. by market capitalization, returned over $11.2 billion to shareholders during that period in the form of dividends and stock buybacks.

The utility giants' massive profits have come at a cost to U.S. households, roughly 20 million of which are behind on their utility payments as providers continue to raise rates across the U.S., pushing home energy costs to unaffordable levels and prompting warnings of a "tsunami of shutoffs."

The Center for Biological Diversity recently estimated that utilities have shut off households' power 440,000 times across 15 states that have made their rates publicly available, a large increase from last year.

"Well-heeled utility company CEOs are holding consumers' feet to the fire with exorbitant energy prices," Liz Zelnick, director of Accountable.US' Economic Security and Corporate Power program, said in a statement Tuesday. "Not because they have to, judging by their own high profits and generous giveaways to wealthy investors—but because they can with colder weather on the horizon."

"To prey on families who use a necessary service with unreasonable and unjustified rate hikes is corporate greed at its worst," Zelnick added.

The Accountable.US analysis shows that the same large utility companies raking in huge profits and paying their executives massive pay packages are driving price increases nationwide.

Southern Company's Georgia subsidiary, for instance, "had a near-12% rate hike approved in June 2022—and in August 2022, its Tennessee subsidiary was granted a rate hike that would result in typical monthly home heating bills rising by about 25%," the analysis notes.

NBC News reported in October that "nationwide, investor-owned utilities have requested rate increases amounting to nearly $12 billion from the beginning of the year through the end of August."

Zelnick argued that utility giants' price hikes are part of a broader trend of corporate price-gouging, a practice that companies frequently excuse by pointing to higher overall inflation throughout the economy.

NBC News reported in October that "nationwide, investor-owned utilities have requested rate increases amounting to nearly $12 billion from the beginning of the year through the end of August."

Zelnick argued that utility giants' price hikes are part of a broader trend of corporate price-gouging, a practice that companies frequently excuse by pointing to higher overall inflation throughout the economy.

"Like so many other industries during the pandemic, utility companies have chased higher and higher profits and enriched investors rather than keep prices stable for working families," said Zelnick. "While the economy is seeing signs of slowing inflation, it is clear corporate greed continues to be a primary driver of high costs on everything from groceries to heating bills—a problem that won't be solved by the Fed's one-track-minded policy of excessive interest rate hikes that threaten millions of jobs."

Utility firms' greedy behavior throughout the coronavirus pandemic has drawn the attention of progressive lawmakers such as Reps. Cori Bush (D-Mo.), Rashida Tlaib (D-Mich.), and Jamaal Bowman (D-N.Y.), who in September introduced a resolution that would recognize access to utilities such as electricity and heating as a basic human right.

The Resolution Recognizing the Human Rights to Utilities has not yet received a vote.

"Utilities are the foundation we build our lives upon," Tlaib said in a statement upon introduction of the measure. "In the richest country the world has ever known, it is an outrage that millions of Americans struggle with utility insecurity, substandard and dangerous services, and inhumane shutoffs."

"It's time to change the conversation around what we all deserve, take the profit motive out of providing the basics of a good life, and give every American the opportunity to thrive," Tlaib added.

Oil company profits boom as Americans reel from high fuel prices

ExxonMobil posts second-quarter profits of $17.85bn – four times last year’s figure – with Chevron making $11.62bn

Dominic Rushe in New York - the guardian

Fri 29 Jul 2022 11.44 EDT

The US’s biggest oil companies pumped out record profits over the last few months as Americans struggled to pay for gasoline, food and other basic necessities.

On Friday, ExxonMobil reported an unprecedented $17.85bn (£14.77bn) profit for the second quarter, nearly four times as much as the same period a year ago, and Chevron made a record $11.62bn (£9.61bn). The sky-high profits come one day after the UK’s Shell shattered its own profit record.

Soaring energy prices have rattled consumers and become a political flashpoint. “We’re going to make sure everybody knows Exxon’s profits,” Joe Biden said in June. “Exxon made more money than God this year.”

The record profits came after similarly outsized gains in the first quarter when the largest oil companies made close to $100bn in profits.

High energy prices are one of the major factors driving inflation to a four-decade high in the US. Gas prices have fallen slightly in recent weeks but are now averaging $4.25 a gallon across the US, more than $1 a gallon higher than a year ago.

Consumers are facing high fuel prices not just at the pump. Soaring energy prices are being baked into delivery costs, which is driving up the cost of everything from apples to toilet paper.

One reason gasoline prices have been so high is that fewer refineries are operating in the US than before the pandemic, so there is a limit to how much gasoline can be produced.

Biden has called for the companies to increase production and refining capacities in an attempt to bring down prices. On Friday Exxon said it was expanding refinery and production in Texas and New Mexico.

Exxon, based in Irving, Texas, increased its oil and gas production as crude prices hovered above $100 a barrel. Revenue at Exxon soared to $115.68bn, up from $67.74bn during the same quarter last year.

Natural gas and liquefied natural gas (LNG) prices are also elevated due to Russia’s invasion of Ukraine and ensuing sanctions against Russia, a major supplier of natural gas. Many European nations have been scrambling for alternatives to Russian natural gas, and have been competing for boatloads of LNG, driving up prices for natural gas globally and in the US.

In addition to oil company executives, shareholders also reaped the benefits of high energy prices during the quarter. Since the start of 2022, Exxon and Chevron shares have risen close to 46% and 26%, respectively.

Exxon’s CEO, Darren Woods, attributed the company’s success to its investments in oil and gas fields in Guyana and the Permian Basin, as well as its investments in liquefied natural gas, which has been in high demand globally.

“We’re also helping meet increased demand by expanding our refining capacity by about 250,000 barrels per day in the first quarter of 2023 – representing the industry’s largest single capacity addition in the US since 2012,” Woods said in a prepared statement.

Chevron’s chief executive officer, Mike Wirth, sought to tamp down criticism that the company was profiteering at the expense of consumers.

“We more than doubled investment compared to last year to grow both traditional and new energy business lines,” Wirth said in the statement. “Chevron is increasing energy supplies to help meet the challenges facing global markets,” he said.

Exxon and Chevron’s bumper profits come a day after Shell posted record earnings of $11.4bn (nearly £10bn) for the three-month period from April to June.

Frances O’Grady, the general secretary of Britain’s Trades Union Congress, called the “eye-watering profits” “an insult to the millions of working people struggling to get by because of soaring energy bills.

“Working people are facing the longest and harshest wage squeeze in modern history. It’s time working people got their fair share of the wealth they create, starting with real action to bring bills down,” said O’Grady.

On Friday, ExxonMobil reported an unprecedented $17.85bn (£14.77bn) profit for the second quarter, nearly four times as much as the same period a year ago, and Chevron made a record $11.62bn (£9.61bn). The sky-high profits come one day after the UK’s Shell shattered its own profit record.

Soaring energy prices have rattled consumers and become a political flashpoint. “We’re going to make sure everybody knows Exxon’s profits,” Joe Biden said in June. “Exxon made more money than God this year.”

The record profits came after similarly outsized gains in the first quarter when the largest oil companies made close to $100bn in profits.

High energy prices are one of the major factors driving inflation to a four-decade high in the US. Gas prices have fallen slightly in recent weeks but are now averaging $4.25 a gallon across the US, more than $1 a gallon higher than a year ago.

Consumers are facing high fuel prices not just at the pump. Soaring energy prices are being baked into delivery costs, which is driving up the cost of everything from apples to toilet paper.

One reason gasoline prices have been so high is that fewer refineries are operating in the US than before the pandemic, so there is a limit to how much gasoline can be produced.

Biden has called for the companies to increase production and refining capacities in an attempt to bring down prices. On Friday Exxon said it was expanding refinery and production in Texas and New Mexico.

Exxon, based in Irving, Texas, increased its oil and gas production as crude prices hovered above $100 a barrel. Revenue at Exxon soared to $115.68bn, up from $67.74bn during the same quarter last year.

Natural gas and liquefied natural gas (LNG) prices are also elevated due to Russia’s invasion of Ukraine and ensuing sanctions against Russia, a major supplier of natural gas. Many European nations have been scrambling for alternatives to Russian natural gas, and have been competing for boatloads of LNG, driving up prices for natural gas globally and in the US.

In addition to oil company executives, shareholders also reaped the benefits of high energy prices during the quarter. Since the start of 2022, Exxon and Chevron shares have risen close to 46% and 26%, respectively.

Exxon’s CEO, Darren Woods, attributed the company’s success to its investments in oil and gas fields in Guyana and the Permian Basin, as well as its investments in liquefied natural gas, which has been in high demand globally.

“We’re also helping meet increased demand by expanding our refining capacity by about 250,000 barrels per day in the first quarter of 2023 – representing the industry’s largest single capacity addition in the US since 2012,” Woods said in a prepared statement.

Chevron’s chief executive officer, Mike Wirth, sought to tamp down criticism that the company was profiteering at the expense of consumers.

“We more than doubled investment compared to last year to grow both traditional and new energy business lines,” Wirth said in the statement. “Chevron is increasing energy supplies to help meet the challenges facing global markets,” he said.

Exxon and Chevron’s bumper profits come a day after Shell posted record earnings of $11.4bn (nearly £10bn) for the three-month period from April to June.

Frances O’Grady, the general secretary of Britain’s Trades Union Congress, called the “eye-watering profits” “an insult to the millions of working people struggling to get by because of soaring energy bills.

“Working people are facing the longest and harshest wage squeeze in modern history. It’s time working people got their fair share of the wealth they create, starting with real action to bring bills down,” said O’Grady.

US Oil Firms Set to Reap Up to $126 Billion in Extra Profits Amid War on Ukraine

BY Jake Johnson, Common Dreams

PUBLISHED March 29, 2022

A new analysis released Tuesday estimates that U.S. oil and gas corporations are poised to rake in windfall profits of up to $126 billion this year as they exploit Russia’s deadly assault on Ukraine to raise prices at the pump.

Conducted by Oil Change International, Greenpeace USA, and Global Witness, the analysis uses a database that tracks the fossil fuel industry’s production economics to assess how much money the industry is set to make as a result of high global oil prices.

“Under conservative estimates, we find the U.S. upstream oil and gas industry will collect a windfall of $37 to $126 billion in 2022 alone,” the groups’ report states.

The higher-end profit estimate is dependent on oil prices spiking to $120 per barrel this summer and remaining elevated as the West moves to restrict Russian oil imports — a major opportunity for U.S. fossil fuel companies, particularly as the Biden administration looks to ramp up gas exports to Europe.

If oil prices average $88 per barrel, the new analysis finds, the U.S. oil and gas industry would reap $37 billion in additional profits in 2022.

The report notes that the top beneficiaries of the windfall would be industry giants ConocoPhillips, Chevron, Occidental Petroleum, and ExxonMobil.

“It is unconscionable that U.S. upstream companies like Chevron, Occidental, and ExxonMobil, who receive federal tax subsidies totaling millions of dollars every year, are now set to make billions of dollars more from these high wartime gas prices,” Tim Donaghy, the research manager at Greenpeace USA, said in a statement Tuesday.

“American consumers don’t get a break from high prices just because we drill more here at home,” added Donaghy. “Instead, we get more air and water pollution and higher public health risks. The only way to achieve true energy independence is to cut our ties with fossil fuels entirely.”

Collin Rees, the U.S. program manager at Oil Change International, argued that the new findings bolster the case for a windfall profits tax of the kind congressional Democrats introduced earlier this month.

“From lobbying against climate solutions to actively spreading misinformation, the oil and gas industry has spent decades doing everything in its power to deepen our dependence on dirty fossil fuels,” said Rees. “Now, Big Oil and Gas executives are rolling in cash while working families suffer.”

“It’s high time for Congress to pass a windfall profits tax and prevent the fossil fuel industry from harnessing a war to make billions,” Rees continued. “This can be a clear step toward a fossil-free future if paired with real investments in a renewable energy future.”

The Big Oil Windfall Profits Tax, led by Rep. Ro Khanna (D-Calif.) in the House and Sen. Sheldon Whitehouse (D-R.I.) in the Senate, would hit large fossil fuel companies with a quarterly tax equal to 50% of the difference between the current per-barrel price of oil and the average pre-pandemic price between 2015 and 2019.

“At $120 per barrel of oil, the levy would raise approximately $45 billion per year,” according to a summary released by Khanna’s office. The bill would use the new revenue to pay out a quarterly rebate to consumers.

A recent survey by the League of Conservation Voters found that 80% of U.S. voters — including 73% of Republicans — would support “placing a windfall profits tax on the extra profits oil companies are making from the higher gasoline prices they are charging because of the Russia-Ukraine situation.”

Cassidy DiPaola, a spokesperson for the Stop the Oil Profiteering campaign at Fossil Free Media, said Tuesday that “while Americans are struggling to keep up with high prices at the pump and on their utility bills, Big Oil is profiting off of the war in Ukraine, driving up gas prices and raking in record profits.”

“Fortunately, there’s a simple way to stop this profiteering: put a tax on the excess profits oil companies are making because of this crisis and use the money to send a check to the people who need it,” said DiPaola. “Making Big Oil pay for their greedy war profiteering is a win-win for our families and the climate.”

Conducted by Oil Change International, Greenpeace USA, and Global Witness, the analysis uses a database that tracks the fossil fuel industry’s production economics to assess how much money the industry is set to make as a result of high global oil prices.

“Under conservative estimates, we find the U.S. upstream oil and gas industry will collect a windfall of $37 to $126 billion in 2022 alone,” the groups’ report states.

The higher-end profit estimate is dependent on oil prices spiking to $120 per barrel this summer and remaining elevated as the West moves to restrict Russian oil imports — a major opportunity for U.S. fossil fuel companies, particularly as the Biden administration looks to ramp up gas exports to Europe.

If oil prices average $88 per barrel, the new analysis finds, the U.S. oil and gas industry would reap $37 billion in additional profits in 2022.

The report notes that the top beneficiaries of the windfall would be industry giants ConocoPhillips, Chevron, Occidental Petroleum, and ExxonMobil.

“It is unconscionable that U.S. upstream companies like Chevron, Occidental, and ExxonMobil, who receive federal tax subsidies totaling millions of dollars every year, are now set to make billions of dollars more from these high wartime gas prices,” Tim Donaghy, the research manager at Greenpeace USA, said in a statement Tuesday.

“American consumers don’t get a break from high prices just because we drill more here at home,” added Donaghy. “Instead, we get more air and water pollution and higher public health risks. The only way to achieve true energy independence is to cut our ties with fossil fuels entirely.”

Collin Rees, the U.S. program manager at Oil Change International, argued that the new findings bolster the case for a windfall profits tax of the kind congressional Democrats introduced earlier this month.

“From lobbying against climate solutions to actively spreading misinformation, the oil and gas industry has spent decades doing everything in its power to deepen our dependence on dirty fossil fuels,” said Rees. “Now, Big Oil and Gas executives are rolling in cash while working families suffer.”

“It’s high time for Congress to pass a windfall profits tax and prevent the fossil fuel industry from harnessing a war to make billions,” Rees continued. “This can be a clear step toward a fossil-free future if paired with real investments in a renewable energy future.”

The Big Oil Windfall Profits Tax, led by Rep. Ro Khanna (D-Calif.) in the House and Sen. Sheldon Whitehouse (D-R.I.) in the Senate, would hit large fossil fuel companies with a quarterly tax equal to 50% of the difference between the current per-barrel price of oil and the average pre-pandemic price between 2015 and 2019.

“At $120 per barrel of oil, the levy would raise approximately $45 billion per year,” according to a summary released by Khanna’s office. The bill would use the new revenue to pay out a quarterly rebate to consumers.

A recent survey by the League of Conservation Voters found that 80% of U.S. voters — including 73% of Republicans — would support “placing a windfall profits tax on the extra profits oil companies are making from the higher gasoline prices they are charging because of the Russia-Ukraine situation.”

Cassidy DiPaola, a spokesperson for the Stop the Oil Profiteering campaign at Fossil Free Media, said Tuesday that “while Americans are struggling to keep up with high prices at the pump and on their utility bills, Big Oil is profiting off of the war in Ukraine, driving up gas prices and raking in record profits.”

“Fortunately, there’s a simple way to stop this profiteering: put a tax on the excess profits oil companies are making because of this crisis and use the money to send a check to the people who need it,” said DiPaola. “Making Big Oil pay for their greedy war profiteering is a win-win for our families and the climate.”

The Fossil Fuel Industry Doesn't Create Nearly as Many Jobs as it Says It Does

The industry is wildly fudging the numbers to make itself look like a major job creator. We shouldn’t be fooled.

WENONAH HAUTER - in these times

FEBRUARY 14, 2022

For years now, any discussion about climate action or the need to move off fossil fuels has run headlong into a familiar quandary: The industries fueling the climate crisis create good jobs, often in areas of the country where finding work that can support a family is incredibly difficult.

This leaves activists gesturing towards well-intentioned goals like a “just transition,” a promise that likely rings hollow for workers and many labor unions because it’s hard to see where this has actually happened — even though, by every measure, we need to create some real policies that turn this vision into reality. While there are encouraging examples of labor unions throwing their support behind robust climate plans, it has proven difficult for the climate movement to find its way out of the jobs versus environment framing.

But that is especially true when we refuse to question the original premise. The truth is that the fossil fuel industry wildly inflates its employment record, and the recent data show they are producing more fuel with fewer workers. Instead of avoiding this reality, perhaps it is time to tackle it head on. Dirty energy corporations are not creating jobs as much as they are cutting them these days, and that provides an opening to envision the kinds of employment — in areas like orphaned well clean up and energy efficiency — that will provide employment for the thousands of workers the industry is no longer employing.

Some of the most common jobs estimates are produced by the American Petroleum Institute (API), the powerful oil and gas trade association. Over the years, API has released reports claiming that the domestic fracking industry creates somewhere between 2.5 million to 11 million jobs, both directly and indirectly. These numbers — or versions of them — are floated in political debates and in the media, but they are significantly out of step with other estimates, including the federal government’s labor reports. Food & Water Watch, an organization I founded, created a more accurate model that relies on direct jobs and relevant support activities, including pipeline construction and product transportation. The total comes to just over 500,000 in 2020, or about 0.4 percent of all jobs in the country.

How to explain the massive gap between industry propaganda and reality? The API figures include a range of employment categories; in addition to direct industry employment, they add indirect jobs (those within a supply chain) and induced jobs (those that are supposedly ‘supported’ by direct and indirect jobs). These categories make up the vast majority of their total. Convenience store workers, for example — working where gas happens to be sold — make up almost 35 percent of the industry’s supposed employment record.

These wildly inaccurate figures can form the basis for tired debates pitting “jobs versus the environment,” which remain politically potent. In 2020, when all eyes were fixed on Pennsylvania’s 20 electoral votes, Donald Trump made campaign stops in the state declaring that Joe Biden would kill hundreds of thousands of fracking jobs. (Biden, of course, countered by saying that he had no such intentions to rein in drilling.) That framing of the issue, fueled by countless other media reports, reinforces the idea that gas drilling is an especially important jobs bonanza in Pennsylvania, and that Democrats would be wise to continue to support fracking — never mind the cost to clean air, water, climate and human health. The same dynamic is already one of the themes in the state’s Senate Democratic primary race.

But despite the fossil fuel propaganda, the oil and gas industries employ relatively few Pennsylvanians — fewer than 25,000 workers in 2020. This was a sharp drop in the workforce, and it’s not all linked to Covid-19. These jobs have been on the decline since the state’s “boom” years. The story is the same nationally: Since 2014, oil and gas employment has fallen 33 percent, while production has risen 32 percent. While this might be Wall Street’s ideal mode of capitalism — huge profits and lower labor costs — it’s obviously not one that serves the interests of workers.

The trends are clear: After the drilling boom encouraged by the Obama administration, fracking jobs are declining. The political debate rarely acknowledges this reality, and our failure to challenge the industry’s spin is dangerous; it reinforces the notion that climate activists are eager to sacrifice high – paying jobs for the broader goal of decarbonization. It’s hard to imagine how to ‘win’ that argument unless we are willing to confront it head on: Fossil fuel companies are shedding workers, pay is stagnant, and the drilling companies are pulling more oil and gas out of the ground while registering astonishing profits. This is not a record that the industry can plausibly defend as being good for workers, frontline communities or the planet.

This leaves activists gesturing towards well-intentioned goals like a “just transition,” a promise that likely rings hollow for workers and many labor unions because it’s hard to see where this has actually happened — even though, by every measure, we need to create some real policies that turn this vision into reality. While there are encouraging examples of labor unions throwing their support behind robust climate plans, it has proven difficult for the climate movement to find its way out of the jobs versus environment framing.

But that is especially true when we refuse to question the original premise. The truth is that the fossil fuel industry wildly inflates its employment record, and the recent data show they are producing more fuel with fewer workers. Instead of avoiding this reality, perhaps it is time to tackle it head on. Dirty energy corporations are not creating jobs as much as they are cutting them these days, and that provides an opening to envision the kinds of employment — in areas like orphaned well clean up and energy efficiency — that will provide employment for the thousands of workers the industry is no longer employing.

Some of the most common jobs estimates are produced by the American Petroleum Institute (API), the powerful oil and gas trade association. Over the years, API has released reports claiming that the domestic fracking industry creates somewhere between 2.5 million to 11 million jobs, both directly and indirectly. These numbers — or versions of them — are floated in political debates and in the media, but they are significantly out of step with other estimates, including the federal government’s labor reports. Food & Water Watch, an organization I founded, created a more accurate model that relies on direct jobs and relevant support activities, including pipeline construction and product transportation. The total comes to just over 500,000 in 2020, or about 0.4 percent of all jobs in the country.

How to explain the massive gap between industry propaganda and reality? The API figures include a range of employment categories; in addition to direct industry employment, they add indirect jobs (those within a supply chain) and induced jobs (those that are supposedly ‘supported’ by direct and indirect jobs). These categories make up the vast majority of their total. Convenience store workers, for example — working where gas happens to be sold — make up almost 35 percent of the industry’s supposed employment record.

These wildly inaccurate figures can form the basis for tired debates pitting “jobs versus the environment,” which remain politically potent. In 2020, when all eyes were fixed on Pennsylvania’s 20 electoral votes, Donald Trump made campaign stops in the state declaring that Joe Biden would kill hundreds of thousands of fracking jobs. (Biden, of course, countered by saying that he had no such intentions to rein in drilling.) That framing of the issue, fueled by countless other media reports, reinforces the idea that gas drilling is an especially important jobs bonanza in Pennsylvania, and that Democrats would be wise to continue to support fracking — never mind the cost to clean air, water, climate and human health. The same dynamic is already one of the themes in the state’s Senate Democratic primary race.

But despite the fossil fuel propaganda, the oil and gas industries employ relatively few Pennsylvanians — fewer than 25,000 workers in 2020. This was a sharp drop in the workforce, and it’s not all linked to Covid-19. These jobs have been on the decline since the state’s “boom” years. The story is the same nationally: Since 2014, oil and gas employment has fallen 33 percent, while production has risen 32 percent. While this might be Wall Street’s ideal mode of capitalism — huge profits and lower labor costs — it’s obviously not one that serves the interests of workers.

The trends are clear: After the drilling boom encouraged by the Obama administration, fracking jobs are declining. The political debate rarely acknowledges this reality, and our failure to challenge the industry’s spin is dangerous; it reinforces the notion that climate activists are eager to sacrifice high – paying jobs for the broader goal of decarbonization. It’s hard to imagine how to ‘win’ that argument unless we are willing to confront it head on: Fossil fuel companies are shedding workers, pay is stagnant, and the drilling companies are pulling more oil and gas out of the ground while registering astonishing profits. This is not a record that the industry can plausibly defend as being good for workers, frontline communities or the planet.

Louisiana energy firm to pay millions following oil spill that began 17 years ago

Taylor Energy to pay more than $43m in clean-up costs, penalties and damage, and transfer $432m clean-up fund

Edward Helmore in New York

the guardian

Fri 24 Dec 2021 09.12 EST

America’s longest running oil spill dispute is close to a resolution after a Louisiana-based energy firm has agreed to a proposed multi-million dollar settlement.

Taylor Energy agreed to pay more than $43m in clean-up costs, civil penalties and natural resource damage, and transfer a $432m clean-up trust fund to the Department of Interior, according to a proposed settlement announced by the Department of Justice.

The proposed agreement stems from more than a dozen Taylor Energy-owned wells in the Mississippi Canyon area of the Gulf of Mexico that began leaking after a production platform was damaged by Hurricane Ivan in 2004. The pipeline has lost hundreds of thousands of gallons of oil, and continues to leak.

“Offshore operators cannot allow oil to spill into our nation’s waters,” said Todd Kim, assistant attorney general for the DoJ’senvironment and natural resources division, adding: “If an oil spill occurs, the responsible party must cooperate with the government to timely address the problem and pay for the cleanup.”

As part of the settlement, Taylor Energy will withdraw three existing lawsuits it filed against the government and will not be required to admit “any liability to the United States or the State arising out of the MC-20 Incident.” The agreement will now put before a court’s review and approval.

The National Oceanic and Atmospheric Administration’s national ocean service, said in a statement that the “settlement represents an important down payment” to the costs of the environmental clean-up.

“Millions of Americans along the Gulf Coast depend on healthy coastal ecosystems. Noaa and our co-trustees look forward to working in partnership with the National Pollution Funds Center to ensure the region and the ecosystem can recover from this ongoing tragedy,” said Nicole LeBoeuf, national ocean service director

The spill began 17 years ago when a cluster of pipes connecting sixteen wells off the Louisiana coast were damaged by a subsea mudslide caused by the toppling of a Taylor production platform by hurricane winds.

The company plugged nine wells but has said it cannot plug the rest. The Coast Guard said a system had captured and removed more than 800,000 gallons of oil since April 2019.

Taylor Energy sold its oil and gas assets in 2008, according to its website. The trust fund will be created to plug the wells, as well as to permanently decommission the platform and clean contaminated soil.

The agreement, if approved, will also settle a series of legal disputes over the costs of the clean-up.

“Despite being a catalyst for beneficial environmental technological innovation, the damage to our ecosystem caused by this 17-year-old oil spill is unacceptable,” said Duane Evans, US attorney for the eastern district of Louisiana.

Taylor Energy agreed to pay more than $43m in clean-up costs, civil penalties and natural resource damage, and transfer a $432m clean-up trust fund to the Department of Interior, according to a proposed settlement announced by the Department of Justice.

The proposed agreement stems from more than a dozen Taylor Energy-owned wells in the Mississippi Canyon area of the Gulf of Mexico that began leaking after a production platform was damaged by Hurricane Ivan in 2004. The pipeline has lost hundreds of thousands of gallons of oil, and continues to leak.

“Offshore operators cannot allow oil to spill into our nation’s waters,” said Todd Kim, assistant attorney general for the DoJ’senvironment and natural resources division, adding: “If an oil spill occurs, the responsible party must cooperate with the government to timely address the problem and pay for the cleanup.”

As part of the settlement, Taylor Energy will withdraw three existing lawsuits it filed against the government and will not be required to admit “any liability to the United States or the State arising out of the MC-20 Incident.” The agreement will now put before a court’s review and approval.

The National Oceanic and Atmospheric Administration’s national ocean service, said in a statement that the “settlement represents an important down payment” to the costs of the environmental clean-up.